Private-equity ('PE') firms were once dubbed 'corporate raiders'...

Private-equity ('PE') firms were once dubbed 'corporate raiders'...

They were known for swooping into companies, cutting costs, and doing whatever they could to increase cash flows.

These changes didn't always make businesses better... In fact, they were much worse for employees.

Job cuts meant fewer folks were expected to handle the same amount of work. A "skeleton crew" kept the lights on and kept cash coming in. That was all.

Although this often meant job losses, it was seen as a vital part of the economic dynamism that kept the U.S. at the forefront of the global economy.

But the narrative around PE firms has since evolved. Investors are growing wary. They're beginning to question whether these firms are adding genuine value... or merely extracting as much money as possible.

Even the big guys aren't safe. For almost 40 years, "vampire squid" Blackstone (BX) has made its mark in the world of private equity. While it diversified into new areas, PE remained at its core.

The company uses financial tools such as margin loans to boost returns and return money to investors. However, investors are now scrutinizing such strategies more closely. They're not convinced these tactics are sustainable... especially with fewer chances to make deals.

As we'll discuss today, investors are becoming less inclined to give PE companies their hard-earned cash. And this trend could disrupt a business that has been a big tenet of U.S. capitalism for the past 40 years.

Private equity has become a financial engineering game...

Private equity has become a financial engineering game...

PE firms have taken to dubious strategies to increase their returns. For instance, it's not uncommon for them to borrow money specifically to pay off investors.

It has gotten so bad that the Institutional Limited Partners Association, which represents PE investors, has started examining ways it could push back on some classic PE tactics.

Many PE investors aren't happy that their payouts seem to be coming from loans rather than more traditional sources... like cash flows or proceeds of recently sold businesses.

PE firms want to avoid selling their holdings for a loss, because it can set off a domino effect. Valuations across the industry start dropping. Banks are less likely to offer loans. And new investors won't be lining up until valuations recover.

That's why PE firms have started taking out net asset value ("NAV") loans to pay investors.

These loans have nothing to do with specific holding companies. Rather, PE firms can borrow based on the value of their entire portfolio to pay investors.

These loans make it harder for investors to know how much of their returns are coming from holding companies.

Investors aren't happy just getting paychecks... They want to know where the money is coming from to make sure it's sustainable.

And the more they question tools like NAV loans, the worse off private equity looks.

The mood in the PE sector is predominantly bearish...

The mood in the PE sector is predominantly bearish...

According to a survey from asset manager State Street, only 68% of asset owners and managers expect to continue working with private equity.

Investors have to keep their money in for a set period of time... often 10 to 15 years. But once that window is over, PE firms could lose money hand over fist.

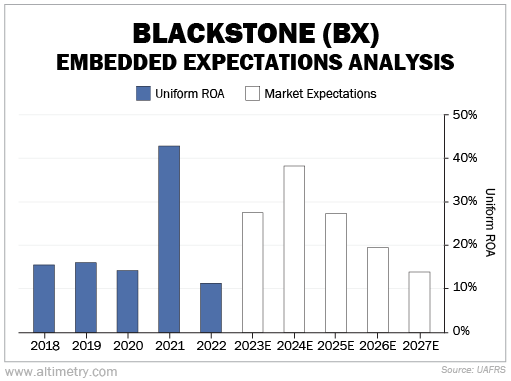

And yet, public investors in Blackstone don't seem wise to this concerning setup. To gauge investor sentiment, we can look at our Embedded Expectations Analysis ("EEA")...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Aside from the occasional good year, like in 2021, Blackstone's Uniform return on assets ("ROA") has been hovering around the 12% corporate average. And the market doesn't expect that to change.

Take a look...

Investors seem to be missing the bigger picture. PE companies thrived on the low interest rates that lasted from the end of the Great Recession until early last year.

Rates are high today. If they stay elevated – and if investors start putting their money elsewhere – PE firms simply won't be able to maintain strong returns.

Tougher times are coming for PE...

Tougher times are coming for PE...

People have long seen the sector as a good source of financial growth, which has kept investors coming back.

Now, they're getting concerned about the tactics these firms use. And the high-rate environment already poses a challenge to the PE business model.

Blackstone has its tentacles wrapped around the PE treasure chest. Its business could face serious challenges as investors rethink where they put their money... and so could the sector as a whole.

Regards,

Joel Litman

October 26, 2023

Private-equity ('PE') firms were once dubbed 'corporate raiders'...

Private-equity ('PE') firms were once dubbed 'corporate raiders'...