Each year, market-research firm CB Insights publishes a list of game-changing startups...

Each year, market-research firm CB Insights publishes a list of game-changing startups...

CB Insights is widely respected in the industry... and this year's release didn't disappoint.

The list included innovations such as CRISPR 2.0, which provides safer and more precise approaches to gene editing. The report also covered "carbon capture" companies. These firms could recycle or even remove carbon emissions from the Earth's atmosphere.

Electrocharged therapeutics is another exciting area. Companies in this space are trying to reshape disease treatment by using electrical impulses instead of drugs.

The list goes on... including developments such as speed-of-light chips, artificial intelligence ("AI")-based protein prediction, microbiome masters, next-generation nuclear energy, and sustainable shippers.

All of these technologies are at a nascent stage of development. And yet, most of the themes lack focus on the way that the coronavirus pandemic is affecting the world. In a year where one disease has changed almost every aspect of society, it's surprising to see a lack of connection to it.

And yet, one of the few topics directly related to the changing world is quantum cryptography. This is the science of using quantum mechanics to solve cryptographic tasks. It's a critical field... Adequate online security has become even more important in today's work-from-home environment.

The world was already moving more online prior to the pandemic, and now the process has accelerated. Physical documents in the workplace are growing more obsolete. And with the growing risk of corporate and government espionage, quantum cryptography will only continue to become more important.

However, analysis on corporate cybersecurity doesn't start with cryptography...

However, analysis on corporate cybersecurity doesn't start with cryptography...

Much of cybersecurity has to do with other variables. The first is threat management based on analyzing a system's vulnerabilities. The second is training employees to be aware of risks. Finally, a security company needs to be able to track and respond to issues beyond the act of a data hack itself.

One firm that focuses on all of these is Rapid7 (RPD) – a company based right here in Boston. And since the start of the "At-Home Revolution," Rapid7 has been a popular name. The company offers full coverage – assisting customers before, during, and after attacks. Rapid7 even plays war games for its clients and prospects.

Rapid7 acts as a "white-hat hacker" that tries to break into a company's system in order to find its weak spots. It does this by sending fake phishing e-mails to employees, among other tactics.

Looking at Rapid7's stock, RPD shares have risen from a low of around $33 in March to more than $60 today – right around their pre-pandemic peak. Take a look...

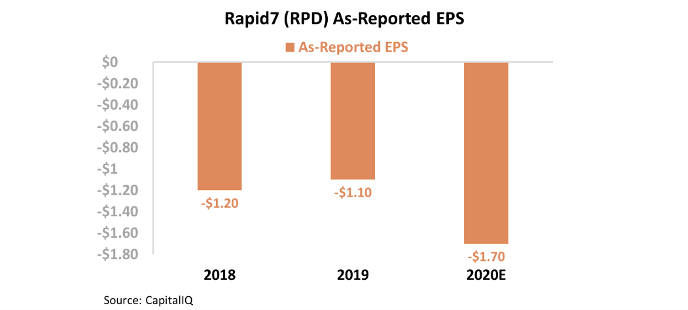

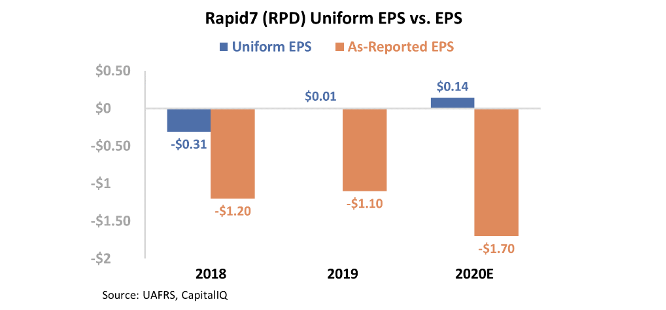

However the GAAP numbers don't show why this stock appreciation may be warranted. Rapid7's as-reported earnings per share ("EPS") stood at negative $1.10 last year, and analysts expect this to fall to negative $1.70 this year. Take a look...

However, as-reported accounting is missing the mark. Stock option expenses and other distortions are adversely affecting Rapid7's profitability.

Uniform Accounting shows that in 2019, the company's EPS was slightly positive. On top of that, Rapid7's EPS is forecasted to increase to $0.14 this year...

Uniform metrics show Rapid7's earnings are accelerating and are now positive. This is happening as demand for the company's offerings is surging in the midst of the At-Home Revolution.

However, in order to get a better picture of what this means for the stock going forward, just understanding the company's quality isn't enough... We have to look at longer-term market valuations. For this, let's turn to the Embedded Expectations Framework...

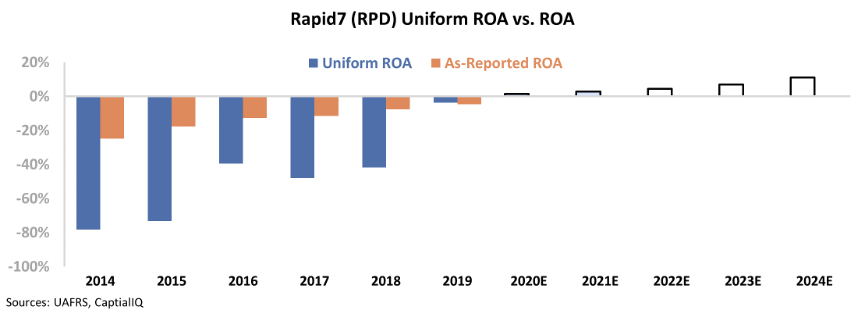

The chart below explains Rapid7's historical corporate performance levels, in terms of return on assets ("ROA," in the dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Sell-side analysts are expecting Rapid7's profitability to rise to 3%. The market is then pricing in further improvement to 11% in 2024.

This growth expectation seems substantial... but Rapid7's profitability measures have consistently increased since 2016 – possibly highlighting the company's ability to continue the trend. Furthermore, Uniform Accounting shows that plenty of Rapid7's cybersecurity peers have returns just as robust... or better.

The current macroeconomic environment is significantly aiding Rapid7. As the world moves more online than ever before, the need for cybersecurity will only continue to grow.

Additionally, Uniform Accounting shows that Rapid7 is already benefiting from greater demand. As long as demand continues to grow, the company may be able to continue to justify its share price... contrary to what its negative as-reported EPS would have you believe.

Regards,

Rob Spivey

September 15, 2020

Each year, market-research firm CB Insights publishes a list of game-changing startups...

Each year, market-research firm CB Insights publishes a list of game-changing startups...