One company is in particularly deep trouble...

One company is in particularly deep trouble...

Russia's invasion of Ukraine is a tragedy on a massive scale, and this stark upending of European peace sent shockwaves across the world.

From supply chain and operational disruptions to rising commodity prices, this crisis is causing many international companies to think about the world in a new way.

One particular company is EPAM Systems (EPAM).

EPAM is one of the largest manufacturers of custom software and consulting providers in the world, and the company has branches in more than 40 countries.

Arkadiy Dobkin, co-founder and CEO, is Belarussian. This is one reason why the company's roots spread from New Jersey to Minsk, capital of Belarus.

Along with facing the emotional side of the crisis, Arkadiy Dobkin now must worry about the company's regional operations in Ukraine, Belarus, and Russia.

Before the war, of EPAM's 58,000 employees, 14,000 were in Ukraine and 18,000 were in Belarus or Russia. This means more than half of its employees were directly impacted by the war and are on both sides.

The company is now forced to walk an impossibly thin line to both protect and provide for its Ukrainian employees while also threading the needle to appease the governments where even more of its employees are working.

Can EPAM turn this crisis around?

Can EPAM turn this crisis around?

The problem EPAM is now facing isn't an easy one to resolve without alienating half of its work force.

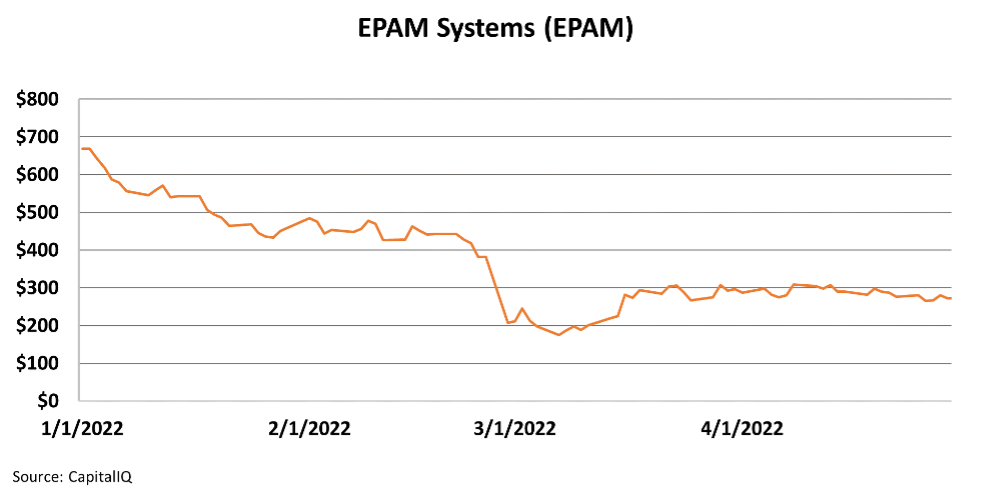

The challenges caused by the war have led the stock to crater around 60% from over $700 in 2021 to around $275.

This huge drop shows how EPAM's operations have ground to a halt over the past few months. However, such a large fall may also have investors wondering if there is a buying opportunity to be had.

Were EPAM to navigate these headwinds and return to some form of its prewar operations, the stock could be trading at a bargain.

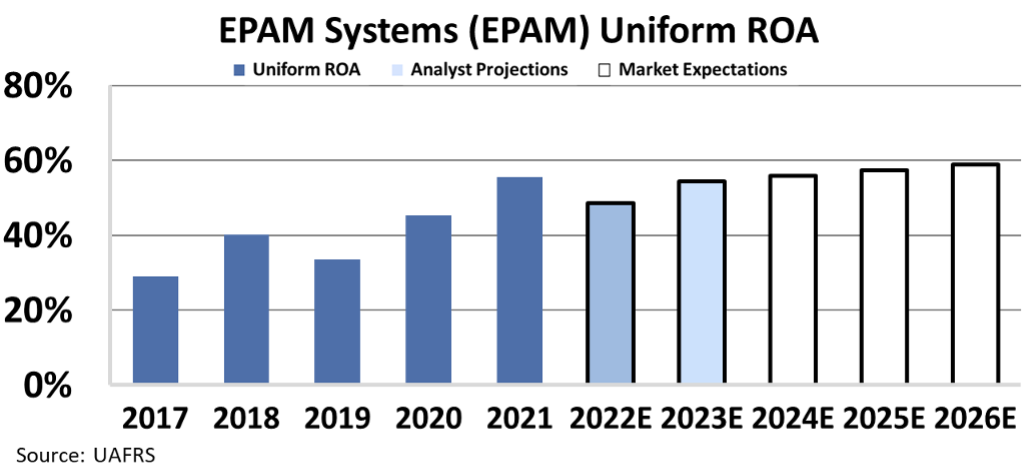

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect a company to do at its current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our EEA to determine what returns the market expects.

A look at the EEA highlights something staggering. Even after the more than 60% drop in stock price, the market is still pricing in the company for return on assets ("ROA") to stay at all-time highs going forward.

The market was paying such an absurd valuation before that, even after a geopolitical crisis sent the price back down to earth, these valuations would have only been reasonable before the invasion.

Without Uniform Accounting, investors would have no clue they were paying a huge premium for EPAM, both before and after the invasion of Ukraine. Only by looking at the right data can smart investors invest with confidence.

Regards,

Rob Spivey

May 3, 2022

One company is in particularly deep trouble...

One company is in particularly deep trouble...