Airlines weren't ready for the return to travel...

Airlines weren't ready for the return to travel...

There's no denying that COVID-19 was the worst thing to happen to the industry in decades. Airlines faced an unprecedented decline in passengers, relying on billions of dollars in bailout funds to stay afloat. They laid off and furloughed air and ground crews.

As the pandemic progressed, the urge to travel grew, too. But that pent-up demand can cause a different problem for airlines.

You see, demand grew so fast that when things opened back up, understaffed airports and airlines couldn't keep up. The existing infrastructure just isn't robust enough to support booming travel demand... particularly amid strikes from pilots and ground staff.

That's why traveling has become such a nightmare for almost everyone. In the first six months of 2022, there were more canceled flights than in all of 2021.

London's Heathrow Airport has capped the number of departing passengers at 100,000 per day. The limit at Amsterdam's Schiphol Airport will drop to 67,500 passengers per day in September.

The U.S. is having similar problems. According to claims-management company AirHelp, the average American airport canceled 2.6% of all flights during peak summer travel... between May 27 and July 15. That number is usually closer to 1.5%.

And to nobody's surprise, New York City topped the list. LaGuardia Airport canceled 7.7% of flights during peak months. Newark Liberty International Airport in nearby New Jersey wasn't far behind, canceling 7.6% of flights.

This is a structural problem. Labor is in short supply and demand is unsustainably strong. We hope conditions calm down by the next round of holidays, or Thanksgiving and Christmas travel will be unbearable.

The poor performance of New York-area airports might spell trouble for one company in particular...

The poor performance of New York-area airports might spell trouble for one company in particular...

One of major air carrier United Airlines' (UAL) biggest hubs is Newark airport, where it's responsible for 68% of flights. But in June, the company announced it was cutting 12% of flights from the airport.

Since it emerged from bankruptcy in 2006, the company has done a lot to get back on its feet. By 2011, it ranked 10th in number of passengers carried globally. It reached fourth place in 2019.

But the past two years have been hard on United...

Of course, it struggled during the height of the pandemic. And now that travel is roaring back, flight cancellations at some of its biggest hubs are putting pressure on the company.

That's why shares are still down 59% since the beginning of 2020.

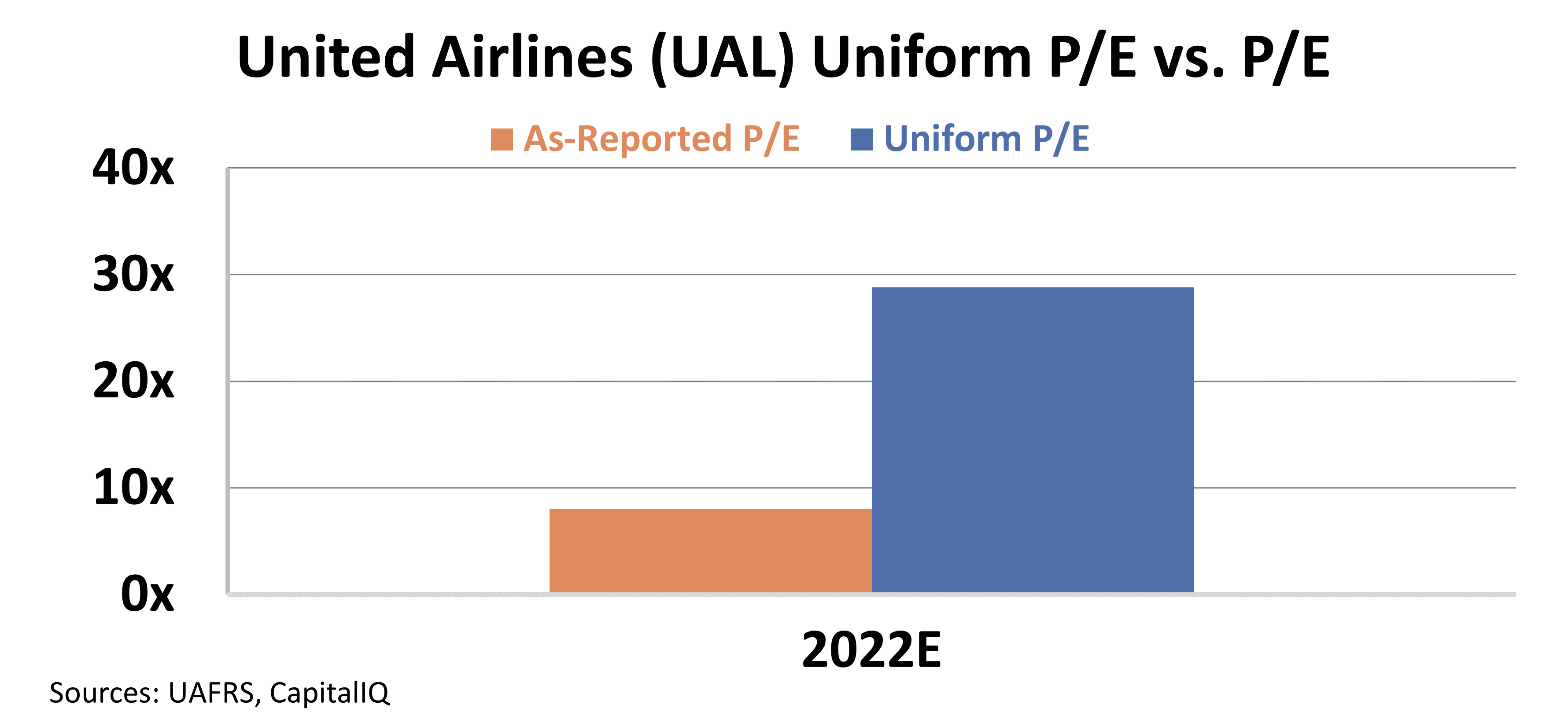

The market seems to be pricing in more future cancellations. United's as-reported price-to-earnings (P/E) ratio is below 10 times.

At these levels, it looks like investors currently expect United's struggles to continue. Market average valuations are around 20 times. If the company can turn operations around, it looks like its valuations could rise.

But in reality, the as-reported metrics overstate United's earnings...

But in reality, the as-reported metrics overstate United's earnings...

As a result, its P/E ratio is also skewed. By making more than 130 adjustments under Uniform Accounting, we can gain an accurate picture of the company's financials.

It turns out United is trading closer to 29 times earnings. That tells a wildly different story...

The market is actually expecting travel supply and demand to stabilize. Investors predict huge benefits for the airline industry and United.

But even when travel stabilizes, United's stock might struggle...

The market is pricing in a steep recovery. Frankly, even in the best travel environments, airlines don't tend to be that profitable. If cancellations continue, it might not be possible for United to meet expectations.

Regards,

Rob Spivey

August 31, 2022

Airlines weren't ready for the return to travel...

Airlines weren't ready for the return to travel...