Texas was crippled when its power grid failed...

Texas was crippled when its power grid failed...

Most of the state lost power as its independent electrical grid failed during winter storms last month. An estimated 70 people lost their lives as Texas scrambled to get its grid up and running again.

Many homes were damaged as pipes froze and burst. Roads were unnavigable as few plows were available. The state's production of oil trickled to just 600,000 to 700,000 barrels a day, compared to pre-cold snap levels of 3.5 million.

Texas is still picking up the pieces, and fingers are already being pointed in blame for this disaster. Meanwhile, a political debate was ignited in Washington, D.C., as power companies jacked up prices by more than 600% in the privatized power grid during the worst of the shortages.

It was a rare, unpredictable debacle with severe consequences – a "black swan" event. However, these events create "losers" and "winners." Last month, Forbes highlighted a few of these companies...

The big losers during the storm were energy retailers like Just Energy (JE). As these companies purchase power wholesale to sell at retail, they were forced to fill demand at high prices.

Similarly, the big energy producers themselves struggled, as they were unable to secure natural gas at reasonable prices to burn. Companies like NRG Energy (NRG) operated when they could, no matter the cost.

Meanwhile, in Texas' deregulated energy market, the big winners were companies that don't produce power... Instead, they simply distribute it from the power plants to the end user. The distributors were able to pass costs directly onto the consumer and make a profit from the sudden scarcity of power.

Companies like CenterPoint Energy (CNP) and Sempra Energy (SRE) not only benefited from high demand, but higher volumes, as they were now selling to a larger pool of customers outside of their usual coverage.

While we should all feel for the pain and hardship Texas endured during the last month, it's important to understand how the state was unevenly affected and what was happening on the ground.

Let's take a closer look at another 'winner' from this meltdown...

Let's take a closer look at another 'winner' from this meltdown...

Vistra (VST) is one of Texas' independent power providers, which means it both produces power and sells it on the open market to power distributors. In 2019, a little more than one-third of the company's earnings before interest, taxes, depreciation, and amortization ("EBITDA") and revenue was based in Texas alone.

Vistra has a large variety of power sources, such as natural gas, coal, nuclear, alternatives, and battery storage solutions. The company's diverse power supply and solid fuel sourcing meant it was able to weather the chaos, with only 1,000 megawatts of its total 19 gigawatts of power knocked offline.

In Texas' darkest hour, Vistra went from providing 18% of the grid's power to between 25% and 30%. Vistra also has nuclear and solar power, combined with the largest battery facility in the U.S. to keep the energy flowing.

Rather than a one-time bump, Vistra appears to be seeing the fruits of its diversification efforts pay off.

To understand how strong of a company Vistra is, we can use our Altimeter tool...

To understand how strong of a company Vistra is, we can use our Altimeter tool...

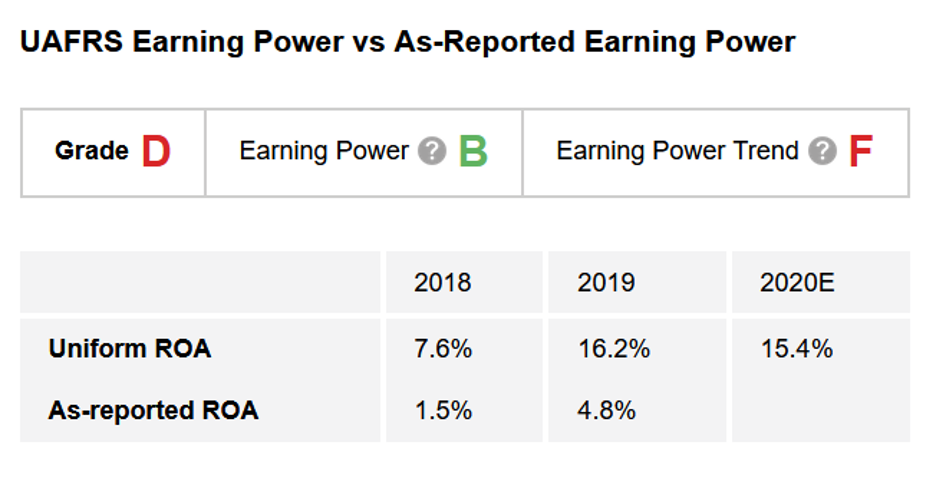

Using the power of Uniform Accounting – which eliminates the distortions in GAAP financial metrics – The Altimeter shows users easily digestible grades to rank stocks based on their real financials.

After making more than 130 adjustments though Uniform Accounting to clean up the distorted as-reported numbers, we can see that Vistra's return on assets ("ROA") has been much stronger than those of other utilities, which usually hover around 4%.

This is thanks to management's smart investment into a diversified power portfolio. At 16% returns in 2019, Vistra gets a "B" grade for its earnings power in The Altimeter.

On the other hand, Vistra's 2020 earnings per share ("EPS") and ROA are forecasted to have taken a step back as a result of pandemic-induced pullback in demand for power as the economy contracted. Therefore, the company gets an "F" grade for its earnings power trend.

That said, the tailwinds of the Texas power market shake-up aren't yet built into this forecast... meaning Vistra's earnings power trend will likely make a full recovery to an "A" rating.

Of course, prior performance is only one piece of the puzzle when determining whether a stock is a good buy...

Of course, prior performance is only one piece of the puzzle when determining whether a stock is a good buy...

Valuations are also important. They signal if the market has caught on to whether Vistra is becoming a strong operator.

With The Altimeter, you can see the full performance breakdown as well as the valuation for Vistra. You can also see which of the company's competitors are struggling... and which are thriving.

We cover more than 4,000 publicly traded companies across industries – all through the framework of Uniform Accounting – so you can see how they all grade out for yourself... Learn more here.

Regards,

Rob Spivey

March 4, 2021

Texas was crippled when its power grid failed...

Texas was crippled when its power grid failed...