This $2 Trillion Company Is Changing the

Gaming Landscape

The purchase of Activision makes sense...

The purchase of Activision makes sense...

Microsoft's (MSFT) recent acquisition is a smart move on multiple levels.

The $2.3 trillion company announced its plans to acquire Activision Blizzard (ATVI) last month, marking its largest purchase ever.

Activision is the mastermind behind some of the most popular game franchises to date, including Call of Duty, World of Warcraft, Candy Crush, and Guitar Hero.

And Microsoft is getting Activision for a steal at $68.7 billion, or roughly $95 per share.

Shares hit a high of more than $100 in February 2021, thanks to the At-Home Revolution in gaming. But its stock price plummeted to nearly half that by December 2021.

In the latter half of the year, Activision was rocked by sexual misconduct and discrimination accusations against CEO Bobby Kotick.

Microsoft's offer might be a saving grace for the electronic gaming company...

In addition, the acquisition makes Microsoft even more dominant in the world of gaming, which seems to be consolidating at an accelerating pace. Sony (SONY), one of Microsoft's biggest rivals in the gaming industry, followed up by announcing it was buying game developer Bungie for nearly $4 billion.

Between Microsoft's Xbox system and its acquisitions of Minecraft and now Activision, it is on track to be the third-largest gaming company in the world.

Many of Activision's games focus on community and utilize a subscription-based model on the cloud, known as Software as a Service ("SaaS"). This model fits with Microsoft's focus on content, community, and cloud software, along with a shift to more subscription-based models.

While Activision is currently not in its best position, it has potential...

While Activision is currently not in its best position, it has potential...

By turning to Uniform Accounting, we can get an even clearer understanding of why Microsoft acquired Activision.

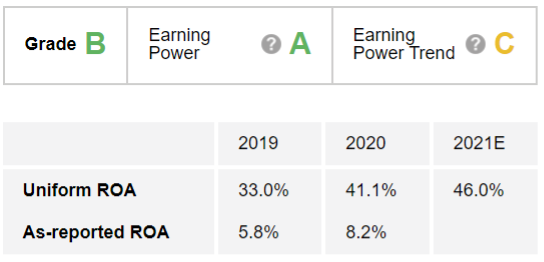

The Altimeter – which shows users easily digestible grades to rank stocks on their real financials – makes it easy to see why Microsoft likes the company so much.

As-reported metrics make it seem that Activision had a return on assets ("ROA") of just 6% and 8% in 2019 and 2020, respectively. In that case, it doesn't look like a very profitable company.

Uniform ROA, however, shows a bit of a different picture.

We can see that Activision generated a 41% Uniform ROA in 2020, with an estimated 46% Uniform ROA in 2021.

Microsoft already has an impressive Uniform ROA of 35%. But Activision looks even better...

These strong returns generate an "A" Earnings Power grade for Activision.

Earnings Power Trend tells us the ability of the company to grow its earnings year over year. Activision earns a "C" Earnings Power Trend grade, as earnings growth is forecast to be around 8% in the next two years.

While not as impressive as Earnings Power, Activision still earns a "B" overall.

Activision's performance highlights that getting more into the gaming subscription business might not be a bad bet.

However, the purchase of Activision won't come without some work that needs to be done.

In addition to repairing the company's image since the sexual misconduct and discrimination accusations came out last July, Microsoft will have to deal with difficult regulatory processes. Currently, Big Tech companies receive a lot of scrutiny for mergers like this one.

While it's not the perfect company, Microsoft views Activision as a chance to integrate itself into the gaming business further.

Can you still profit from megacaps like Microsoft?

Can you still profit from megacaps like Microsoft?

While Microsoft's biggest gains may be in the rearview, our team recently discovered a high-upside opportunity in a different corner of the market.

Using a scientific system, we found five mega-cap stocks with tremendous upside, all profiting from the same $12 trillion industry.

For these companies involved, it could mean billions of dollars in pure profit. For you, it could mean a series of 250%... 500%... even 1,000% gains... And in less time than you think.

Click here to learn how to get your share.

Regards,

Rob Spivey

February 10, 2022

The purchase of Activision makes sense...

The purchase of Activision makes sense...