Competition is heating up in the food-delivery space...

Competition is heating up in the food-delivery space...

Recently, e-commerce giant Amazon (AMZN) announced that Prime members will get a free year of Grubhub+.

As part of the deal, Amazon also gets a 2% stake in Grubhub. And if the partnership is successful, Amazon could get as much as 15% of the company.

Grubhub is the fifth-largest food-delivery service by revenue. Now that it has a massive new partner in Amazon, it's putting even more pressure on competitors in an already cutthroat industry.

Take direct Grubhub competitor DoorDash (DASH)...

DoorDash is the fourth-largest player in the space, putting it just above Grubhub in terms of revenue. Now, DoorDash has to worry even more about market share. One of its smaller competitors just got much deeper pockets.

That's bad news for all of Grubhub's competitors, of course. But it's especially bad for DoorDash, which was already a low performer.

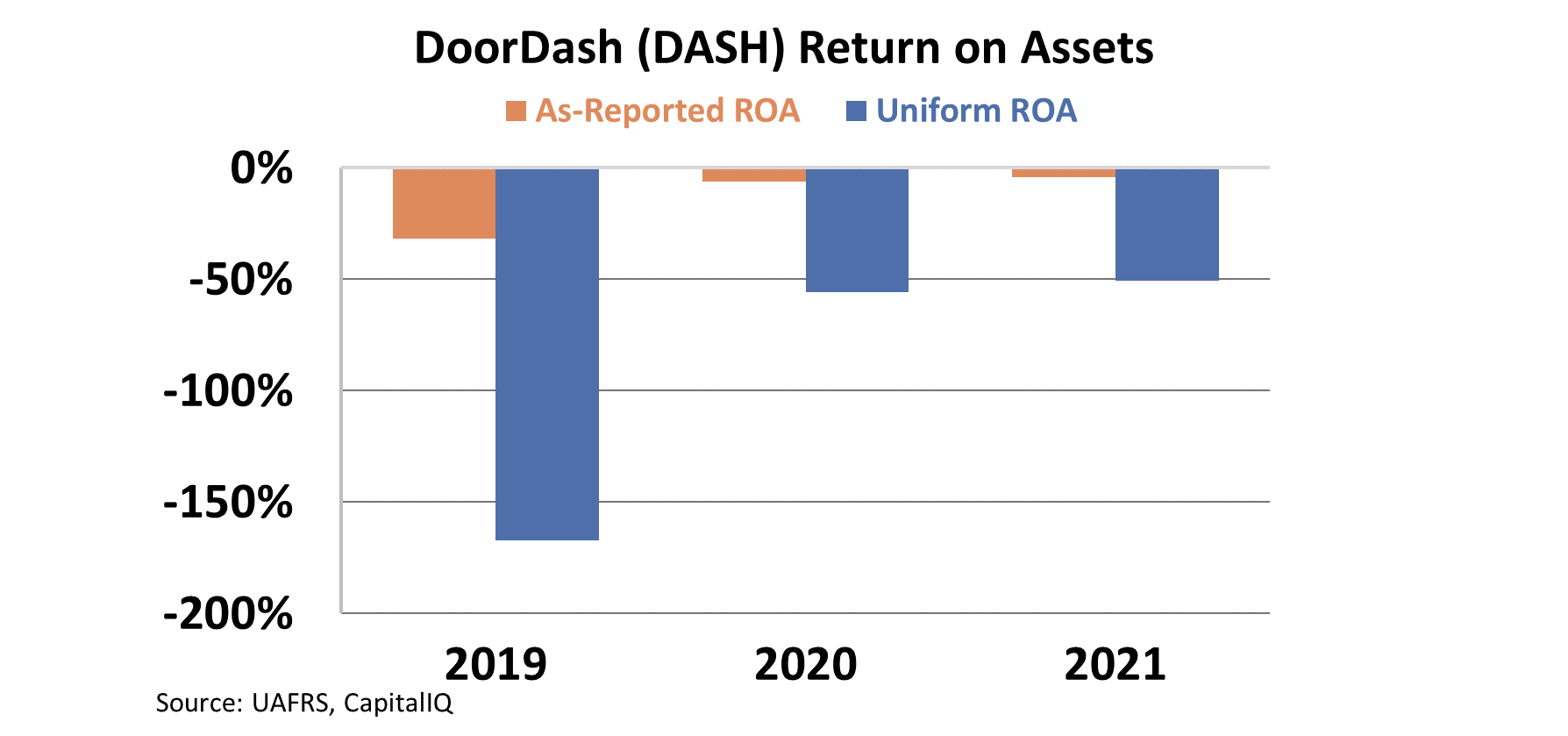

DoorDash's Uniform return on assets ("ROA") is negative. It was an abysmal negative 167% in 2019, and only "improved" to negative 56% in 2021. Every year, DoorDash burns through cash.

