It's the kind of insightful and pointed research that Wall Street analysts are known for...

It's the kind of insightful and pointed research that Wall Street analysts are known for...

You may have seen the footage last week of electric-vehicle maker Tesla's (TSLA) announcement of its new pickup truck. Whatever your view of the company, the introduction of a pickup truck potentially opens up a market that could be very relevant for Tesla: the commercial market.

Despite the range that a Tesla has, many people talk about the "range anxiety" issue drivers may experience with an electric vehicle. This is the concern that a car will run out of battery power while you're driving.

The commercial market – where company cars are driven during the day around town and then returned to a lot at night – doesn't face that same risk.

One might assume that Wall Street analysts would focus on that opportunity and how Tesla could eventually scale into the commercial market. Instead, Deutsche Bank's analysis focused on a different aspect of the launch:

The shattering of the truck's unbreakable glass windows during the live demonstration was not a good start.

While that is a fair statement, it also has nothing to do with the potential for a truck that won't even come out until 2021.

But this type of insight is exactly what we've come to expect from Wall Street analysts: Missing the potential real story.

There's a famous quote that's misattributed to the most prestigious thinker of the 20th century...

There's a famous quote that's misattributed to the most prestigious thinker of the 20th century...

According to urban legend, Albert Einstein said, "Compound interest is the most powerful force in the universe."

Einstein never said this. As far as we can tell, someone said Einstein said this, and then a bunch of articles referencing each other attributing the quote to Einstein all created a successful echo chamber. Now, it's a permanent fixture in popular culture.

That being said, an intelligent investor cannot deny the power of compound returns. Investors looking for the greatest compounding return will usually turn to the "Dividend Aristocrats."

Many investment professional and financial news sources extoll the virtues of the Dividend Aristocrats. However, they are an often-misunderstood equity class. It pays to understand exactly what they are before investing.

The term "Dividend Aristocrat" is trademarked by Standard & Poor's, but the concept is universal. To be a Dividend Aristocrat, a company must increase its dividend consistently for at least 25 consecutive years.

The perfect example is Abbott Laboratories (ABT). Founded in 1888, Abbott produces a broad range of generic pharmaceuticals and medical devices. In other words, it's a solid, steady company that isn't disrupted by short-term market trends.

This stability means that Abbott has increased its dividend for 46 consecutive years. Over the long term, an investor can see his Abbott investment compound as the stock appreciates in value, dividends are paid out, and those dividends are reinvested into the stock...

If you invested $10,000 into Abbott in November 1999 and reinvested your dividends, you would be sitting on $81,208 today. This is compared to only $32,720 invested in the S&P 500 over the same time frame.

This compound return is a powerful force... When comparing the S&P Dividend Aristocrat Index to the S&P 500 since 2008, the Dividend Aristocrats have averaged more than 1% better returns with lower risk.

However, Dividend Aristocrats are a rare breed. There are only 57 of them in the S&P 500 index – a little more than 10% of the largest companies in the world. Investors are always looking for the next potential Dividend Aristocrat, because the reward for choosing wisely is significant.

Getting in early on the next Dividend Aristocrat is the goal of many long-term investors. So when telecom giant Verizon (VZ) raised its dividend in September for the 13th consecutive, many investors debated whether Verizon will be inducted into the hallowed halls of the S&P Dividend Aristocrat Index.

