The U.S. obesity market was valued at $1.5 billion in 2022...

The U.S. obesity market was valued at $1.5 billion in 2022...

That ramped up significantly last year with the development of weight-loss drugs like Novo Nordisk's (NVO) Wegovy and Eli Lilly's (LLY) Zepbound.

Research from JPMorgan Chase estimates that the obesity market reached $5.1 billion in 2023 – up 240% in just a year. By 2030, it's forecast to hit $44 billion.

Pharmaceutical giants Novo Nordisk and Eli Lilly have been scrambling for a piece of that pie. They've been vying for the top spot in the weight-loss space for some time now...

Shares of both companies have soared in response to the runaway demand for their drugs. Novo Nordisk's stock is up 68% over the past year, while Eli Lilly's is up 112%.

However, demand for their drugs has spiked so much in recent months that both companies are struggling to maintain their supply. Some folks have even likened being able to find Wegovy to winning the lottery.

Earlier this month, Novo Nordisk's holding company, Novo, made a game-changing move to try and fix this problem... It agreed to buy the pharma giant's supplier, Catalent (CTLT), for $16.5 billion.

Today, we'll take a look at Novo's recently announced acquisition. As we'll explain, the pharmaceutical giant is now perfectly positioned to come out on top in the weight-loss drug race...

Catalent has been a vital piece of Novo Nordisk's supply chain...

Catalent has been a vital piece of Novo Nordisk's supply chain...

The company is one of the largest outsourced manufacturers in the pharmaceutical industry. It has more than 50 global sites and helps supply nearly 8,000 products each year. And it boasts big-name clients like AstraZeneca (AZN), Eli Lilly, and Novo Nordisk...

Catalent is the main supplier of "fill-finish work" for Novo Nordisk's Wegovy... meaning it fills and packages syringes and injection pens for the drug.

Novo's acquisition of the company would give it direct control of Catalent's manufacturing plants and therefore help ease some of its current production bottlenecks. It would also prevent competitors like Eli Lilly, who also rely on Catalent's manufacturing, from acquiring the company first.

Moreover, the acquisition represents an opportunity to fix the quality-control issues that have plagued the company over the past several years...

See, according to the U.S. Food and Drug Administration, Catalent's Brussels manufacturing plant has repeatedly failed to complete required safety tests and even breached U.S. sterile-safety rules.

At the same time, the company's debt has been piling up. Catalent has $4.5 billion in debt on its balance sheet and only about $230 million in cash. And with interest rates still at elevated levels, that debt is expensive.

However, these issues allow Novo to get a great deal...

However, these issues allow Novo to get a great deal...

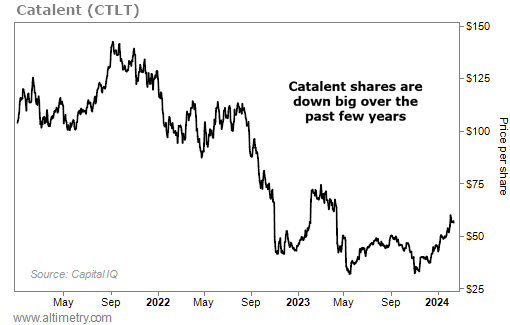

Catalent's regulatory troubles, combined with its significant debt, have led to a large drop in its stock price over the past few years.

Shares reached an all-time high of around $140 in 2021, when business was booming from pandemic-era manufacturing deals. However, Catalent's stock has fallen about 60% since then.

Check it out...

In other words, not only is Novo getting a leg up on the competition, but it's buying a vital business at a steep discount.

And outside of its recent regulatory struggles, Catalent has proven that it can provide stable returns. Prior to 2023, the company's Uniform return on assets averaged between 9% and 12% for nine years straight.

Plus, with Catalent's plants under its control, Novo has an opportunity to invest in better quality control at its factories.

It can also easily take care of Catalent's debt load... Novo Nordisk has more than $30 billion in cash on its balance sheet. That means it could pay all of that debt off right away.

In the coming months and years, this may prove to be the landmark moment in the weight-loss battle between Novo Nordisk and Eli Lilly.

It gives Novo a huge production advantage... and that will likely show in its stock in the coming years.

Regards,

Joel Litman

February 15, 2024

Editor's note: Catalent's problems aren't unique. Joel says 1 in 3 U.S. companies now faces a "Wall of Debt"... And in today's tight credit environment, they'll be forced to make some tough choices to avoid bankruptcy.

According to Joel, we're about to see a wave of divestitures – one that will open an urgent window of opportunity for smart, savvy acquirers. And investors who get in now have a chance at extraordinary gains.

Joel recently went live with Stansberry Research's Dr. David "Doc" Eifrig to cover this rare market setup. They even shared the name and ticker symbol of a company that will win big as this story plays out... and one you should avoid at all costs. Get the details here.

The U.S. obesity market was valued at $1.5 billion in 2022...

The U.S. obesity market was valued at $1.5 billion in 2022...