The pandemic was a terrible time for a lot of folks...

The pandemic was a terrible time for a lot of folks...

There was fear of infection, loneliness from social isolation, and many economic hardships.

The elevated stress sent global anxiety and depression levels up 25%... and it shed light on the fact that the world was in dire need of better mental health services.

Private-equity ("PE") firms were quick to see the massive opportunity for funding. In 2021, they poured nearly $7 billion into U.S. mental and behavioral health companies – nearly three times the amount from 2019.

Then, inflation hit... and the Federal Reserve started hiking rates to rein in rising prices. Investment activity in the behavioral health space fell off a cliff. According to The Braff Group, a health care mergers and acquisitions advisory firm, deal flow decreased 23% in 2022 from its peak in 2021. And it decreased another 27% in 2023.

That's not surprising. It's harder to make good money on these deals with interest rates as high as they are. Plus, many health care professionals retired after the pandemic, leading to a big staffing shortage. That's driving health care labor costs higher and, in turn, making it harder for these companies to grow.

Unfortunately, debt from all these deals is coming due very soon. And management teams are now scrambling to come up with the cash to meet their obligations...

As we'll explain today, this is a problem across the entire health care industry. And while it's bad news for some companies, it's creating a major opportunity for others...

The health care industry has been growing on mountains of debt...

The health care industry has been growing on mountains of debt...

For years, PE firms and other large industry players would borrow money at low interest rates to buy smaller health care facilities like individual clinics and hospitals. They would then streamline their costs to improve their cash flows.

And while that model worked well when interest rates were low, it's now coming apart at the seams.

As we said earlier, health care companies have tons of debt coming due in the next few years. And they aren't profiting enough to keep up with their obligations...

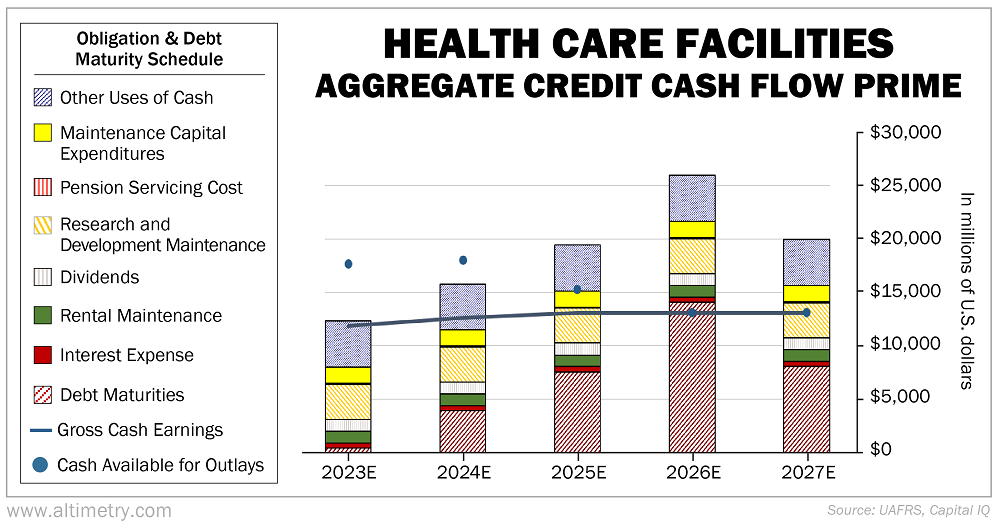

We can see this by looking at our aggregate Credit Cash Flow Prime ("CCFP") analysis for health care facilities companies. These are the companies that operate sites of care, like clinics, doctors' offices, and hospitals.

Our aggregate CCFP takes the Uniform cash flows and cash reserves for health care facilities companies and compares them with their annual obligations.

In the following chart, the stacked bars represent these companies' obligations each year through 2027. We compare these with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

Take a look...

In 2023, these companies should have been able to use their cash flows to cover debt. However, as you can see, their debt maturities and expenses will soon start to overtake the cash available...

This year, they'll have to use most of their cash on hand just to meet all of their obligations. As soon as next year, they're forecast to run out of cash. And in 2026, they don't even have enough cash flows to cover their nearly $15 billion debt load.

Health care companies will need to find a way to manage their debts – and fast.

And without enough growth in the industry to justify refinancing at high rates, many of these companies will have no choice but to sell their distressed assets.

That's creating a massive opportunity for smart strategic acquirers...

That's creating a massive opportunity for smart strategic acquirers...

These companies have the expertise and the cash to start snapping up the competition when distressed health care assets come to market.

Take health care facilities operator HCA Healthcare (HCA), for example...

It's one of the largest health care services providers in the U.S. It has more than 180 hospitals and more than 2,300 sites of care across the U.S. and the U.K.

It has made 10 acquisitions since 2021 worth more than $1.5 billion combined. And over that time, its stock has surged nearly 80% – more than twice as much as the S&P 500 Index.

Many other strategic acquirers just like HCA Healthcare are gearing up to take advantage of this opportunity. They are poised for massive growth... and savvy investors would do well to pay attention.

Regards,

Joel Litman

February 21, 2024

Editor's note: More than a dozen companies already plan to sell their assets by the end of the year. Hundreds are now facing a "Wall of Debt." And it's creating a special opportunity for strategic acquirers like HCA Healthcare...

According to Joel, this could be "the most overlooked stock market opportunity of 2024." He's teaming up with Stansberry Research's Dr. David Eifrig to sound the alarm on this well-hidden crisis... and reveal how it could lead to triple-digit upside if you get in now. Plus, they share the No. 1 strategic acquirer you should own today. Full story here.

The pandemic was a terrible time for a lot of folks...

The pandemic was a terrible time for a lot of folks...