Joel's note: Both the market and Altimetry are closed on Monday for Memorial Day, so look for the next Altimetry Daily Authority on Tuesday, May 26. I hope everyone has a safe and enjoyable weekend.

'To be a great stock picker, you have to be a solid credit analyst'...

'To be a great stock picker, you have to be a solid credit analyst'...

People often ask when we at Valens Research and Altimetry decided to focus on equities and credit when we analyze companies.

The "why" of looking at both factors is so glaringly obvious to people as soon as we explain our reasoning for doing it, that no one ever questions whether we should.

At times, both equity and debt act as derivatives of each other, depending on the market environment. And if you're properly analyzing a company, you should be analyzing the company – equity and debt are both derivatives of the value of a company.

So naturally, you should examine both asset classes if you're going to analyze a company. Otherwise, you might miss something.

But the "when" of our decision to focus on credit goes back to long before I founded Valens more than 10 years ago. In the late 1990s, I was invited to present at a debt conference in Las Vegas... even though I had no experience in debt, I was an "equity" guy at best, and really just an "accounting" guy.

Mitch Julis of Canyon Partners, one of the world's great value investors (and in particular, a debt and cross-capital investor), was one of the conference organizers.

Before I went on stage, I confessed to Mitch that I didn't even know why he invited me. He responded by saying that if I just explained what's wrong with GAAP accounting, the debt investors would figure out how to use it. He also gave me another piece of advice when I said I was an "equities" guy...

To be a great stock picker, you have to be a solid credit analyst.

Any equity investor would be missing half of the analysis if he didn't check the credit of the company in question. Just as important, as we've highlighted in our Altimetry Daily Authority macro pieces, any investor in the broad market should check the credit fundamentals underneath the market before piling into stocks.

It's Mitch's advice that led Valens (and Altimetry) on the path to focusing on credit along with equity analysis. And during times like today, when understanding corporate credit is so incredibly important, I'm especially grateful for his advice all those years ago.

If you've ever taken a business class or read a book on sales, you're likely familiar with the 'razor and blade' sales model...

If you've ever taken a business class or read a book on sales, you're likely familiar with the 'razor and blade' sales model...

It's nothing new. And even if you've never heard of it before, you can probably guess from the name what it's about...

The first time you buy a razor – maybe you're trying a new brand, you forgot to pack one on your trip, or it's your first time shaving – you'll notice that the razor isn't particularly expensive.

Rather, you might not notice anything about the buying experience.

However, once the first blade has worn out, your first trip buying replacement blades is likely to be memorable.

The replacement blades are unfathomably expensive compared to the handle and the first blade. But since you already own the handle, you're unlikely to switch brands.

This sales model gets its name because it's an experience most people understand, and because razors and blades were one of the first examples...

Legend has it that King Camp Gillette, the founder of the Gillette brand, created the model for his innovative safety razor.

In reality, that's somewhat of a revisionist view on the origin. Gillette's razors actually were expensive to begin with – handle and all.

You see, he held a number of patents on the product for many years and had no reason to lower prices on the handle and first blade. But once his patents expired, his competitors jumped on the opportunity to steal market share by flaunting their inexpensive replacements.

These competitors created the razor-and-blade model to steal share from Gillette – he merely adopted the model to protect his business.

The model ended up being massively profitable, even though Gillette initially opposed the idea. He sold the initial handle and blade at cost to lure customers into his company's "ecosystem." Once customers were hooked, the company realized it had a lot more pricing flexibility... and the razor-and-blade model was minted.

The model worked so well that in 2005 – a century after the business was founded – the Gillette company was eventually purchased by consumer-products firm Procter & Gamble (PG) for a massive $57 billion. For reference, Gillette's Uniform return on assets ("ROA") at the time was 20% – an incredible figure for such a competitive industry.

While the "razor and blade" term was originally coined for razors, many industries have followed a similar model.

It's the same idea that printing companies employ with their printers and ink, with the recurring ink cartridge purchases being much higher-margin.

