The market still doesn't understand how cheap U.S. Steel (X) is...

The market still doesn't understand how cheap U.S. Steel (X) is...

As we highlighted last week, U.S. Steel is currently priced for bankruptcy. When a company starts to trade at a significant discount to its assets – as U.S. Steel does – this tends to serve as a "floor" for valuations.

Last Friday, the company updated fourth-quarter guidance, forecasting a significantly bigger loss than Wall Street had previously expected. It's not great news when a company expects to lose $1.15 a share, and it spooked investors... Shares fell more than 10% on the day.

But the company is currently trading at just 0.3 times price-to-book ("P/B"). At those valuations – absent bankruptcy – the company's assets alone should offer a floor to valuations. And even with the company's earnings issues, the company has no real risk of bankruptcy in the near term, with no debt maturities, and significant flexibility around their obligations.

With last week's news now priced in, even more risk has been squeezed out. As we mentioned in last week's issue, we'll continue to keep an eye on this "left for dead" steelmaker...

Not many businesses can survive a head-to-head competition with retail behemoth Amazon (AMZN)...

Not many businesses can survive a head-to-head competition with retail behemoth Amazon (AMZN)...

But one company did just that, turning its weakness into a strength and executing a powerful turnaround.

In 2010, executives at electronics retailer Best Buy (BBY) found themselves in an untenable position. In the past, Best Buy had used its large footprint and economies of scale to deliver the best price possible to consumers. However, Amazon was able to leverage its supply chain network to provide cheaper prices than Best Buy, and ship directly to its customers' front doors.

This led to the phenomenon known as "showrooming," where customers would go into a Best Buy to try out electronics... then go home and buy them cheaper online from Amazon. Best Buy executives knew that if nothing changed, they were headed for bankruptcy, just as they had seen happen with Circuit City. So in 2012, CEO Hubert Joly launched the "Renew Blue" initiative.

The company knew that it could never compete directly with Amazon on price, so instead, it pivoted...

First, Best Buy offered price matching. When customers came to the company to test out its products, they would be incentivized to purchase in store rather than going home and waiting for a delivery days later. This also meant Best Buy didn't need to slash pricing on all of its products, which helped cushion its margins.

Management also decided to further focus on its showrooms as a draw for customers. Through initiatives such as Magnolia, Best Buy created expansive set ups which allow customers to demo home-theater or surround-sound setups. Best Buy also partnered with Microsoft and Samsung to create smartphone showrooms. The phone manufacturers paid for the space, which reduced Best Buy's costs and boosted revenues.

