It seems like every investor wants AI...

It seems like every investor wants AI...

But no one wants to live near it.

The rise of AI promises unparalleled progress across industries. It's all dependent on the rapid expansion of data centers, though... and the communities hosting these centers are paying the price.

Like nuclear power plants, data centers are important yet unwelcome neighbors. Major tech players like Amazon (AMZN), Meta Platforms (META), and Microsoft (MSFT) are establishing massive facilities that span hundreds of acres and run 24/7. They're stirring conflicts over noise, water, and energy.

Residents in Northern Virginia – home to the biggest data-center market in the world – told the New York Times that the relentless sound of cooling fans is like "a leaf blower that never stops."

The energy demands also burden local grids, driving up household utility bills by hundreds of dollars each year.

By the time the public learns about these projects, it's often too late to stop them. Tech giants employ nondisclosure agreements with local officials, silencing potential opposition until they've broken ground.

That said, the pushback is getting stronger. A group of Oregon residents removed two pro-data-center officials from office. And a $1.3 billion project in Indiana was scrapped earlier this year after it faced resistance.

All that opposition may seem like it's going to hurt data-center companies... but as we'll explain, it may not be that simple.

The AI boom has set off a race among data-center operators...

The AI boom has set off a race among data-center operators...

And almost nobody has more on the line than Equinix (EQIX). It has 260 facilities in 70 metropolitan areas across 36 countries... including key hubs like Silicon Valley, Northern Virginia, Frankfurt, and Singapore.

But that expansion comes at a cost.

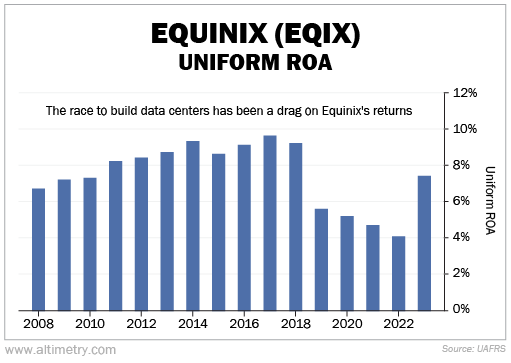

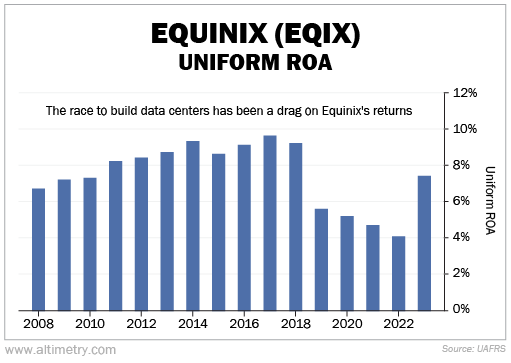

Massive infrastructure investment has strained Equinix's Uniform return on assets ("ROA"). While returns used to consistently run above 9%, they've fallen as low as 4% in recent years.

Take a look...

Part of the issue is how much the company has been spending. Equinix is adding data centers as fast as possible. It's expensive to build and run them in these extremely popular areas.

So pushback from communities about data centers might help companies like Equinix in the long run.

Building data centers in less populated areas might be the best way forward...

Building data centers in less populated areas might be the best way forward...

These locations often offer simpler regulatory landscapes and lower land prices... meaning companies can sidestep some of the noise and water usage criticisms.

This can help projects win approval faster. And it can reduce construction and operating costs. That should improve returns over time.

The data-center industry's momentum isn't slowing. Companies like Equinix are going to have to keep building regardless of the cost. The global data-center market was valued at just over $200 billion in 2021. It's projected to surpass $517 billion by 2030.

That said, most data-center stocks are already wildly expensive...

Equinix's stock trades at a 60 times Uniform price-to-earnings (P/E) ratio... roughly three times the market average.

Even if returns improve, shares are a long way off from being a good deal.

Regards,

Rob Spivey

November 6, 2024

P.S. The election results are rolling in as we go to press. And no matter the outcome, it's safe to say political tensions have rarely been higher.

That goes double for many investors... which is why Altimetry founder Joel Litman and I are hosting an exclusive, live "Ask Me Anything" election video call today at 3 p.m. Eastern time.

While we can't provide personalized investment advice, we'll discuss investor concerns, share our favorite corner of the market to profit from either administration – and most important, answer questions from subscribers like you.

This event is completely free to attend. All we ask is that you reserve your spot right here.

It seems like every investor wants AI...

It seems like every investor wants AI...