Dear reader,

In my e-letter earlier this month, I talked about how major market events tend to leave investors gun-shy.

We saw homebuilding and U.S. auto valuations remain particularly low following the housing crisis and the auto industry bailout. This was a great opportunity for the few investors who braved entering these tattered markets early to buy high-quality companies while they were cheap...

But for most folks, the dust was already settled by the time they had the courage to get back on their horses.

In that same letter, I pointed out that the oil market is still facing aftershocks from the recent oil glut. I recommended taking a look at Viper Energy Partners (VNOM) as a high-quality company being lumped in with a struggling industry.

Viper is an interesting name because the business owns so few assets and can benefit greatly from small increases in oil prices.

However, there's another company in the industry that poses a similar value proposition for the exact opposite reasons...

This company is the largest publicly traded oil and gas business in the world. It has 24.3 billion oil-equivalent barrels of proven reserves and it employs 71,000 people.

If you haven't guessed it already... I'm talking about ExxonMobil (XOM). Through all of its controversy over the years, ExxonMobil has remained one of the largest and most powerful oil companies in the world.

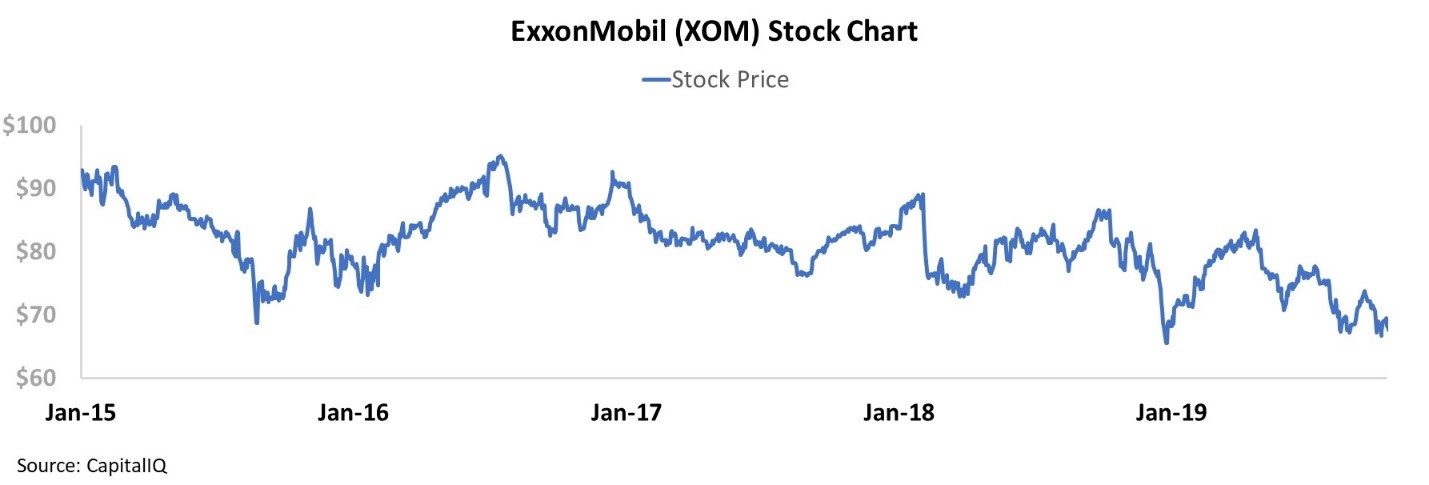

Regardless of its size and strength, the oil glut has taken its toll. Despite pushing higher multiple times, the company's stock has not been able to return to pre-2015 levels, and shares are currently trading near five-year lows.

