After recently gaining the spotlight, Japanese whisky is changing...

After recently gaining the spotlight, Japanese whisky is changing...

Until recently, liquor connoisseurs would point to Scotland as the undisputed home of fine whisky (spelled without the "e" in Caledonia and places that seek to mimic the Scots' flavor profile).

However, over the past 20 years, the popularity of Japanese whisky has exploded onto the scene. While the beverage has been commercially distilled in the country since the 1920s, it took decades for it to catch on.

Ever since a Japanese whisky brand won the "Best of the Best" award from Whisky Magazine in 2001, connoisseurs have flocked to the country's beverage. Subsequently, the import of Japanese whisky to the U.S. jumped 1,000% in just five years.

Unbeknownst to many fans of the drink, Japanese whisky historically hasn't shared the same rigor as a drink like scotch...

Unbeknownst to many fans of the drink, Japanese whisky historically hasn't shared the same rigor as a drink like scotch...

Other famous liquor variants such as bourbon and scotch from the U.S. and Scotland are region-specific or have detailed rules about their distillation and aging. In other words, a distillery in Ireland can make a peated whisk(e)y, but to be scotch it must be made and bottled in Scotland.

Meanwhile, as long as Japanese whisky is bottled in the country, it can be sourced anywhere on the planet.

That is, until now...

In approximately one month, all Japanese whisky must be sourced, created, and bottled in Japan.

These regulations around the entire product bring Japanese whisky to the level of more stringent guidelines for drinks like scotch and bourbon. For the first time, consumers of Japanese whisky will have a clear concept of the liquor, with a name that ties it to its country of origin.

With this change in Japanese whisky regulation, many distilleries have scrambled to alter production to meet these requirements.

As a result, these changes may disrupt a hot and growing industry. They may also lead consumers to transition to the whisky that's already made from Japanese ingredients, as the supply won't be disrupted.

The distilleries that are already set up to meet the new standard have the potential to be the biggest beneficiaries of these changes in the industry.

One brewer and distiller on that list is Suntory Beverage & Food (STBFY)...

One brewer and distiller on that list is Suntory Beverage & Food (STBFY)...

The company has been giving consumers what they thought they were buying all along: authentic Japanese whisky sourced and made in Japan.

Many of the company's whiskies, such as the Hakushu, Hibiki, Toki, and Yamazaki brands already meet the new requirements within the industry. This means Suntory is already prepared for this forced market shift.

Suntory has been investing in its supply chain to bring the necessary whisky components domestic for years. Specifically, it has positioned itself to market and sell its products in Japan using domestic ingredients.

Suntory already has strong positioning within the industry... And yet, its profitability appears weak.

Suntory already has strong positioning within the industry... And yet, its profitability appears weak.

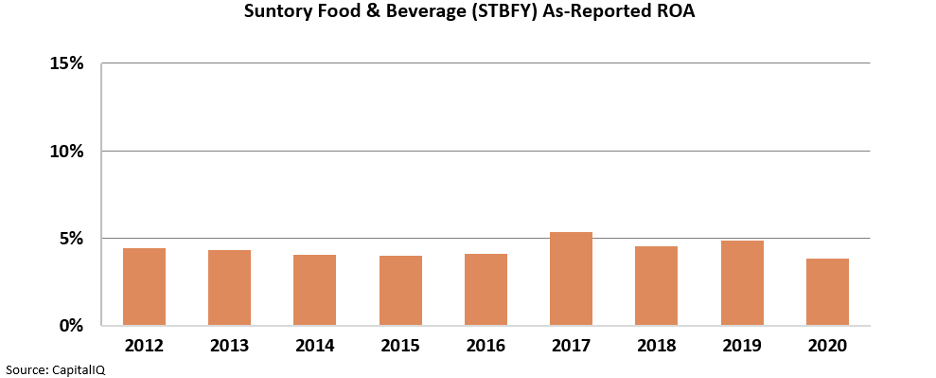

Since 2012, the company's return-on-asset ("ROA") levels have stagnated at around 5% or lower. Based on these GAAP metrics, investors would conclude Suntory struggles to even see returns break above cost-of-capital levels.

Based on this stagnant and low profitability, many folks would assume Suntory's investments in the business have been a waste... and that the company's positioning as an authentic Japanese distiller isn't highly valued enough by consumers to translate into high ROAs. Take a look...

In reality, this apparent weak ROA is just 'noise' from bad accounting...

In reality, this apparent weak ROA is just 'noise' from bad accounting...

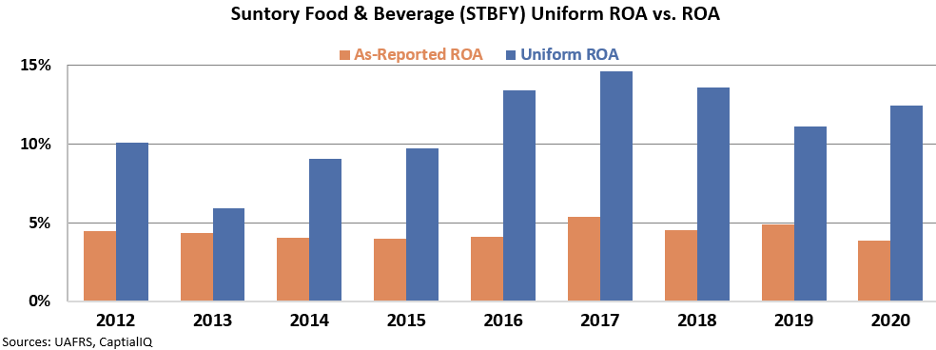

After adjusting the GAAP financial statements for items such as goodwill, interest expense, and other distortions, we can see Suntory's real performance.

Specifically, after fading from 10% in 2012 to 6% in 2013, the company's Uniform ROA expanded to double-digit levels from 2016 on.

As you can see in the chart below, instead of continued weakness in profitability, Suntory has had strong returns driven by successful investments in the business.

By viewing Suntory through the lens of Uniform Accounting, we can begin to understand the power of the firm's investment in brand quality.

Furthermore, the company is set up to see returns continue to improve if other producers of Japanese whisky are disrupted in the near future.

Best regards,

Rob Spivey

March 16, 2021

P.S. Here at Altimetry, many of us have a passion for whisk(e)y in all its forms – especially scotch. If you're interested in exploring but never have because you're unsure about what you might like, here's a useful "flavor map" of Scottish single malt whiskies.

I first came across it when my wife and I went to Scotland and I convinced her to let me spend a day in one of the largest whisky-making regions, Speyside. It isn't an exhaustive "map," but it can help you identify which single malts you might like, based on your palette.

Depending on the day, I might go to my old standby "Lag" (Lagavulin) 16-year... or I might break out my Auchentoshan 10-year... or if I'm celebrating, sip some of my Macallan 18-year. And as the map will show you, those are all across the flavor profile!

After recently gaining the spotlight, Japanese whisky is changing...

After recently gaining the spotlight, Japanese whisky is changing...