Brazil's state-owned oil player is still navigating a tough political landscape...

Brazil's state-owned oil player is still navigating a tough political landscape...

For many years, Petróleo Brasileiro (PBR) – better known as just "Petrobras" – was as much a cash register and patronage distribution platform for different Brazilian governments as anything else.

The company was founded in 1953 as a fully-nationalized oil producer, and the Brazilian president at the time proclaimed: "The Oil is Ours!" Today, even as problems continue to plague the company, Petrobras is ranked No. 120 in Fortune's Global 500 list.

A few years ago, Brazil's economics minister decided it was time to right the ship. He announced reform plans within Brazil, permitting Petrobras to consolidate and rationalize operations in 2018.

This would allow the company to work more like a normal business (or at least, as much as any national oil company can).

However, in late February, Brazilian President Jair Bolsonaro fired the head of Petrobras via Facebook in an effort to appease truck drivers complaining about high prices. Government leadership may not be as supportive of reforming the company as the politicians originally implied...

It also shows that Bolsonaro isn't interested in private reforms. He's instead appealing to rising populism in the country looking for direct intervention.

These ham-fisted actions by the Brazilian government spooked investors. PBR shares sold off dramatically following the news, dipping more than 20%.

And the equity investors weren't the only ones fearful over the recent events...

Credit investors also hit the panic button...

Credit investors also hit the panic button...

Between February and March, the "yield to worst" on the company's 2025 bonds climbed from 1.58% to 2.08%. Such a high spike in yields shows that credit investors now demand a higher yield to offset a perceived risk.

However, over the years, Petrobras has faced many headwinds and struggled in developing the offshore oil it has discovered. The company has also faced challenges in having to deal with rapidly changing political circumstances.

Despite equity and credit investors responding poorly to the news, there's some hope for Petrobras. The company is still operating... and it throws off significant cash flow from operations.

And even after accounting for ongoing political concerns, considering Petrobras' fundamentals, the credit market and credit-ratings agencies are overly pessimistic.

Specifically, the company earns a "BB-" rating from S&P Global Ratings. This indicates that Petrobras has a greater than 10% chance of default over the next five years.

So to get a more accurate picture of the company's credit risk, we can turn to Uniform Accounting...

So to get a more accurate picture of the company's credit risk, we can turn to Uniform Accounting...

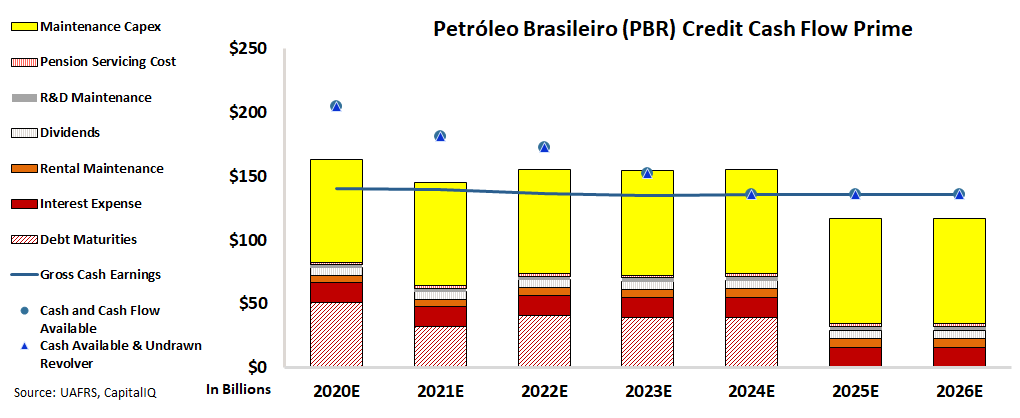

By removing the distortions inherent in GAAP metrics, our Credit Cash Flow Prime ("CCFP") analysis breaks down the full story behind Petrobras' debt.

In the chart below, the stacked bars represent the company's obligations each year for the next five years. We compare these obligations to cash flow (blue line), cash on hand at the beginning of each period (blue dots), and the undrawn credit revolver (blue triangles).

As the CCFP shows, Petrobras' cash flows alone should exceed operating obligations – all obligations other than debt maturities – each year.

Additionally, the company's significant flexibility with its massive commitments for capital expenditures ("capex"), cash flow, and available cash on hand should allow it to cover all obligations in the years ahead, except in 2024. Then, Petrobras can trim its large capex costs to cover all obligations.

Using the correct, Uniform data, we can give Petrobras an investment-grade rating of "IG4," which is equivalent to a "BBB" rating from S&P. This corresponds to a less than 2% risk of default over the next five years.

It's important for investors to always be cautious of geopolitical risks for a company like Petrobras... but if the fundamentals show that cash and cash flows are enough to cover obligations, the risk is relatively low.

The geopolitical issues aren't severe enough to disrupt Petrobras' cash flows... so the company's debt is safer than the ratings agencies would have you believe.

Regards,

Rob Spivey

March 9, 2021

Brazil's state-owned oil player is still navigating a tough political landscape...

Brazil's state-owned oil player is still navigating a tough political landscape...