These numbers don't bode well for DoorDash. Competition is on the rise. The company needs to make major changes if it wants to generate any returns.

Investors think DoorDash has what it takes...

Investors think DoorDash has what it takes...

The company is in a weak position. However, the market doesn't seem to realize how fast the ship is sinking.

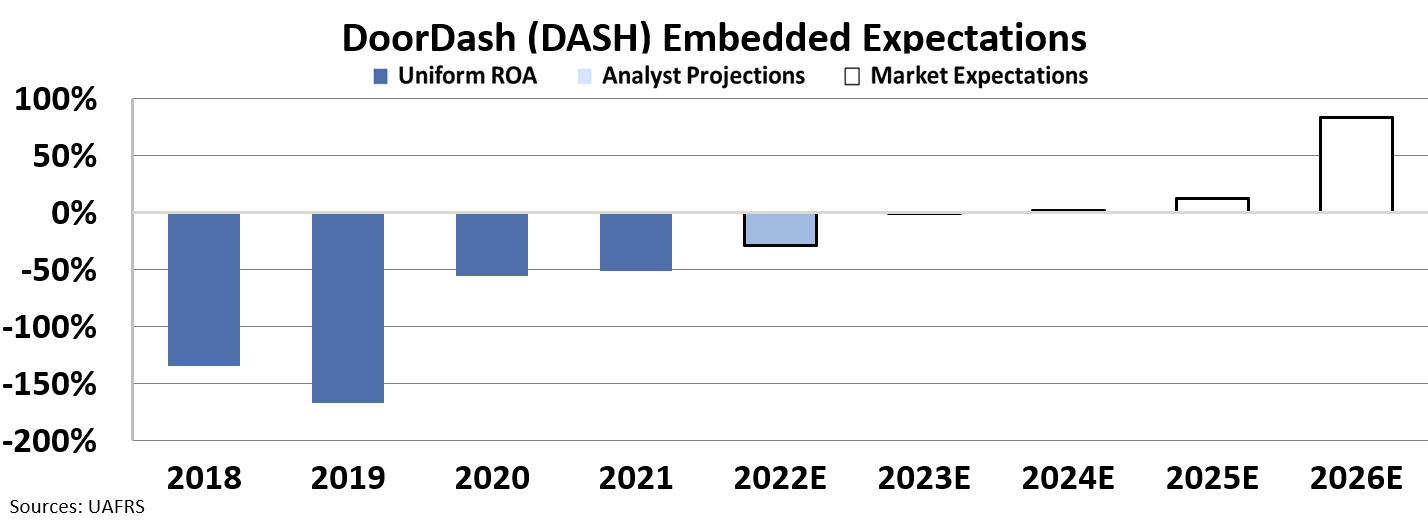

To better understand market projections, we can use our Embedded Expectations Analysis ("EEA") framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model. It takes assumptions about the future and produces the "intrinsic value" of a stock.

Traditional methods rely on as-reported metrics, which use immaterial assumptions to produce the same inaccurate models. So we've turned the DCF model on its head... We use the current stock price to determine what returns the market expects.

In the chart below, the dark blue bars represent DoorDash's historical corporate performance levels in terms of ROA, as we already discussed. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for DoorDash based on current valuations.

Take a look...

The market's expectations fly in the face of DoorDash's struggles. The company hasn't been able to make money amid competitive pressure, but investors predict it will generate huge returns.

Investors think DoorDash's Uniform ROA will reach 83% by 2026. That's absurd when you see how unprofitable it is today.

To reach such high returns, DoorDash would need to become the dominant delivery app. Grubhub's partnership with Amazon is likely a major speed bump... offering it more money and staying power.

DoorDash investors could soon be in for a rude surprise.

Regards,

Rob Spivey

July 19, 2022

Competition is heating up in the food-delivery space...

Competition is heating up in the food-delivery space...