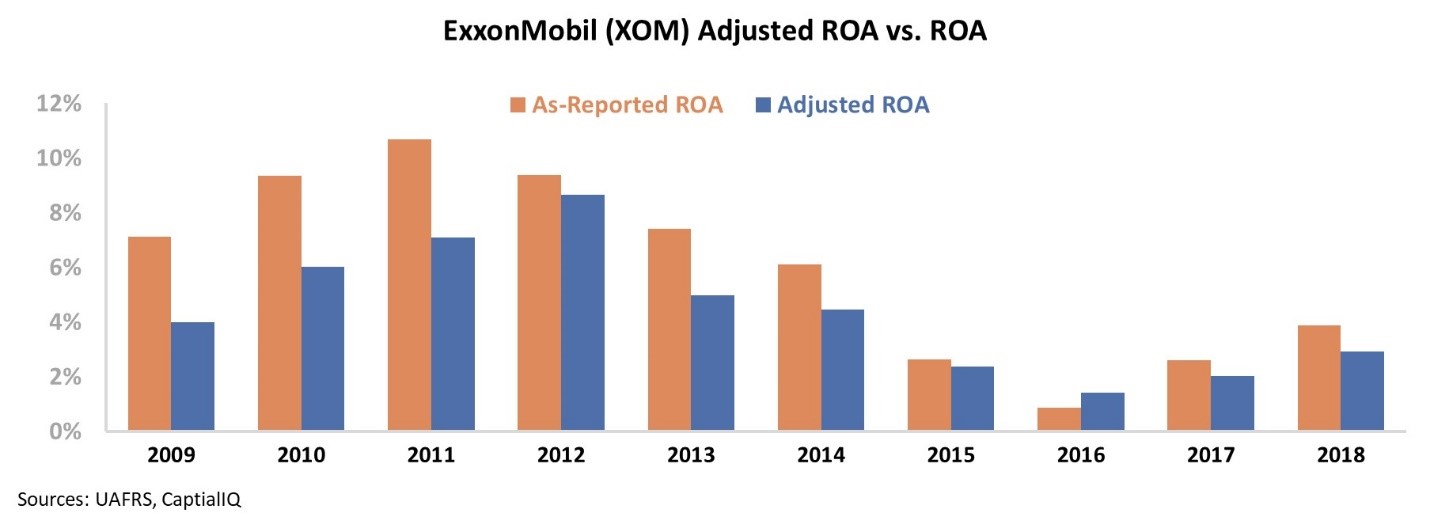

The markets are reacting to ExxonMobil's struggles. With oil prices still near recent lows, the company has been generating much lower earnings than in previous years.

While ExxonMobil has never been an ultra-high-profitability business, it typically outperforms the 6% long-term corporate return-on-asset ("ROA") averages. However, since 2015, the company's ROA has consistently been in the 1% to 3% range.

Within a single industry, I'm not sure it's possible to find two companies less alike than Viper and ExxonMobil.

While Viper benefits from being agile, having very few assets, and having very high upside potential, ExxonMobil benefits from being a "mill on the hill."

Put simply, ExxonMobil's assets – its massive stockpile of oil reserves – are the value of the company. This is very similar to the principle of a mining company. The value of the assets still in the ground are the value of the company itself, more so than its current cash flows.

As such, we can't possibly value ExxonMobil the same way we valued a royalty company like Viper Energy. Put simply, to value the "mill on the hill," we need to inspect the hill itself.

Without extending this metaphor further than I need to, I'll say that for most companies, we tend to value stocks based on their price-to-earnings ("P/E") ratios. This is the current stock price divided by the earnings – the "cash flows" – generated per share.

A P/E ratio is great, but for a company like ExxonMobil, we need to look elsewhere.

Rather than looking at earnings, we need a metric that looks at the value of the hill.

Baring a bankruptcy, the floor to a company's valuation should generally be the value of its assets. That is – if a company with $100 in assets doesn't generate another dollar of profit, it can still sell its assets and be worth around $100.

A company like ExxonMobil, at worst, is worth its oil reserves.

This type of analysis is called "book analysis" – where the "book" represents the book value of the company's assets. Much like a P/E ratio, we can look at a price-to-book ("P/B") ratio to understand how a company is being valued by investors.

When a company starts trading below a P/B ratio of 1, this indicates that the market is pricing the business lower than its assets, which tends to represent the low end of valuations.

