Apparel retailer Nike (NKE) has put a lot of effort into trying to improve its image...

Apparel retailer Nike (NKE) has put a lot of effort into trying to improve its image...

For years, the company received scrutiny for poor manufacturing facilities and processes overseas. Even today, some folks still accuse Nike of questionable manufacturing processes – suggesting that it spends next to nothing on labor to make shoes that it sells for a huge markup.

A Bloomberg article recently highlighted that Nike has been trying to change its image.

In recent years, Nike has attempted to position itself as a business that supports social justice issues.

One of the best-known examples: Nike took a stand in supporting former NFL quarterback Colin Kaepernick in his position to take the knee during the National Anthem to protest social injustice. The company even released an all-black jersey in September to commemorate four years of support.

Nike also brought attention to and supported Middle Eastern women pushing against social and religious norms in their countries.

And back in its 2012 advertisement campaign, Nike supported Title IX for women's college sports. That placed a clear stake in the ground.

While all these actions sent a message, some people wondered if Nike would follow through when money was on the line.

Now it appears we have an answer... Just last month, Nike seemed to put ethics ahead of potential revenues.

The company decided to sever ties with Brazilian soccer superstar Neymar after he was accused of sexual assault. Neymar refused to cooperate with an internal probe about the allegation made by a Nike employee.

Neymar is one of Nike's biggest stars and a massive revenue generator. Walking away from him could dent the company's soccer revenue for some time.

But Nike made it a point that it will not stand for such actions or even claims – going as far as giving up profits to prove it.

Considering these decisions and efforts to boost ethical reputation, some investors are asking questions about the effect on Nike's business...

Considering these decisions and efforts to boost ethical reputation, some investors are asking questions about the effect on Nike's business...

They may also be wondering if the stands that Nike has taken imply more risk, given that the company could become a lightning rod in the culture wars that seem to crop up from time to time in the U.S. and across the globe.

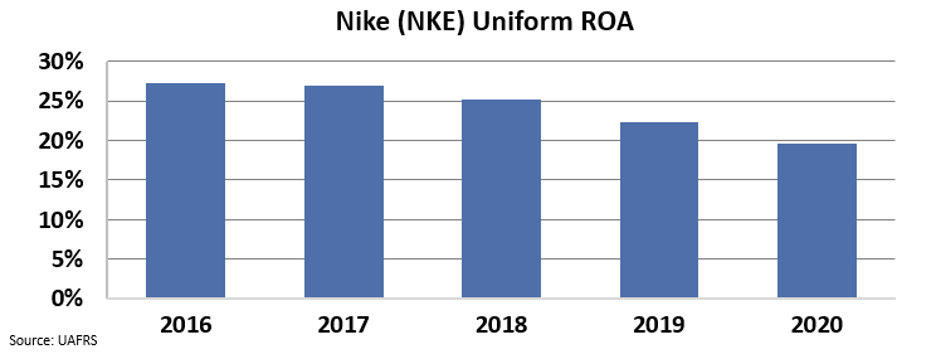

As we explained last summer, Nike has seen returns suffer over the past few years. The company's Uniform return on assets ("ROA") has faded from 27% in 2016 to 20% in 2020. Take a look...

Perhaps that is a sign that as Nike focuses on taking a stand, its customers have been voting with their wallets on whether they agree. That could concerning for profitability.

But the real question is whether the market thinks this slide will continue... or if it believes customers will come around to Nike's way of thinking.

But the real question is whether the market thinks this slide will continue... or if it believes customers will come around to Nike's way of thinking.

To better understand what the market is pricing in, we can use our Embedded Expectations Framework.

It breaks down like this...

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which makes assumptions about the future to produce the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage.

Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. Here, we use the current stock price to determine what returns the market expects.

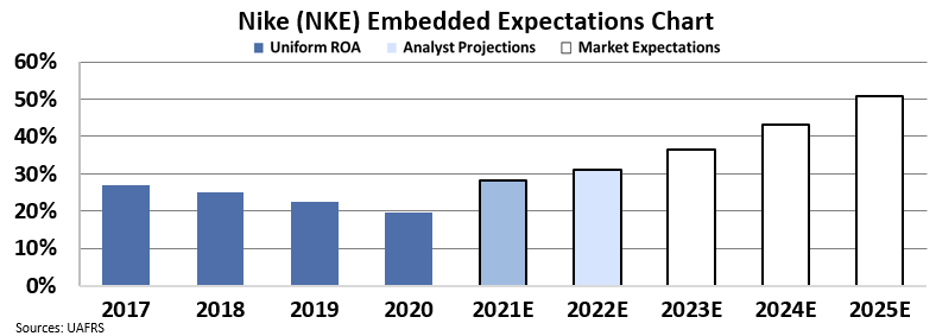

In the chart below, the dark blue bars represent Nike's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

Looking at the Embedded Expectations, we can see that the market doesn't think the rollover in returns will last forever. Instead, it's betting the opposite will happen... The market thinks Nike's stands and its business model will benefit the company over the longer term.

The market expects Nike's ROA, which had dropped to around 20% even before the pandemic, to expand rapidly to 51% by 2025. That's a huge expansion in profitability.

Wall Street analysts are also forecasting a recovery, though not as aggressively as the market. Wall Street thinks Nike's Uniform ROA will improve to 31% by 2022 and that the company's strategy is starting to pay off.

Previously, Nike's highest ROA levels were around 28%. So the market and Wall Street analysts also expect the company to surpass all-time highs.

It's great that Nike is getting this vote of confidence from investors, but it would require a massive turnaround in its profitability to live up to these expectations.

Perhaps Nike's social justice efforts will pay off financially. But even if they do, investors buying NKE shares today would be hard-pressed to make a profit considering the lofty expectations.

Regards,

Rob Spivey

June 15, 2021

Apparel retailer Nike (NKE) has put a lot of effort into trying to improve its image...

Apparel retailer Nike (NKE) has put a lot of effort into trying to improve its image...