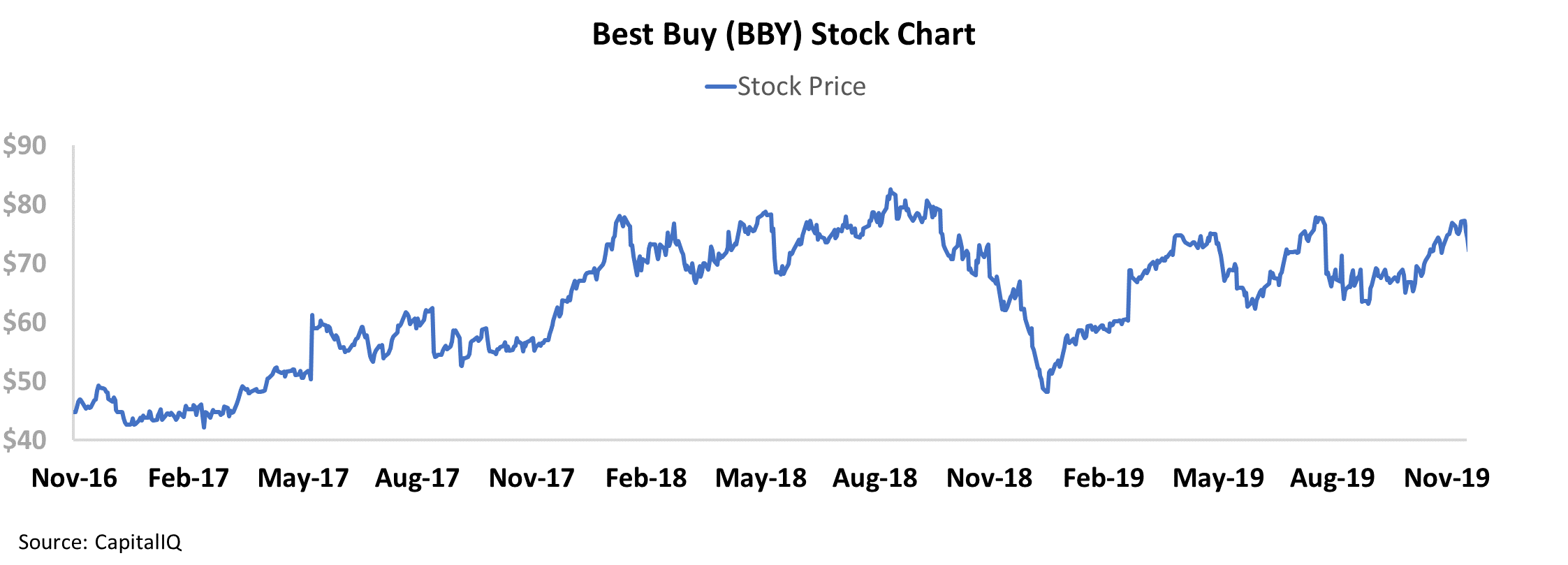

Together, this business initiative transitioned Best Buy from the traditional retail space to a new market niche. The stock has rebounded sharply, soaring from around $40 in December 2016 to almost $90 today...

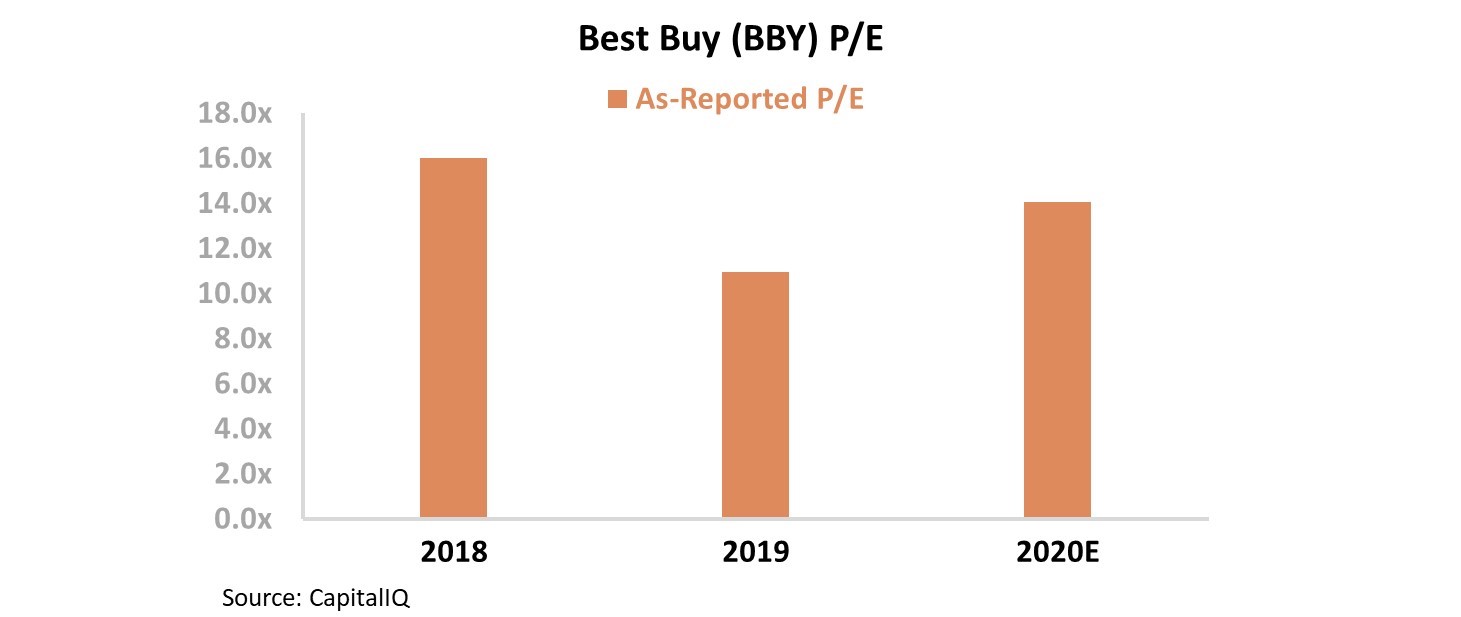

Even after its meteoric run, using as-reported metrics, Best Buy still appears attractive for value investors.

Best Buy currently has an as-reported price-to-earnings ("P/E") ratio of 13.6, well below market-average ratios of 20. That's down from fiscal year 2018, when the stock was trading at 16 times as-reported numbers. In other words, Best Buy appears cheaper now than it did before it completed its transformative efforts...

