American industry was coasting after World War II...

American industry was coasting after World War II...

As one of the only economies that wasn't damaged by the war, the U.S. was able to sell its goods without much pushback. Quality didn't matter – the competition had mostly been wiped out.

A famous consultant named W. Edwards Deming recognized that this couldn't go on forever. If the U.S. manufacturing industry kept skating by, it would eventually fall behind. Other countries in Europe and Asia would rebuild and competition would come back.

Deming tried convincing companies that they needed to constantly improve. Few listened. So he sought out a more receptive group...

As the Allies helped rebuild Japan, Deming turned to the island nation. He consulted for Japanese companies. His efforts helped lead to the post-WWII Japanese manufacturing boom.

Deming taught Japanese executives 14 points of management. The crucial first point is the concept of continuous improvement – known as "kaizen" in Japanese.

The Japanese took this concept to heart. Kaizen means that everyone, from the CEO down the line, keeps working to analyze and improve the business. It's a big part of why Japan's economy boomed from the 1960s through the 1990s, becoming the second-largest in the world.

One of the best examples of kaizen in action came from automaker Toyota Motor (TM). The company utilized kaizen to keep improving its product quality.

Whenever it thought it could design something better, it would go through a process called a "kaizen blitz" to find a solution. The team got together and brainstormed ideas to improve a specific process or product. They'd keep working until they came up with an improvement.

In the coming decades, Japanese cars, electronics, and other home goods became the gold standard for quality. A big reason for that was because companies like Toyota constantly found ways to get better.

Kaizen still reigns supreme in Japan today. One of the highest honors in Japanese business is the "Deming Prize" for use of his management concepts in practice.

Continuous improvement doesn't stop at big corporations...

Continuous improvement doesn't stop at big corporations...

Kaizen can be useful for economies and smaller companies – and for your portfolio.

There's always opportunity for improvement in investing. Picking stocks for your portfolio is never linear... and it's never a one-time decision.

As the market changes and as you learn more about investing, your philosophy should change, too. After all, good investors don't just get good at one investing approach. They use the right tool for the job.

We practice kaizen here at Altimetry, too...

Regular readers know the basis of everything we do starts with Uniform Accounting and deep company analysis. That's a pretty good combination, if we do say so ourselves. It has led to impressive performances – like our Microcap Confidential advisory, which has doubled the benchmark Russell 2000 Index since our first issue in 2020.

However, even a process that successful can be improved. That's why we're constantly on a quest to find those improvements.

One of the best ways to do this isn't to focus on successes. It's to focus on failures... and how you can eliminate them.

