Back in 1998, I was asked to speak at a conference for credit investors...

Back in 1998, I was asked to speak at a conference for credit investors...

I was 28 at the time... and given that the conference was in Las Vegas, I quickly accepted.

The one problem was that I knew very little about credit investing. At the time, most of my knowledge was in accounting and, to a certain extent, equity investing.

I knew most of the attendees would be investing in corporate bonds, credit default swaps ("CDSs"), and other "credit" investments, so I was thinking on my feet to figure out how to provide the most value with my areas of expertise.

I was lucky to run into Mitchell Julis while I was preparing. Mitch is a co-founder of Canyon Partners, one of the largest and most consistent hedge funds in the U.S.

Canyon invests in many different asset classes, spanning from debt to equity and everything in between. But in particular, Mitch and Canyon focus on investing in debt.

While I was planning my presentation, Mitch gave me a great piece of advice that I'd like to share with you today.

First, he told me that great equity investors need to be deeply knowledgeable on credit, and great credit investors need the same focus on equity.

Then, he said that my accounting knowledge is what the credit investors were interested in – if I focused on giving a full picture of understanding a company, they would figure out how it applies to credit.

Mitch made a fairly simple point. Said differently, he was stating that successful equity and credit investors look at the company as a whole.

It's a logical thought, but it's one investors often overlook...

Whether you're buying equity or credit, you're buying a small claim on a company. If you were buying a car or a house, you'd want to inspect the whole asset, right?

But countless equity investors fail to properly understand a company's credit before buying its stock.

A business finances itself with a combination of debt and equity.

In the event a company liquidates, debtholders have the first claim on that company's assets... while equity investors get whatever is left over. As a result, it's critical for equity investors to understand a company's credit risk before making an investment.

Back in October, we discussed how oil giant ExxonMobil (XOM) was trading below a price-to-book ("P/B") ratio of nearly 1... Valuations below this level are typically reserved for companies with real credit risk.

Today, let's look at a company that looks priced for certain bankruptcy, with a P/B ratio of just 0.3... U.S. Steel (X).

While companies will sometimes reach P/B ratios near 1 – occasionally dropping ratios in the 0.7 to 0.9 range – figures below that level indicate the company may be experiencing elevated bankruptcy risk.

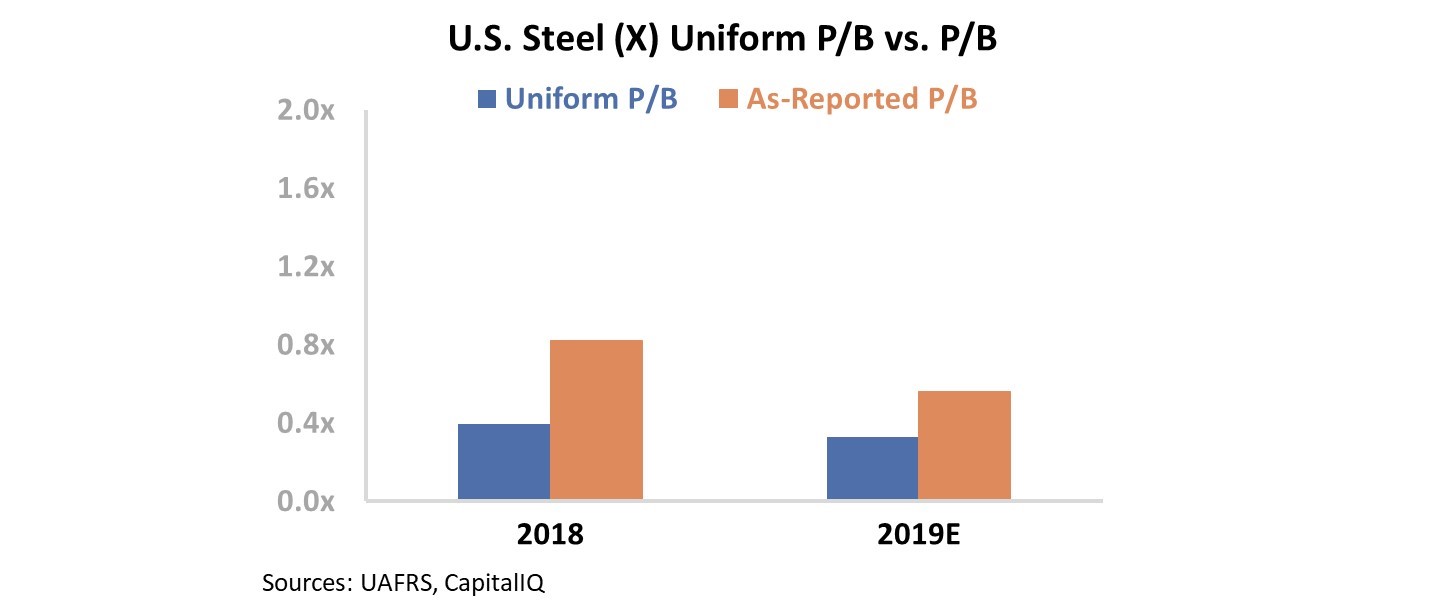

U.S. Steel currently trades at 0.3 times book value on a Uniform basis – one of the lowest valuations we have ever seen for a non-bankrupt company. Take a look...

The markets have been spooked by a combination of shakeups in the steel industry and the company's large amount of debt.

