Semiconductors are scarce... and companies are concerned.

Semiconductors are scarce... and companies are concerned.

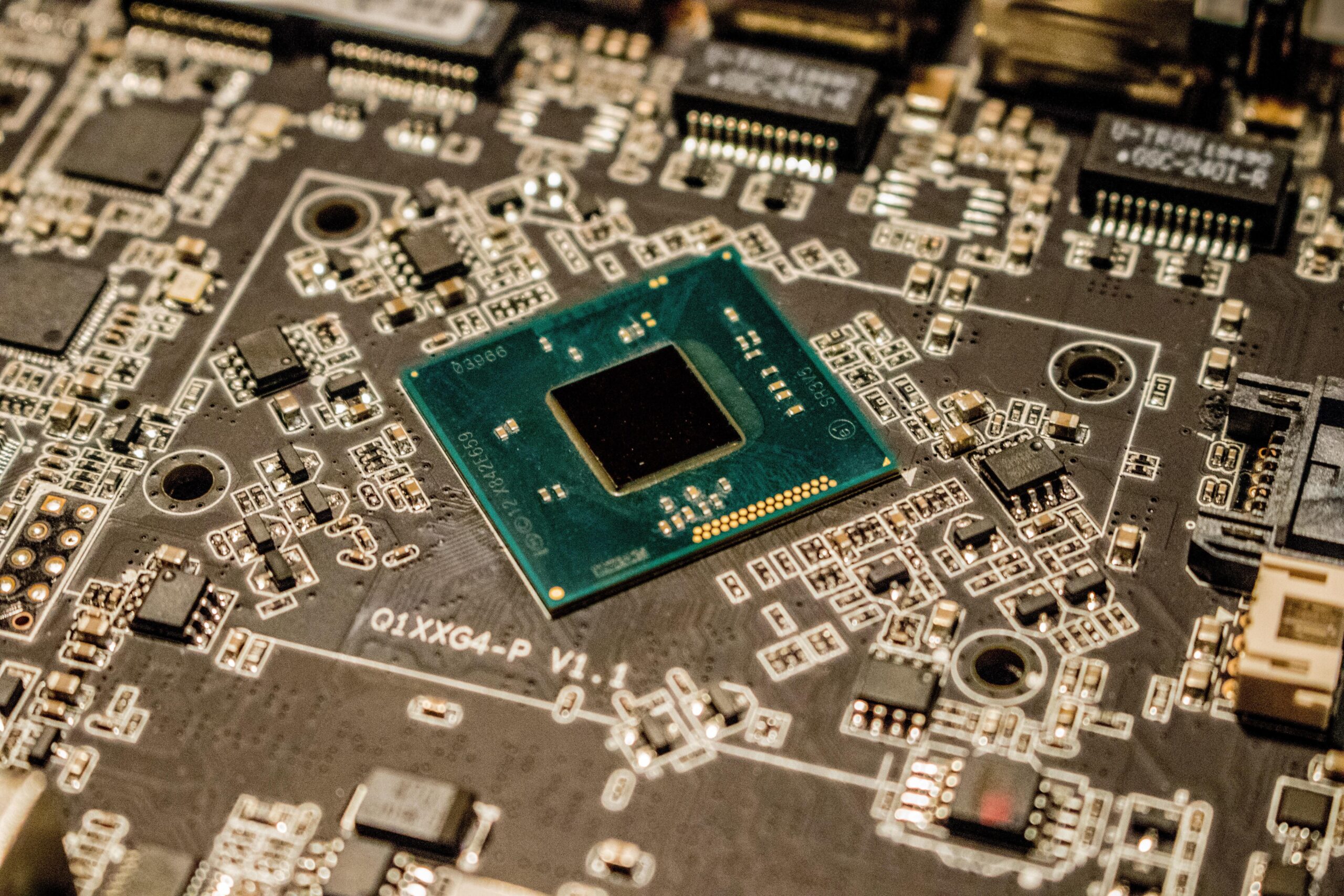

The semiconductor industry provides critical components for everything from electronics in phones and computers to brake sensors in cars.

