Homebuilders have been more resilient than expected...

Homebuilders have been more resilient than expected...

With interest rates rising, most people thought the entire housing market would cool down. After all, 2021 was historically hot for housing because folks were moving out of cities at a historic rate... and government stimulus kept people flush with cash.

Everything reversed last year. Inflation ran rampant, and the Federal Reserve hiked rates as fast as it could to combat soaring prices.

U.S. home prices peaked in June and have come down every month since. That's when folks started calling for a real estate correction.

With rates sky-high, everyone assumed that home sales and homebuilding would collapse. It's well-known in the industry that homebuilders make their investment and development decisions based on interest-rate levels.

People don't want to buy houses when mortgage rates are high, since it means paying more. So you'd also expect that demand for homebuilders would fall as long as rates stay high... and that homebuilding stocks would perform worse.

But that doesn't seem to be what's happening. In fact, homebuilder stocks took off in the second half of last year. The SPDR S&P Homebuilders Fund (XHB), which tracks the performance of homebuilder stocks, is up 27% since mid-June.

Today, we'll take a look at why homebuilders have done better than expected. And we'll discuss what that means for the industry in 2023.

Homebuilders rebounded even when mortgage rates stayed high...

Homebuilders rebounded even when mortgage rates stayed high...

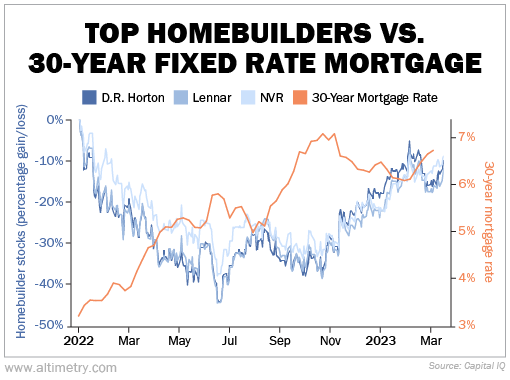

We can see this through the three biggest homebuilders – D.R. Horton (DHI), Lennar (LEN), and NVR (NVR).

All three stocks fell around 40% in the first six months of 2022, before surging back to where they were at the beginning of the year. And as you can see in the following chart, mortgage rates largely climbed...

Investors were shocked by these performances. So they tried to make sense of what was going on.

At first, people reasoned that businesses were still strong because they were working through existing orders. But even after those orders subsided, businesses kept on prospering... and demand seemed sustainable.

Then the logic was that homebuilders benefited from things being "less bad." Mortgage rates dropped from more than 7% in October and early November to just above 6% in 2023.

That's not a bad line of thinking. Mortgage rates did fall after rising rapidly for a year.

But investors are still missing the real story in homebuilders...

But investors are still missing the real story in homebuilders...

To understanding what's going on with these stocks, we have to look at the overall real estate sector.

The market for new builds is only a tiny part of the real estate industry. New homes make up around 600,000 to 800,000 home sales per year... or roughly 10% to 20% of total home sales. The rest is mainly people selling their existing homes.

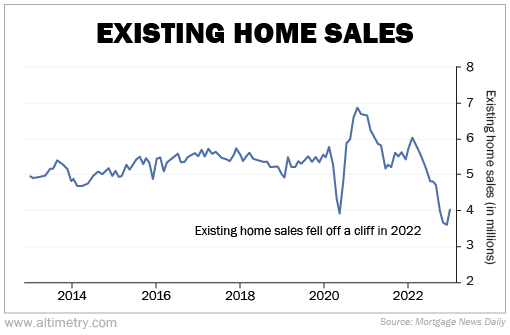

Over the past 10 years, existing home sales have averaged around 5.5 million per year. By the end of last year and early this year, sales had dropped below 4 million homes...

People stopped selling their homes for the exact same reason many of them weren't buying. It all goes back to mortgage rates...

Homeowners locked in incredibly cheap mortgage rates before and during the pandemic. They'd have to pay way more today for a comparable home, or the same amount for something much smaller. So they're choosing to hold on to what they have – and shrinking the market for existing homes.

While many existing homeowners don't want to sell, it doesn't mean nobody is buying...

While many existing homeowners don't want to sell, it doesn't mean nobody is buying...

Folks are getting married, having kids, and switching jobs. With 1.5 million potential homes now "off the market," would-be buyers are turning to the only show in town... homebuilders.

The economy needs to cool down before things get back to normal. With inflation still high and the Fed talking about more rate hikes, that's not likely anytime soon.

Homeowners will have no incentive to sell their homes as long as rates stay elevated. The homebuilder industry may stay stronger for longer than most people expect.

Regards,

Rob Spivey

March 16, 2023

Homebuilders have been more resilient than expected...

Homebuilders have been more resilient than expected...