On an as-reported basis, credit signals look bleak for U.S. Steel. Right now, the company's bonds are trading at a yield-to-worst ("YTW," which is the lowest potential yield without the bond issuer defaulting) of more than 8%, and its CDS is 541 basis points (equivalent to nearly 5.5%).

If you need a refresher on CDSs, you can refer to our piece from September for a deep dive. On a high level, these instruments act like insurance for a bond.

U.S. Steel's yield and CDS levels line up with a company that will be unable to support its operations with the cash it generates, thus leading to bankruptcy.

However, once we apply Uniform Accounting metrics to adjust for the company's actual assets and earnings, we can see if this is true.

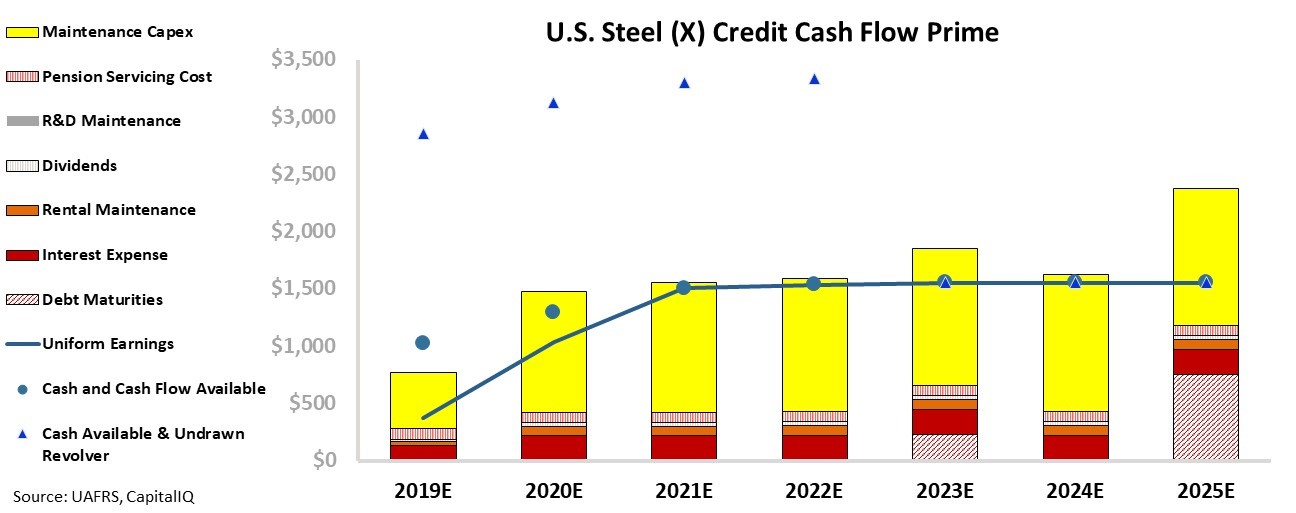

The chart below highlights U.S. Steel's annual financial obligations compared to its Uniform earnings. The vertical bars represent the company's obligations, ranging from debt maturities and interest expense to dividends and capital expenditures. Meanwhile, the blue line and dots represent the company's cleaned-up cash and cash flows.

As long as the line is at or above the top of the stacked bars, U.S. Steel is not at risk of failing to meet payments.

U.S. Steel is currently in a position to match its obligations over the next several years. Additionally, when we recalculate what the company's CDS should be based on its Uniform metrics, the company is far safer, with an "intrinsic" Uniform CDS of just 380 basis points (3.8%).

Furthermore, U.S. Steel has no debt maturities until 2023 and no material debt coming due until 2025, indicating the company has a lot of time to improve its business.

U.S. Steel is priced for bankruptcy, but it has no real bankruptcy risk for the foreseeable future. As the market realizes this, it's likely to lead to higher valuations... so we'll be keeping an eye on U.S. Steel.

It's important to look at the entire business when analyzing at a stock... but it's even more important to make sure you're looking at the correct numbers.

Given that we're talking about credit analysis today...

Given that we're talking about credit analysis today...

On Friday, Bloomberg published a report titled "Fuzzy Math That Fueled Junk Debt Boom Is Sparking Jitters." The piece discusses how companies are adjusting their earnings before interest, taxes, depreciation, and amortization ("EBITDA") numbers to make themselves appear more creditworthy... and thus take out larger loans.

While investors may be concerned about how bad EBITDA calculations misrepresent a company's true credit risk, they should be concerned about the broader issue... Any EBITDA calculation offers an incomplete picture of cash flow generation and credit risk.

We don't focus on EBITDA... Using Uniform Accounting, we produce a more holistic analysis of a company's credit risk in order to understand the real obligations and cash flows.

EBITDA makes absurd assumptions about a company's cash flows and represents them as reality. Charlie Munger of Berkshire Hathaway took it a step further...

I think that, every time you see the word EBITDA, you should substitute the word "bullsh*t" earnings.

Assuming a company has no capital expenditure obligations – and no need to invest in working capital – is a great way to misunderstand a company's operations. And assuming a company has no dividend obligations distorts where it sends its cash flows and what its priorities are.

Last, for things like research and development ("R&D") investment and operating lease obligations, not understanding how much of a company's cash flow is tied up with these variables offers an incomplete picture of the business's real performance.

While investors may be concerned about questionable EBITDA accounting causing misrepresented credit risk, they should be worried about the wrong decisions they're making even if they're using the "right" EBITDA calculations.

Regards,

Joel Litman

December 17, 2019

Back in 1998, I was asked to speak at a conference for credit investors...

Back in 1998, I was asked to speak at a conference for credit investors...