That means supply chain headwinds are holding up the production of goods everywhere.

Without access to the necessary components for modern cars, automakers aren't likely to recover as strongly as they otherwise could have. These companies have been sounding the alarm for months... but they're just the tip of the iceberg.

As Bloomberg highlighted earlier this month, even Samsung Electronics is facing challenges with sourcing the chips it needs for its smartphones and other devices.

When a company that makes chips as part of its business is concerned about getting the chips it needs, you know there's an issue. Samsung clearly thinks its suppliers need to add capacity.

Samsung's complaints may serve as an attempt to push suppliers in order to make them resolve their issues in the near future.

Samsung isn't alone in seeking to fix the supply problem...

Samsung isn't alone in seeking to fix the supply problem...

Taiwan Semiconductor Manufacturing (TSM) is major firm that automakers and electronics companies rely on for chips.

Taiwan Semiconductor solely focuses on manufacturing semiconductors and has created a brand for itself as a go-to producer for many cutting-edge chipsets.

Fabricators, or "fabs," are manufacturing plants in the semiconductor industry where raw silicon wafers are made into integrated circuits. Companies like Taiwan Semiconductor have emerged as dominant fab plants for many semiconductor companies.

A company like Samsung or Qualcomm (QCOM) researches and designs new chips but uses a fab like Taiwan Semiconductor to physically produce most of the hardware. This allows the chip designers to focus on what they're good at and manage their intellectual property, without getting bogged down by owning manufacturing equipment.

The recent news of chip shortages have led some fabs to invest in expanding capacity. For example, Intel (INTC) just announced a $20 billion investment into two new chip plants in Arizona to supply itself and also other chip designers.

While customers may be unhappy with the situation, Taiwan Semiconductor has been taking advantage of the recent change in fortunes for fabs...

While customers may be unhappy with the situation, Taiwan Semiconductor has been taking advantage of the recent change in fortunes for fabs...

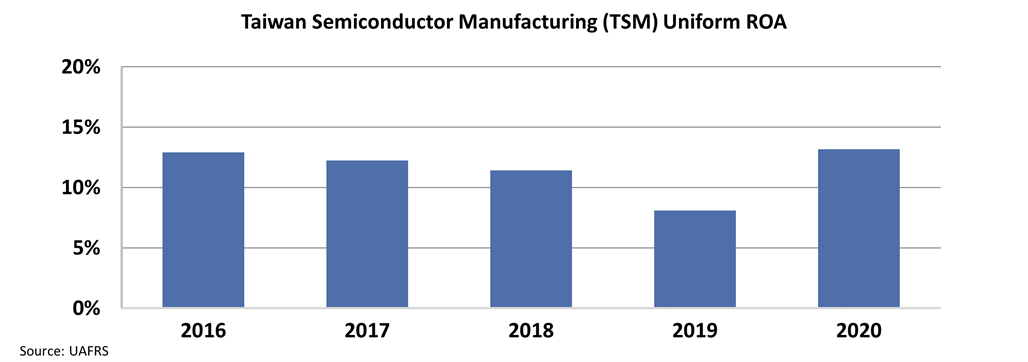

For several years, the company has been expanding capacity and investing. Due to this, it never had capacity tight enough that it could raise prices for customers who needed chips the most. As such, Taiwan Semiconductor's Uniform return-on-asset ("ROA") levels were steadily declining from 2016 through 2019.

As you can see in the chart below, Taiwan Semiconductor's Uniform ROA has dropped from nearly 15% in 2016 to less than 10% in 2019.

