Dollar Tree (DLTR) made a bold move to double its size for pennies on the dollar...

Dollar Tree (DLTR) made a bold move to double its size for pennies on the dollar...

It shelled out $9 billion to acquire struggling rival Family Dollar in 2015.

At the time, executives sought to increase market share in the fiercely competitive discount-retail space.

And for a while, their approach seemed to work... Dollar Tree gained thousands of new stores overnight and became the largest discount chain in the U.S.

But over time, the cracks began to show. And after underperforming for nearly a decade, Dollar Tree is finally giving up...

It will convert 170 Family Dollar locations into Dollar Tree stores. The rest are going to distressed-focused investment firms Brigade Capital Management and Macellum Capital Management... for a mere $1 billion.

That's barely one-tenth of the original price tag.

Today, we'll explore why this failed acquisition has become an anchor around Dollar Tree's neck... and what it means for the company's future.

From day one, the Family Dollar deal was a high-risk bet...

From day one, the Family Dollar deal was a high-risk bet...

Its stores were disorganized and outdated, and theft was common. In some areas, stores lost more than 5% of sales via stolen inventory – well above the 1.6% industry average.

On top of that, Family Dollar's store layouts varied by location, making it hard to streamline operations.

Dollar Tree, on the other hand, had tight inventory controls and standardized its $1-or-less price point across stores.

But despite its strong model, Dollar Tree never managed to align the two business cultures.

Now, the company is struggling to keep its head above water...

Now, the company is struggling to keep its head above water...

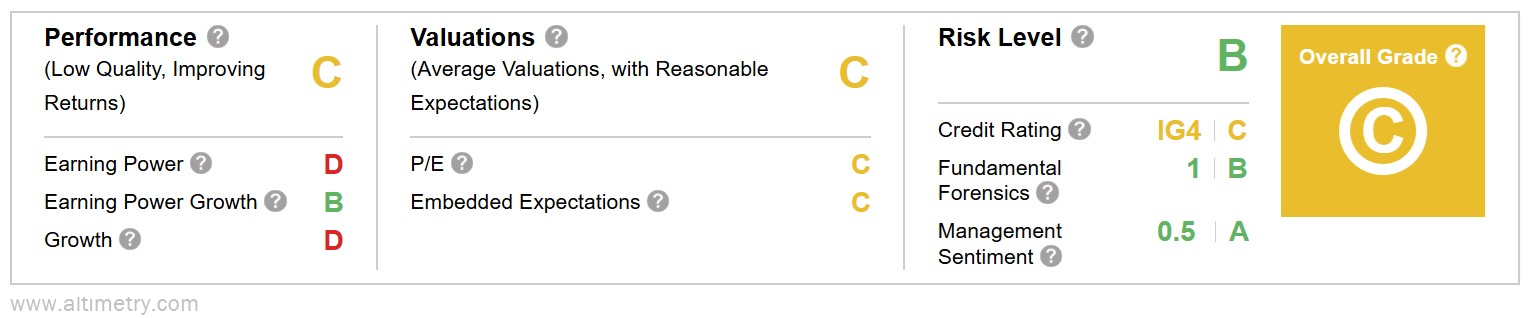

We can see this by looking at some key metrics in the Altimeter...

Dollar Tree's Uniform return on assets ("ROA") has steadily declined. It fell to 8% in 2024, marking a five-year low. The Uniform ROA is expected to dip even further (to 6%) in the next two years – far below the 12% corporate average.

Altogether, it earns Dollar Tree a weak "C" Performance grade in the Altimeter. Take a look...

In theory, selling off Family Dollar should relieve some of the pressure. But the details of the sale suggest otherwise... Dollar Tree is taking a steep loss – collecting only $1 billion for a business it paid nine times that amount to acquire.

Meanwhile, its valuation doesn't reflect these growing pains... Dollar Tree's Uniform price-to-earnings ratio is about 22 times. That's slightly above the 20 times market average, earning it a "C" Valuations grade.

The bottom line is, the company isn't cheap enough to justify the risks.

Investors should tread carefully as the losses pile up...

Investors should tread carefully as the losses pile up...

Dollar Tree has failed to transform the discount-retail space. And now, it's writing off most of that mistake.

But with margins and customer loyalty both slipping, this isn't the same high-efficiency retailer it once was.

And Dollar Tree's current stock price doesn't reflect its true decline. In other words, investors are giving the company too much credit.

This is what happens when acquisitions fail... and the market refuses to accept the outcome.

Dollar Tree's next chapter might be stronger. But it will likely take years for it to become profitable once again.

Regards,

Rob Spivey

May 15, 2025

P.S. A new AI super chip is ready to go mainstream, and it's setting up 1,000% upside potential for investors.

Two financial legends are calling it "the investment opportunity of the decade." In fact, the small company behind the AI super chip could soon completely transform the AI sector.

In a year plagued by the worst sell-off since 2020, this technology could even redefine the market... and create new millionaires.

On Wednesday, May 21, Jeff Brown and Whitney Tilson will explain everything you need to know, including how you can position yourself to profit. They're even giving away several free recommendations.

Don't miss this opportunity, as it could impact your wealth for decades to come.

Dollar Tree (DLTR) made a bold move to double its size for pennies on the dollar...

Dollar Tree (DLTR) made a bold move to double its size for pennies on the dollar...