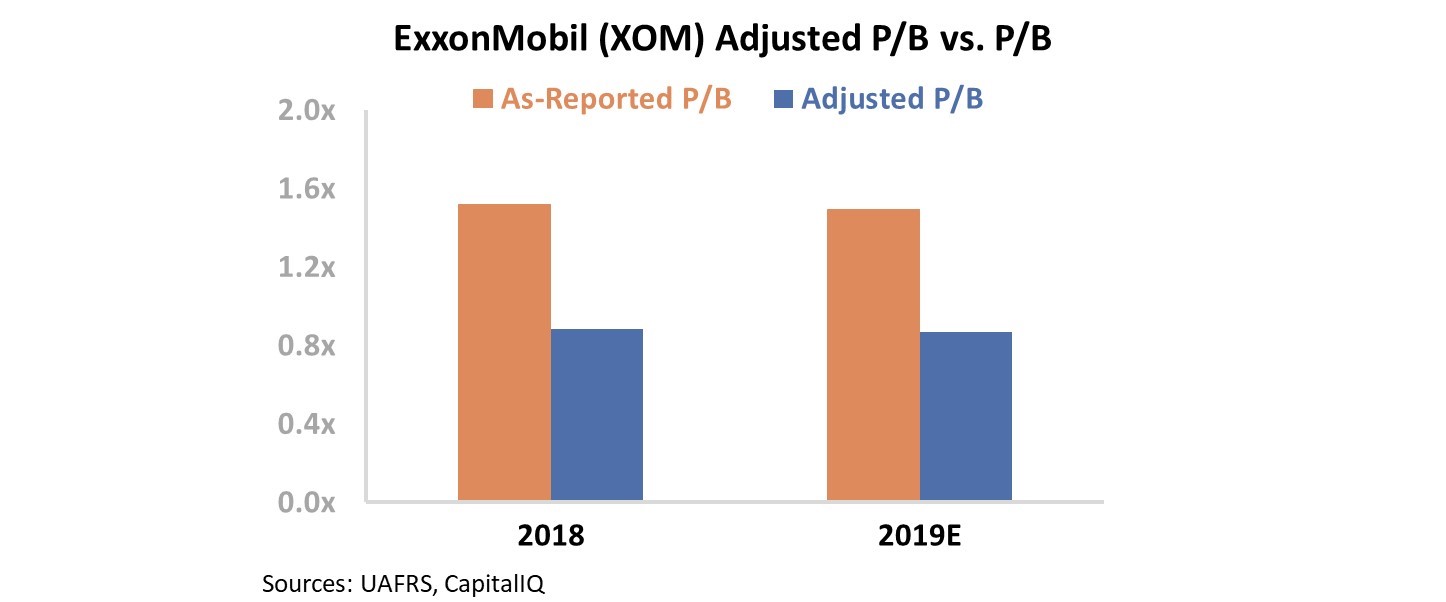

As usual, traditional accounting metrics fail to capture the real value of a company's assets. Once we adjust for inconsistencies – including the treatment of operating leases and adjusting the value of a company's property, plants, and equipment ("PP&E") – using our Uniform Accounting framework, we can see how the stock is trading compared to ExxonMobil's asset base. Let's take a look...

On an as-reported basis, the company currently trades at a P/B ratio of 1.6 relative to its assets. This is low, but not alarmingly so. However, when looking at Uniform Accounting adjusted P/B ratio, we can see ExxonMobil actually trades for a P/B ratio of just 0.9 – below the value of its assets.

Once valuations drop below asset values, this tends to act as a "floor." As such, it's unlikely the company will see valuations fall much further.

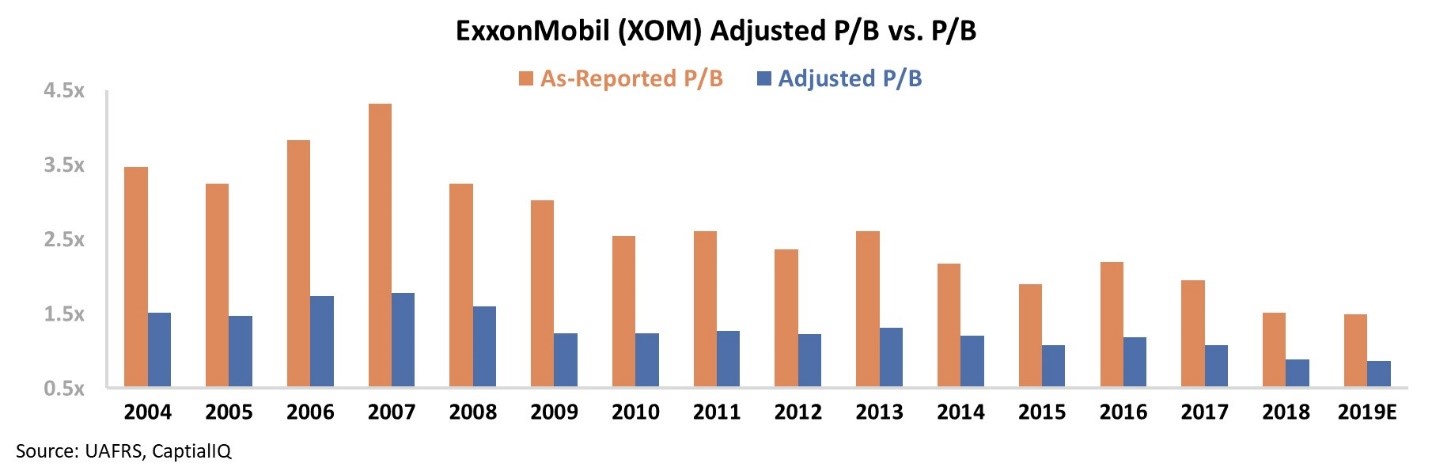

Moreover, when looking back over the past 15 years, we can see that the company is currently trading at historically low levels...

Using as-reported financial data, ExxonMobil looks like it has significant downside risk compared with its asset base. However, if you look at the company using Uniform metrics, you can feel a lot safer about this company.

ExxonMobil starts looking like a "heads you win, tails you don't lose" investment. It's unlikely the stock will fall significantly from its current levels. But if the company sees its profitability recover, there could be significant upside ahead.

Regards,

Joel Litman

October 25, 2019