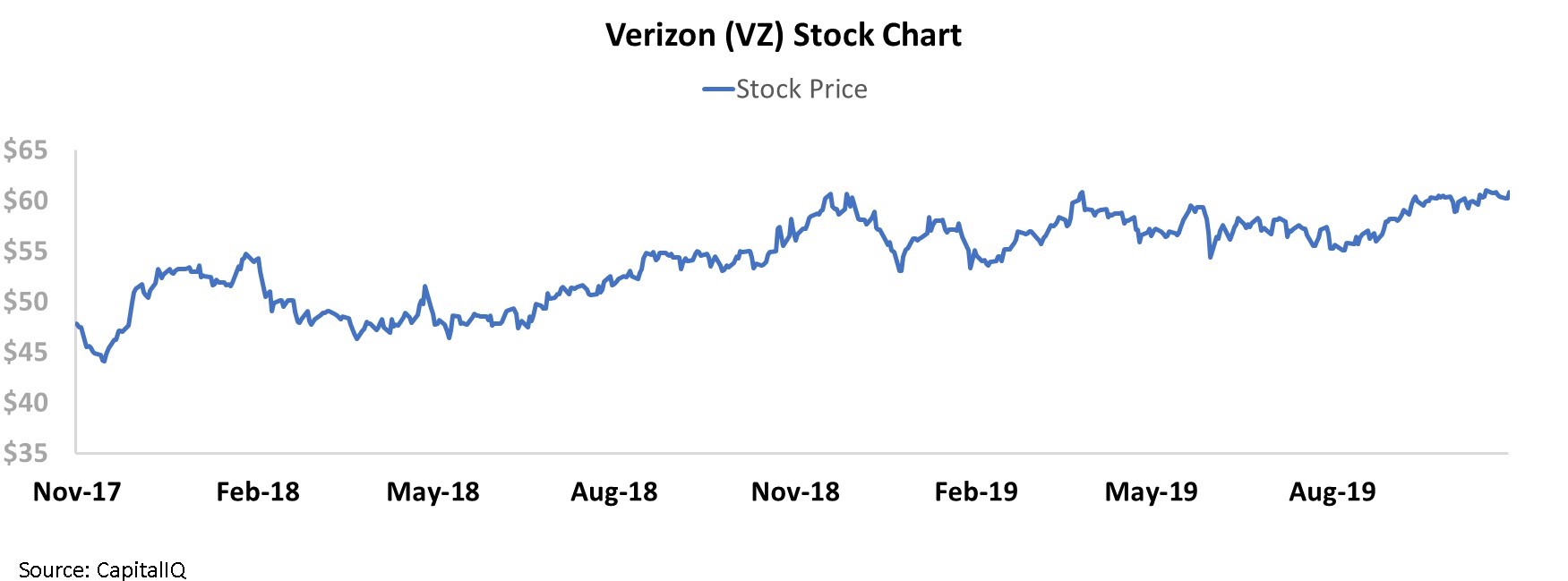

Verizon's current dividend yield is about 4%, in line with other Dividend Aristocrats. Furthermore, the company's stock price has been rising over the past year – from around $50 to $60.

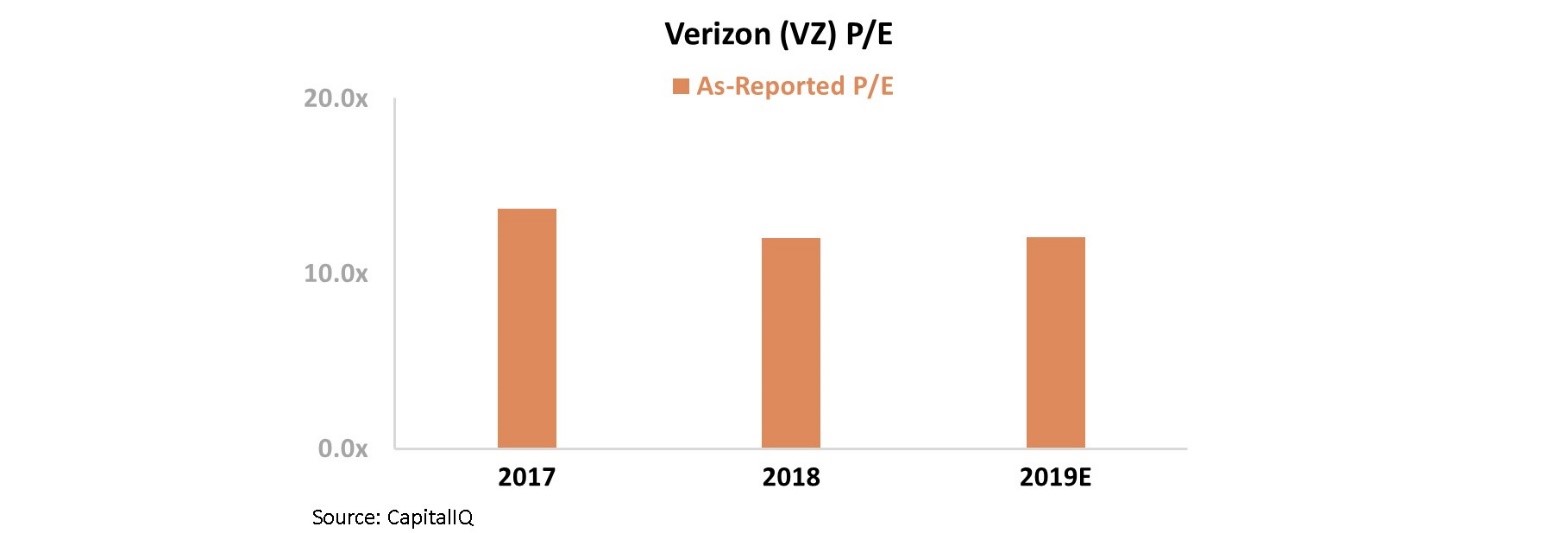

Now past the halfway mark to 25 years, Verizon is being viewed as a future potential Dividend Aristocrat. Furthermore, according to as-reported metrics, Verizon currently appears to be the dividend investment opportunity of a lifetime. With an as-reported price-to-earnings ("P/E") ratio that has been declining over the past three years, it would be common sense to buy such a strong potential investment at a discount.

