The last few weeks have felt eerily familiar…

The last few weeks have felt eerily familiar…

For many companies, the end of summer was supposed to mark the return to the office. A common goalpost for employees was reopening after Labor Day.

But much like the promise of the initial lockdown in March 2020 only lasting for two weeks, current office reopening plans are changing. With cases of the delta variant of the coronavirus on the rise, large companies are pushing back their scheduled return to office dates.

Apple (AAPL) announced Aug. 20 that it was pushing back its return to the office from October to January, citing concerns about the rapid uptick in COVID-19 cases.

Last week's announcement comes a month after the Cupertino, California-based company shifted its September reopening plans to Oct. 1.

Amazon (AMZN) has delayed its return to January at the earliest, too.

Here at Altimetry, we've also just let our analyst team know that our prior plans to shift to a hybrid model after Labor Day are being pushed off indefinitely until we have a better idea about where things are heading.

One big change helping us stay sane during this transition will be how offices are structured...

One big change helping us stay sane during this transition will be how offices are structured...

While a fair amount of debate still exists over the effectiveness of remote work, another thought has been crossing many companies' minds: Why pay rent for an office we don't use?

Smaller firms have already initiated the departure from the office. But the buck stops with the larger corporations. Companies were already bleeding cash in the San Francisco Bay Area, as those offices sat cold and untouched for months. The new developments caused by the delta variant are an additional slap in the face.

Between Dropbox (DBX), Salesforce (CRM), Airbnb (ABNB), and Uber (UBER), more than $1 billion has been racked up in office space asset impairment since the start of the pandemic. Dropbox made a particularly painful $400 million investment into a large office space in downtown San Francisco, only to see the homeward shift occur in a matter of months.

Interestingly, when you look at the real estate investment trusts ("REITs") that dominate the big-ticket corporate office leasing space, you often find these REITs are not being priced for a collapse in lease revenue.

Boston Properties is a great example...

Boston Properties is a great example...

Boston Properties (BXP) owns buildings like the John Hancock Tower and the Prudential Tower in Boston, the General Motors Building in New York City, the Salesforce Tower in San Francisco, and even constructed the NASA headquarters in Washington, D.C. If any company were to suffer from a corporate reduction in operating leases, it would be BXP.

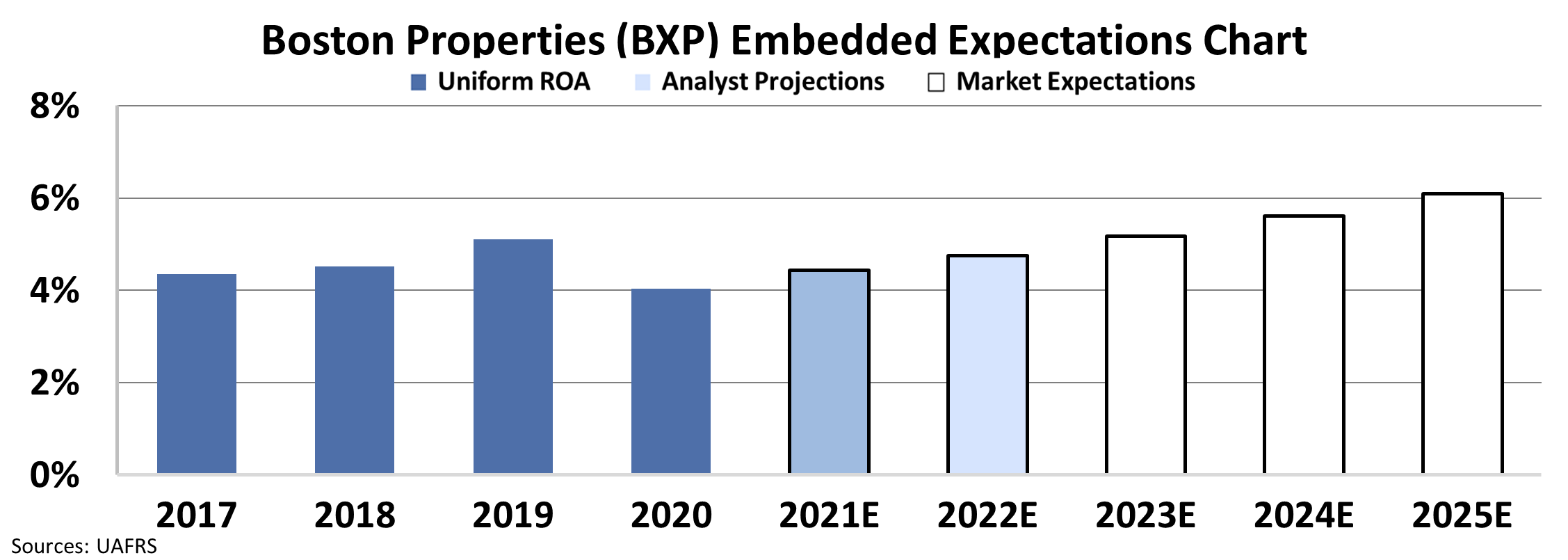

Using our Embedded Expectations Analysis, we can dissect the expectations for future performance already baked into the company's current stock price.

In the chart below, the dark blue bars represent BXP's historical corporate performance levels in terms of Uniform return on assets ("ROA").

The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how BXP's ROA will shift over five years.

Interestingly, BXP and a number of its peers are not priced to suffer.

BXP currently has a 4% Uniform ROA, which is reasonable for an asset-heavy REIT. Analysts who follow the company and the real estate market closely are predicting a modest Uniform ROA expansion.

Moreover, the market is pricing in Uniform ROA to continue expanding to 15-year highs.

Investors and analysts alike expect the headwinds incurred by the office leasing business during 2020 to be just a blip in an otherwise booming business story.

It's not always easy to tell whether a theme is investible or simply passing news...

It's not always easy to tell whether a theme is investible or simply passing news...

Worries about the impending retreat of Fortune 500 companies from office spaces may be an interesting idea to invest in. But sometimes, the reality on the ground is different.

Using Uniform Accounting, we can remove the distortions in as-reported financial metrics and grade stocks based on their real financials. After we clean up the GAAP numbers, we can identify thriving companies and trends.

And we've pinpointed investment themes with major tailwinds in our Hidden Alpha newsletter. Our open positions for the "At-Home Revolution" theme are all up double-digits... with some gains as high as 172%.

To learn more about Hidden Alpha – and how to gain instant access to our top ideas – click here.

Regards,

Joel Litman

August 25, 2021

The last few weeks have felt eerily familiar…

The last few weeks have felt eerily familiar…