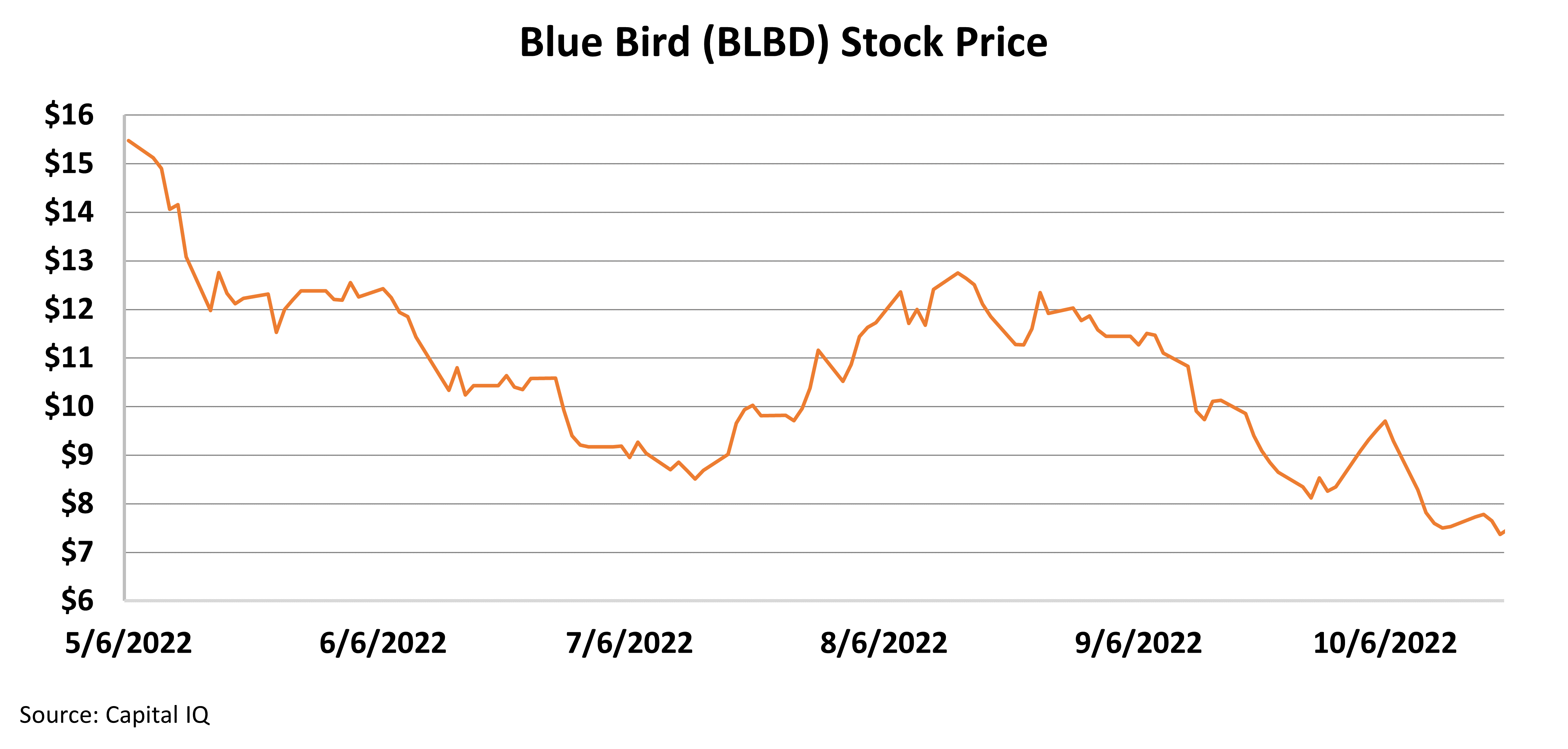

Take school bus maker Blue Bird (BLBD), which we recommended to Microcap Confidential subscribers back in May.

The company boasted impressive Uniform returns. It was well-positioned to benefit from an industry investment cycle. And it's a leader in up-and-coming clean-energy school bus investment.

Despite these tailwinds, the stock was down 15% within a month of our recommendation. That was a much bigger drop than the rest of the market... and our risk controls told us to get out.

(It's a good thing we listened. By mid-October, the stock was down more than 50% from when we recommended it.)

We learned an important lesson from Blue Bird...

We learned an important lesson from Blue Bird...

Momentum is a powerful force in the stock market.

When the market dislikes a stock – meaning it's falling – it has to do a lot to shed that reputation and start rising again. The market was clearly against Blue Bird at the time.

We didn't pay attention to that, though. We were focusing on the fundamentals. We didn't include stock momentum on our checklist, which was why we whiffed on Blue Bird.

In the spirit of continuous improvement, we assessed Blue Bird and some of our other losses. We saw them as an opportunity to hone our process and returns. And we started including momentum indicators in our stock-research process.

We didn't just leverage this improvement for one newsletter, either. We implemented it across our entire system.

We even worked with our corporate affiliate Chaikin Analytics to improve the way we thought about timing our investments in Altimetry's High Alpha. The proprietary Chaikin "Power Gauge" system helps us understand the right (and wrong) time to buy.

When we combined the Power Gauge's signals with our top picks, we generated a list of what we call "Perfect Stocks." These are high-quality companies with strong fundamentals that also satisfied the Chaikin team's momentum indicators. Two of them are up triple digits since we first recommended them.

If you'd like to learn more about Perfect Stocks and access our Perfect Stock portfolio, click here to subscribe to Altimetry's High Alpha.

As an investor, you have plenty of tools at your hands... So you shouldn't rest on your investment laurels.

As an investor, you have plenty of tools at your hands... So you shouldn't rest on your investment laurels.

Your "usual" strategy might have been successful for the past decade-plus. That doesn't mean doing the same thing over and over again is always going to work.

Like many of the most successful businesses, you should be practicing kaizen in your investment process. Be open to new tools and approaches that can add to your tool kit.

Don't beat yourself up over every loss. And don't get overconfident when you win. Instead, keep asking what went wrong or right. Seek to continuously improve on the issues that led to failure. Analyze and emulate the approaches that led to success.

After all, the market is dynamic. If you want to keep adding to your nest egg, you have to adapt... continuously.

Wishing you love, joy, and peace,

Joel

November 18, 2022

American industry was coasting after World War II...

American industry was coasting after World War II...