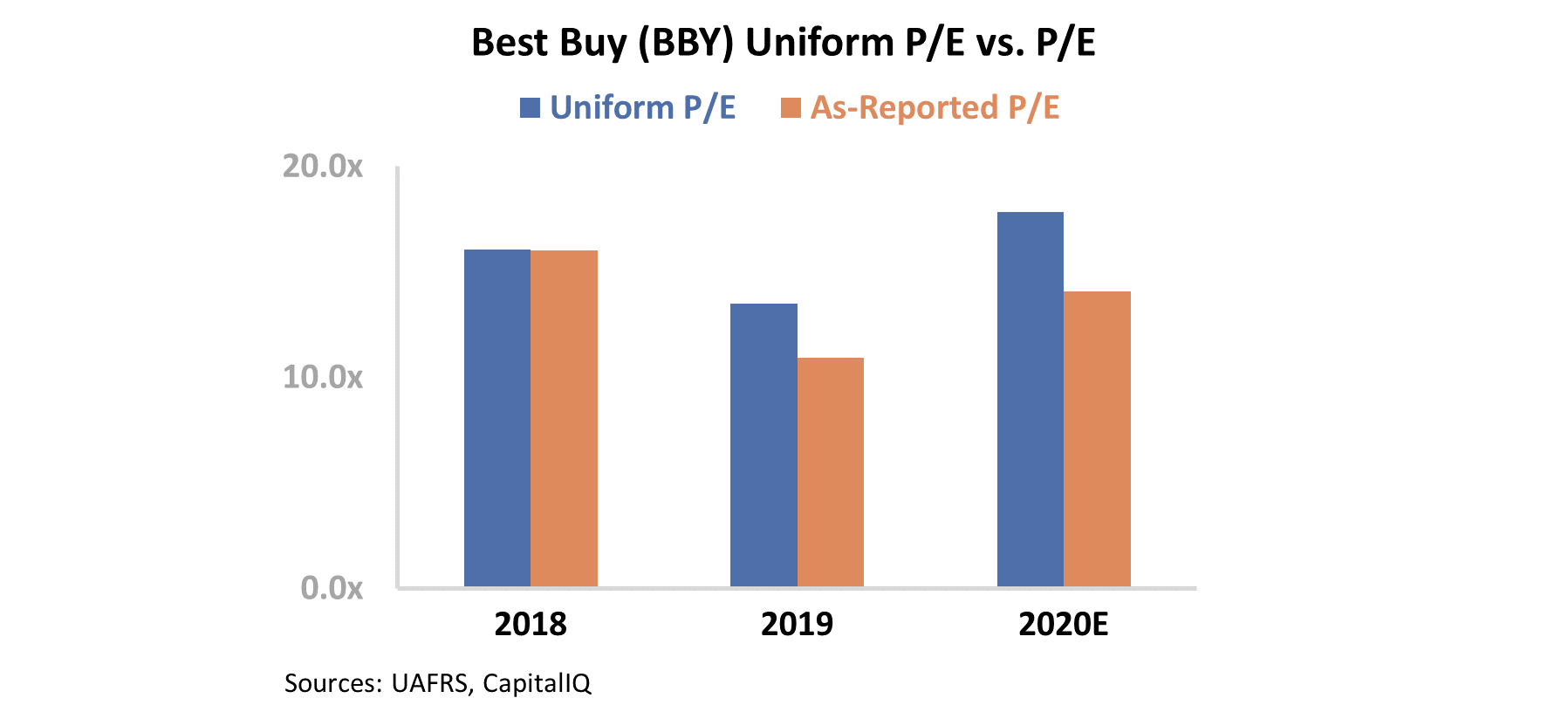

However, the true pricing of Best Buy is hidden behind the smoke and mirrors of as-reported accounting. Due to distortions around goodwill, operating leases, and others, GAAP accounting masks the true profitability of Best Buy. Uniform Accounting tells a much different story...

Rather than a P/E ratio of 13.6, Best Buy actually has a Uniform P/E ratio of 18.1 – much closer to market averages. After its most recent run higher, the market has correctly priced in Best Buy's turnaround after years of underperformance.

Without Uniform Accounting, investors are missing out on the company's real valuations. By relying on Wall Street's misleading metrics, it would be all too easy to buy into a trend after it has already been priced in.

At Altimetry, we like to say that just because a company is great, it doesn't mean it's a great investment. While Best Buy has successfully turned around its business and found a new market niche, investors would be best served to watch from the sidelines.

Regards,

Rob Spivey

December 26, 2019

The market still doesn't understand how cheap U.S. Steel (X) is...

The market still doesn't understand how cheap U.S. Steel (X) is...