There's a scarcity issue for the modern economy's most important resource...

There's a scarcity issue for the modern economy's most important resource...

I recently arrived back in Istanbul after spending much of the first half of 2021 in the U.S., mostly in Florida. As I look back, one of the most jarring parts of my trip was the appearance of many "now hiring" signs.

You have likely read many headlines about high unemployment and historically low labor force participation rates. At the same time, the country faces high worker shortages. Companies are desperate to find employees, even offering unorthodox signing bonuses.

The solution everyone keeps talking about is compensation. President Joe Biden has talked about needing to give people raises and hiking the minimum wage. There is a constant barrage of news articles about raising employee pay.

If people don't make a living wage, the economy can't function. That means pay needs to be at a certain level. However, considering the breadth of these issues with labor scarcity or at least labor mismatch, pay alone will not solve getting people to take certain jobs.

The compensation issue is that it can only be a "nonnegative" incentive tool. Studies show that if you pay people too little, they'll work less, be less engaged, and at some point, quit.

However, if you pay people a lot more, it doesn't mean they'll work harder than they already do. A lot goes into motivating someone to want to work beyond promising more money.

Simply raising pay levels won't do what's best to bring workers into a business or help retain them.

Wall Street's investment banking arms provide some of the highest-paying jobs around. However, the turnover is massive. Why? Because often, the actual work performed and the culture are toxic. For most people, all the pay in the world doesn't offset a horrible work environment.

Studies from Alight Solutions, Gallup to academia show why people stay and love their work... It's not for maximum pay...

Studies from Alight Solutions, Gallup to academia show why people stay and love their work... It's not for maximum pay...

Once in a while, people quit a job because they are truly underpaid. More often than not, people leave a place of employment because they didn't like their boss, the corporate culture, or the role didn't match their expectations.

It's important to think holistically about "employee engagement" drivers to get the right employees and retain them.

In our book, Driven: Business Strategy, Human Actions and the Creation of Wealth, my co-author Mark Frigo and I highlight a framework from Hewitt Associates. It's a firm that had been at the forefront of employee engagement. Aon (AON) bought the firm in 2010. The acquired firm described its business as "human capital consulting."

Human capital consultants spend a lot of time understanding how workers and management can be aligned to fulfill a company's vision. Company boards pay these types to design compensation frameworks for management teams. Management teams hire them to use best practices in recruiting and retain the most valuable talent.

Hewitt came up with a list of the seven "levers" for employee engagement that can help ensure employees are happy, engaged, and working at their most productive and creative capacity:

- Culture and purpose

- Work activities

- Relationships

- Leadership

- Quality of life

- Opportunity

- Compensation and benefits

Compensation is seen as the weakest for motivating workers to perform their best. Gaining and keeping great talent requires covering many different areas.

Even if an employee is well paid, they won't be a high performer if they don't feel purpose. If that employee doesn't like the assigned daily tasks or lacks good relationships and mentorships, that person is likely looking for an alternative.

Great companies and great employee engagement structures focus on all these things, not just on one. After all, those research polls show that people quit because the company dropped the ball in many ways, not pay alone.

Companies turn to these services to figure out the right way to engage employees...

Companies turn to these services to figure out the right way to engage employees...

One of the biggest players in human capital consulting is Aon Hewitt. Hewitt acts as an advisor for companies' human resources, and it has been a great addition to Aon's core business as an insurance broker.

Of course, we can only see how great it is after we clean up the as-reported financial metrics to see the true economic picture of the company.

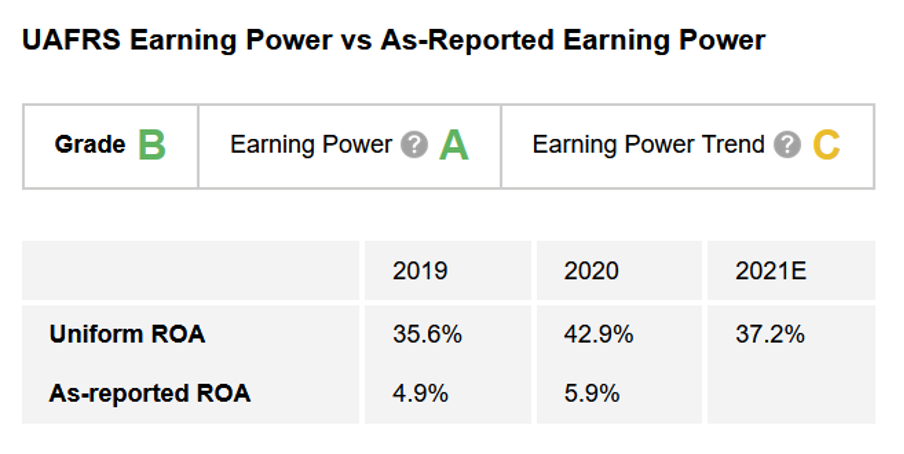

By utilizing Uniform Accounting – which adjusts for these distortions – The Altimeter shows users easily digestible grades to rank businesses and stocks based on their real financials.

Aon isn't a low 6% return on assets ("ROA") business like as-reported metrics reflect. Even amid the global pandemic last year, it was a 43% ROA business, and its year-over-year returns even rose in 2020.

Thanks to its truly strong profitability, it gets an "A" grade for Earning Power. Even though its Earning Power Trend grade is only a "C" as returns will level off in 2021, the overall performance grade for the company is an impressive "B," highlighting the business' profitability.

Aon helps companies manage their most important asset: people. And that, in turn, helps companies make a lot of money.

Of course, that doesn't mean Aon stock is a buy...

Of course, that doesn't mean Aon stock is a buy...

Not all great companies are also great stocks to buy.

What drives stock prices are expectations of what the company will do in the future.

Altimeter subscribers can click here to see how Aon is valued based on Uniform Accounting... and if it is an interesting stock as opposed to just a great business. With The Altimeter, you'll gain immediate access to the full grading for more than 4,400 other publicly traded companies.

If you want to hear more about similar stories and aren't subscribed to The Altimeter, click here to find out more.

Regards,

Joel Litman

August 13, 2021

There's a scarcity issue for the modern economy's most important resource...

There's a scarcity issue for the modern economy's most important resource...