However, investors are missing the true story of Verizon due to their reliance on as-reported metrics...

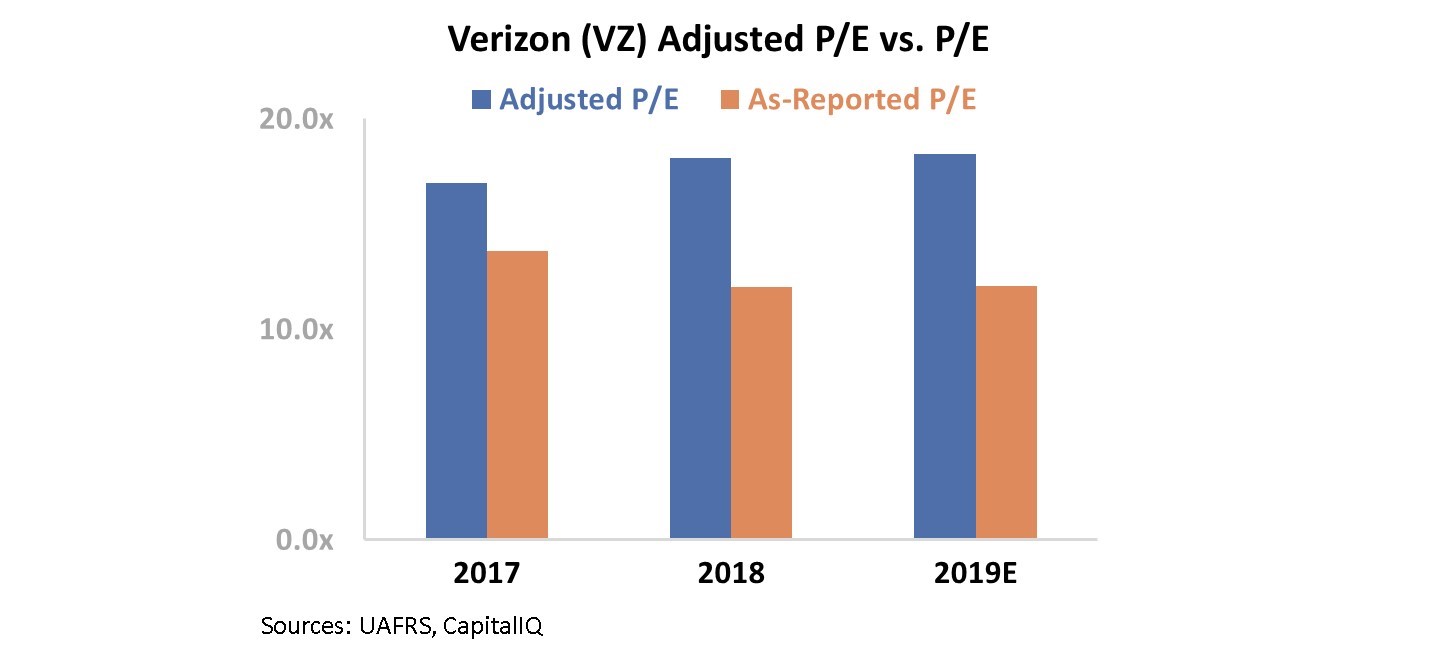

Due to the GAAP treatment of goodwill, operating leases, and other adjustments, Verizon's P/E ratio has been significantly understated. And under Uniform Accounting metrics, Verizon's P/E ratio has actually been increasing over the past three years, from a ratio of 17 to more than 18, even as its as-reported P/E ratio has fallen. Take a look...

Rather than missing the mark, the market is already clued in about Verizon. Trading slightly below market averages, the company is no longer a cheaply valued future Dividend Aristocrat.

Currently, the market is pricing this mature, stable business to continue seeing just above cost-of-capital returns. The market is aware of the opportunity at Verizon.

While the S&P Dividend Aristocrat Index may one day grow to include Verizon, when we use Uniform Accounting we're able to see beyond the excitement and invest rationally.

Regards,

Joel Litman

November 26, 2019

It's the kind of insightful and pointed research that Wall Street analysts are known for...

It's the kind of insightful and pointed research that Wall Street analysts are known for...