Joel's note: The Altimetry offices are closed Friday in observance of Good Friday, so look for your next Altimetry Daily Authority on Monday, April 18.

This third wave of 3D printing may push the technology to the mainstream...

This third wave of 3D printing may push the technology to the mainstream...

It has technically been around since the 1980s.

But the world didn't see the practical use of 3D printing until 2014, when it started to be used for small-scale, high-value manufacturing. Over the past decade, 3D printing has allowed lasers to create any shape out of metal by melting metal powder together into one structure.

On the back of this second wave, 3D printing sales grew 17% in 2021. But growth is still limited because it's still expensive at the current manufacturing scale.

Because 3D printing is so slow compared to normal manufacturing, it's only used in niches like engineering, robotics, and automaking.

But this year might finally be the year 3D printing breaks into the mainstream, thanks to a newer technique called "area printing," which is better for mass production because it can print several items simultaneously.

Area printing of metal goods can be as cost-effective as stamping or casting, and expectations are that the technology could get up to 100 times faster in the next few years.

Area printing could change the fate of 3D printing companies...

Area printing could change the fate of 3D printing companies...

This is exciting news for manufacturers, but it might not be as exciting for investors.

One of the few public 3D printing manufacturing companies is a $1.5 billion firm called Desktop Metal (DM).

The company has two printer lines: Studio System, meant for small-scale printing, and a newer Production System, which is capable of area-printing-style manufacturing.

The Production System debuted in late 2019. But to this point, the system hasn't translated to much profitability.

The company has failed to turn a profit since going public in 2020, and it's not expected to in 2022 either.

Let's turn to The Altimeter to see how Desktop Metal's performance ranks...

Let's turn to The Altimeter to see how Desktop Metal's performance ranks...

We can use The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, to see how Desktop Metal is performing.

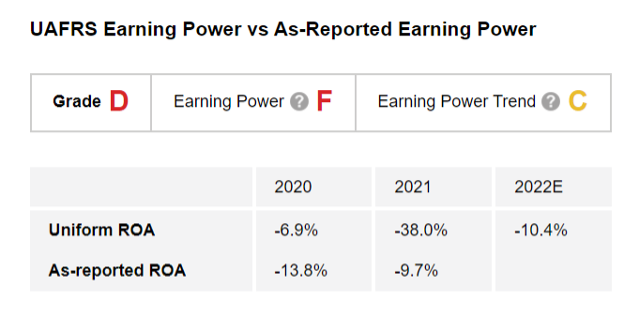

The Altimeter shows us that as-reported metrics make it appear Desktop Metal is seeing improvement in its return on assets ("ROA"), even though the company has not been able to record any profits for the last three years.

Under as-reported metrics, it looks as though ROA is still negative, and that it's rising from around negative 14% in 2020 to roughly negative 10% in 2021, which may indicate to investors that Desktop Metal is turning performance around.

But Uniform Accounting shows us the truth that returns have been struggling much more than Wall Street knows.

Desktop Metal saw a negative 38% Uniform ROA in 2021, a substantial decline from negative 7% in 2020. This weak performance led the company to earn a failing "F" Earning Power grade.

But the company might take advantage of the new "area printing" trend to boost profitability in the coming years and expand earnings.

Desktop Metal's Earning Power Trend has an average "C" grade supported by its earnings expectations. The future could improve for Desktop Metal, but only if manufacturers largely adopt area printing.

Does this mean Desktop Metal is a good stock to buy?

Does this mean Desktop Metal is a good stock to buy?

The Earning Power Trend grade could be good news for investors of Desktop Metal, but returns would have to improve for sizable to see any money returned to investors. Even were valuations to improve, valuations for a pre-profitable company would have to be attractive.

While Desktop Metal may not be a "screaming buy," there are other stocks in a different corner of the market with tremendous upside ahead...

In fact, Uniform Accounting led our team to this emerging subsector. It's one that most investors have never heard of before – but one with massive potential...

In a recent video presentation, my colleague Joel lays out all the details. He even mentions his favorite way to play this emerging trend – ticker symbol included, no e-mail address or credit card required. Watch it here.

Regards,

Rob Spivey

April 14, 2022

This third wave of 3D printing may push the technology to the mainstream...

This third wave of 3D printing may push the technology to the mainstream...