For decades, Big Pharma firm Johnson & Johnson (JNJ) has been famous for its focus on quality and putting customers first...

For decades, Big Pharma firm Johnson & Johnson (JNJ) has been famous for its focus on quality and putting customers first...

Most famously, in 1982, the company pulled all its Tylenol off U.S. shelves after someone poisoned several bottles of the headache and pain medication.

J&J won big praise for working aggressively to limit the risk of more deaths.

The company worked with law enforcement and quickly developed new tamper-proof packaging to better seal its pill bottles.

Once J&J re-launched Tylenol, the brand quickly resumed its market leadership thanks to the trust the company had earned from its customers.

However, recent negative headlines have spooked investors and consumers alike... and have called into question the company's commitment to quality and safety.

However, recent negative headlines have spooked investors and consumers alike... and have called into question the company's commitment to quality and safety.

First was the announcement earlier this month that J&J contract manufacturer Emergent BioSolutions (EBS) suffered a production error at its major Baltimore plant while making J&J's coronavirus vaccine.

Workers had confused components of the J&J and AstraZeneca (AZN) vaccine in February, since both vaccines were being produced at the plant. As a result, 15 million J&J vaccines were ruined.

Then, on Tuesday, the U.S. Food & Drug Administration ("FDA") and Centers for Disease Control and Prevention ("CDC") announced they were pausing J&J vaccinations in the U.S.

Six women who received the vaccine suffered blood clotting issues within a month of receiving their shots. Regulators swiftly stepped in... and every U.S. state has since halted J&J vaccinations.

At first glance, it seems like J&J was cutting corners and rushing production. But if you take a step back, it looks like the exact opposite...

By working with the FDA and CDC to pause the vaccine and help with research, J&J is showing its commitment to putting safety and health of consumers first. And similarly, its decision to work with Emergent – an expert in vaccine manufacturing – was a conscious decision with public health in mind.

And yet, the negative J&J press has also put Emergent in the spotlight...

And yet, the negative J&J press has also put Emergent in the spotlight...

Emergent is one of the few contract manufacturers of vaccines and therapeutics in the U.S. Its job is to have capacity and technology to support major public health disasters, from a pandemic to a nuclear disaster or a chemical attack.

The company's largest customer is the U.S. government. Some of its offerings include vaccines for anthrax, smallpox, cholera, and typhoid for the U.S. military.

When the coronavirus pandemic struck and vaccine development went into overdrive, Emergent was a natural partner for companies looking to ramp up production, such as Big Pharma giants J&J and AstraZeneca.

As the pandemic continues to rage, Emergent will continue to be essential in the battle against the virus. If the company can put those quality mistakes behind it, its positioning could make it a compelling stock.

To get a better idea of Emergent's fundamentals, we can turn to The Altimeter...

To get a better idea of Emergent's fundamentals, we can turn to The Altimeter...

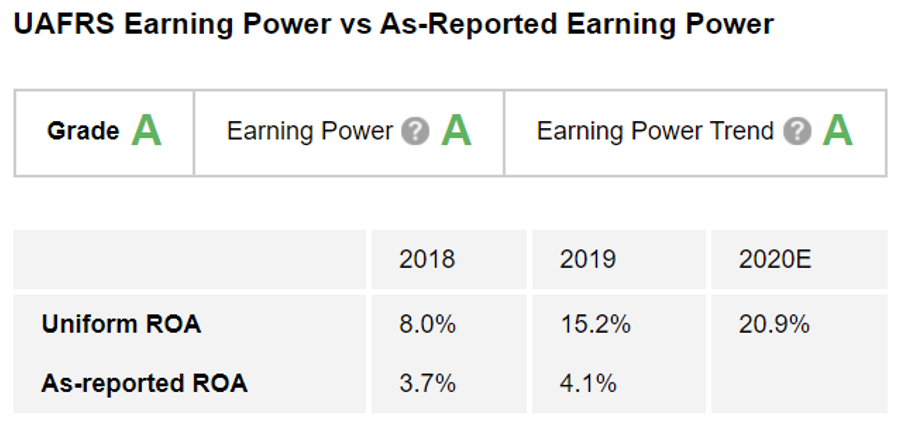

Using the power of Uniform Accounting – which eliminates the distortions in as-reported financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on their real financials.

On an as-reported basis, it looks like Emergent's return on assets ("ROA") sat at less than 4% before the pandemic and continued to remain concerningly low.

On the other hand, looking at Uniform Accounting, it's clear that the company's real ROA was already accelerating before the pandemic – rising from 8% in 2018 to 15% in 2019. And the demand for its offerings as coronavirus vaccines started to take shape led profitability to rise even more to an expected 21% in 2020.

As a result of its strong profitability and significant tailwinds, Emergent gets an "A" for Performance in The Altimeter, with "A" grades for both Earning Power and Earning Power Trend.

While investors may be spooked by the headlines, the reality is that this company is both helping the world fight the pandemic and is primed to produce impressive profitability because of it. And you'd only know it by using The Altimeter to see the real numbers.

Of course, just because a company is printing money doesn't necessarily make its stock a buy...

Of course, just because a company is printing money doesn't necessarily make its stock a buy...

If the market is pricing that company for perfection, then hiccups like the recent issues Emergent has seen could send the stock plummeting.

The market's expectations and the stock's valuations are the other pieces of the puzzle... and The Altimeter has the answers.

If you're an Altimeter subscriber, click here to see exactly what the valuations are for Emergent and if this trend is already priced in.

If not, click here to find out how to gain immediate access to the Uniform Accounting data you're missing out on for Emergent, J&J, and the other big players in the sprint for vaccines... along with the full grades for more than 4,000 other publicly traded companies available in The Altimeter.

Regards,

Rob Spivey

April 15, 2021

For decades, Big Pharma firm Johnson & Johnson (JNJ) has been famous for its focus on quality and putting customers first...

For decades, Big Pharma firm Johnson & Johnson (JNJ) has been famous for its focus on quality and putting customers first...