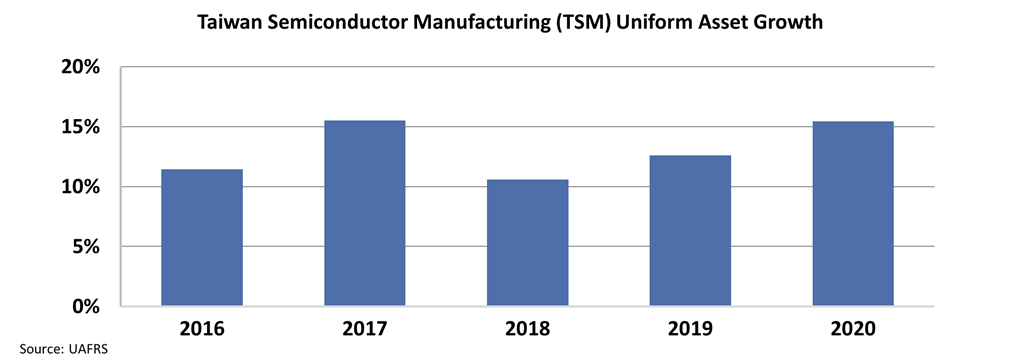

The next chart highlights the relationship between Taiwan Semiconductor's ROA levels and asset growth, or reinvestment in the business. As you can see, the company's years with the strongest Uniform asset growth have been the years ROA levels have faded the most, at least until 2020.

However, with constrained capacity and demand recovering faster than most folks expected post-pandemic, Taiwan Semiconductor's Uniform ROA expanded in 2020. The market got tight for chips fast.

Some investors might look at the setup and think this profitability boost means an opportunity to buy TSM shares...

Some investors might look at the setup and think this profitability boost means an opportunity to buy TSM shares...

But before rushing into the stock, we need to understand what the market is pricing in... and whether Taiwan Semiconductor is undervalued.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of a stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. We use a stock's current price to determine what returns the market expects.

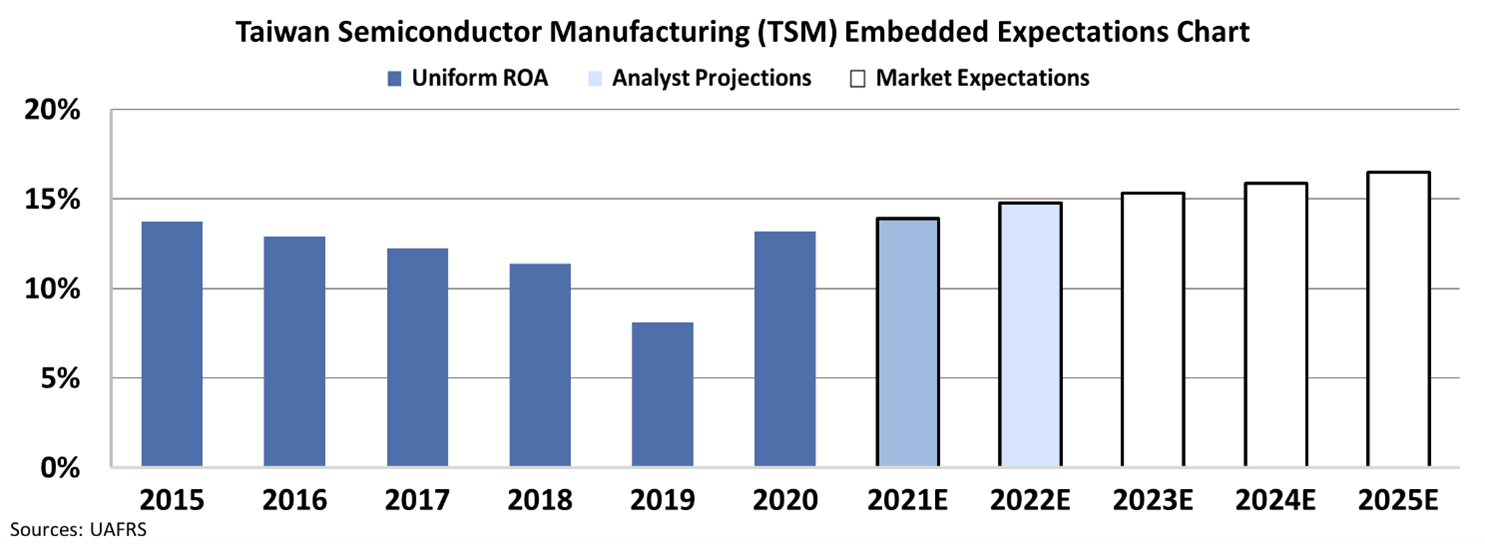

In the chart below, the dark blue bars represent Taiwan Semiconductor's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

While investors might want to jump in based on the headlines, the market is already pricing Taiwan Semiconductor for a strong recovery. As the white bars show, the market already expects ROA to hit levels not seen in the past six years.

