Rite Aid finally gave up the ghost...

Rite Aid finally gave up the ghost...

Folks had been expecting the 61-year-old pharmacy franchise to fail since 2008. It was able to hold on a lot longer than many thought, thanks to strong asset backing and cash flows.

But with today's opioid crisis lawsuits and changing consumer spending patterns, Rite Aid's finances haven't been able to keep up. On October 15, it filed for Chapter 11 bankruptcy protection.

It said it had reached a deal with creditors... and that it would begin "restructuring" to reduce its roughly $4 billion in debt.

Then, in a regulatory filing released on October 18, it got worse...

Rite Aid revealed that it had lost more than $1 billion just in the months leading up to its bankruptcy filing. It warned investors that it may not be able to keep its business alive.

Of course, Rite Aid isn't alone. The number of bankruptcies has skyrocketed this year. It was at 459 as of August 31, surpassing the full-year numbers for 2021 and 2022.

That's also a higher rate than all but two of the past 13 years. Bankruptcies were only higher in 2020, when we were coming out of the pandemic... and 2010, when we were coming out of the Great Recession.

Last week, I explained that we're on the cusp of a credit crunch... and stocks are in for a rough couple of years. Today, I'll share the best way to protect your money as the recession plays out.

Consumer cash is drying up...

Consumer cash is drying up...

Americans have less in savings today than they did before the pandemic. And banks are once again worried about lending.

Add on the growing number of bankruptcies, and you're looking at a looming downturn.

This is nothing new. As we shared at our corporate affiliate Stansberry Research's annual conference last week... equity collapses often come from problems in the credit market.

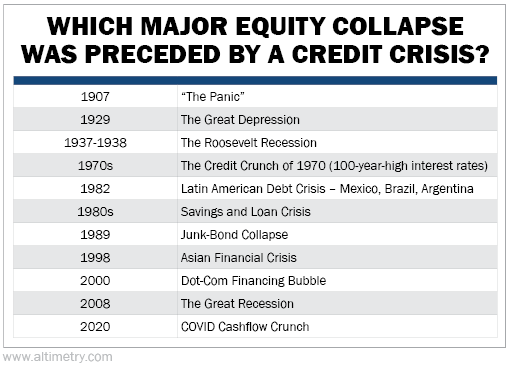

This slide from our presentation shows equity collapses dating back to 1900. And as you can see, there's an obvious connection...

In 1907, a credit crisis known as "The Panic" led to a big drop in the equity market. In 1929, a credit crisis triggered the Great Depression. And on it goes...

The Roosevelt Recession of the late 1930s. The savings and loan crisis of the 1980s. The dot-com bubble in 2000. The Great Recession in 2008. They all followed the same pattern.

Each time, a problem in the credit market eventually crashed the equity market.

Most recently, we had the 2020 cashflow crunch. Bankruptcies started rising. And investors panicked that companies and consumers were running out of cash. If the government hadn't provided emergency stimulus, we could've had a more serious credit crisis... and the stock market wouldn't have recovered so quickly.

Right now, bankruptcies are rising again. We're setting up for another credit crisis. That's a big red flag for anyone with most of their money in stocks.

Instead, there's a much safer place for your money... And it's probably the opposite of what you'd expect.

The right place to be in the midst of a credit crisis... is the credit market.

The right place to be in the midst of a credit crisis... is the credit market.

In any crisis, investors panic. And when that happens, they also panic sell.

So when a credit crisis hits, you get a window where bond prices drop off big time. Everyone is scared that all of corporate America is on the verge of bankruptcy. They'll dump the bonds of perfectly safe companies along with the ones that are in danger.

And if you pay close attention, you can scoop up the bonds of companies that aren't going bankrupt for pennies on the dollar. Your returns on those bonds are backed by legal protections... meaning they're a lot safer and recover a lot faster than equities.

And because they provide regular interest payments, you get a steady income stream while you wait to be paid back.

In short, the credit crisis will be painful for stock investors. But it will also create a rare opportunity to earn equity-like returns... if you're willing to venture into new territory.

Regards,

Rob Spivey

October 27, 2023

P.S. If you're ready to take the next step into bond investing, I encourage you to check out my brand-new Credit Cashflow Investor advisory...

My team and I launched Credit Cashflow Investor last month to take advantage of the rare opportunity approaching in the credit market. We've already added six recommendations to our model portfolio... with expected annualized yields ranging from 7% to almost 20%.

Credit investors are treating these bonds as risky bets. But the underlying companies are actually in great shape from a credit standpoint. And we expect to find plenty more opportunities in the coming months.

To learn more – and claim 50% off one full year of Credit Cashflow Investor – click here.

Rite Aid finally gave up the ghost...

Rite Aid finally gave up the ghost...