We also see cable companies doing the same with their receivers and cable subscriptions, and even software firms that offer free trials or "freemium" sales models.

Surprisingly, the diagnostics industry works in the same way...

The large machines for running diagnostics are typically sold at or near cost, while the disposable, recurring test kits are marked up significantly.

One particular company at the center of bringing the razor-and-blade model to the diagnostics industry is PerkinElmer (PKI), a global diagnostics and testing business.

The company's diagnostic machines are reasonably priced, bordering on affordable. However, each testing kit is exorbitant by comparison... The lowest-end ones cost more than $200 per test, while some can cost nearly $20,000 for just one kit.

That said, the razor-and-blade model doesn't seem to be doing PerkinElmer any favors.

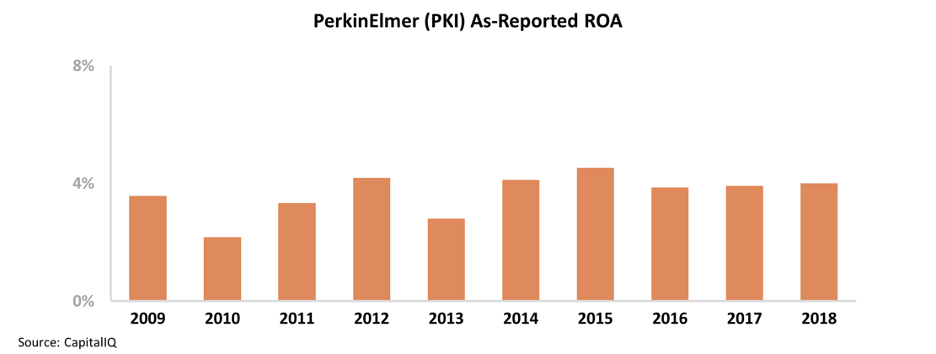

Over the past decade, the company has only maintained ROAs near long-term corporate averages – between 2% and 5% since 2010.

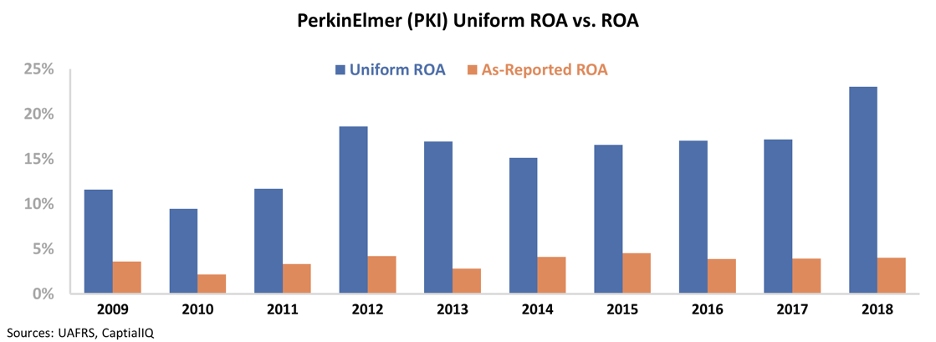

However, in reality, the as-reported metrics don't reflect PerkinElmer's economic reality...

After applying our Uniform Accounting metrics – which adjust for misleading financial practices like the effect of goodwill, research and development (R&D), and operating leases – we can see that PerkinElmer has ramped up its reliance on the razor-and-blade sales model over the past decade.

Since 2010, PerkinElmer's Uniform ROA has consistently improved from 10% levels to a peak of 23% in 2018.

Similar to Gillette's profitability right before the company was acquired by Procter & Gamble, PerkinElmer's returns are significantly greater than corporate averages.

Given PerkinElmer's recent trajectory, it's clear that the company has benefitted from the razor-and-blade sales model. That said, as-reported metrics seem to miss the picture completely... which could mislead investors if they're not careful.

Regards,

Joel Litman

May 22, 2020

'To be a great stock picker, you have to be a solid credit analyst'...

'To be a great stock picker, you have to be a solid credit analyst'...