Even if Taiwan Semiconductor stays profitable in a tight supply market, the stock might not have big upside ahead.

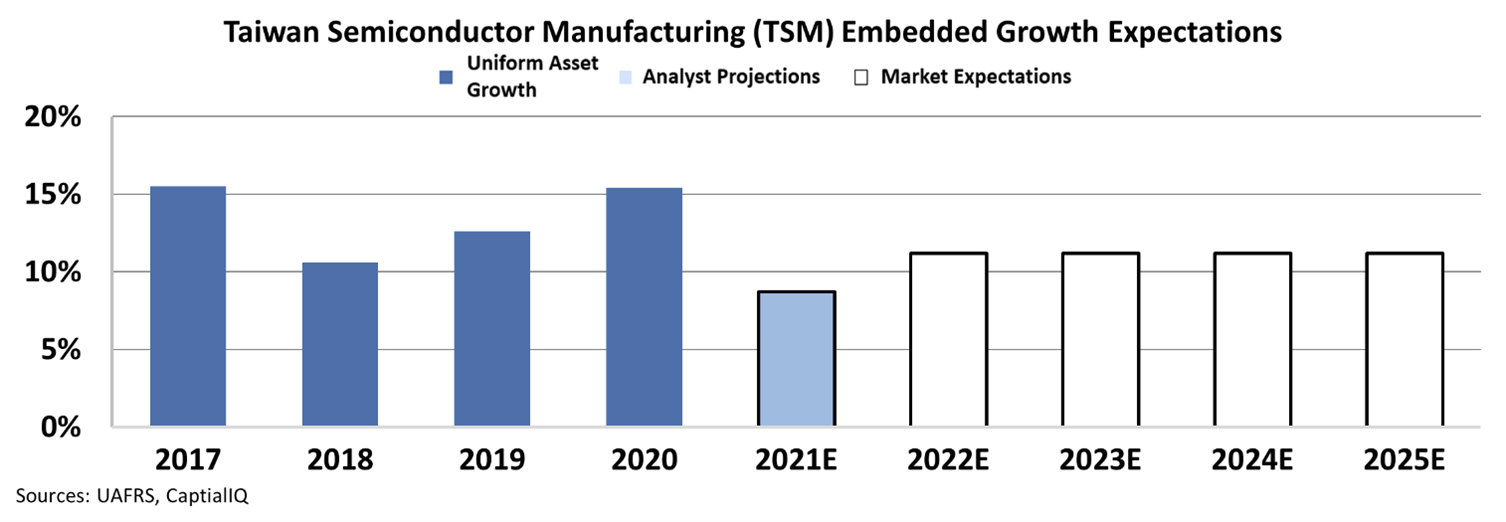

The market is also already pricing in high levels of asset growth above 12% over the next few years. The market thinks that Taiwan Semiconductor will ramp up capacity growth and be able to keep charging premium pricing in a tight market.

The market thinks that Taiwan Semiconductor can have its cake and eat it too. These are lofty expectations.

Investors thinking they should be rushing to buy TSM shares based on this demand story may want to take a second look before jumping in. Thanks to the power of Uniform Accounting, we can see what the market already thinks of the stock... and why it's already pricing in the demand upside.

It's critical to uncovering the real story behind market expectations and a stock's true valuations...

It's critical to uncovering the real story behind market expectations and a stock's true valuations...

Uniform Accounting removes the "noise" from the as-reported numbers. This helps us identify which stocks could see limited upside. It can also help us find ones that could be primed for a big move higher.

Our Altimeter software breaks down the numbers to show users easily digestible grades to rank stocks based on their Uniform fundamentals – including what the market may or may not be pricing in for the future. Don't miss out on the real story... Learn more here.

Regards,

Joel Litman

March 31, 2021

Semiconductors are scarce... and companies are concerned.

Semiconductors are scarce... and companies are concerned.