Trouble is brewing for the pandemic darlings...

Trouble is brewing for the pandemic darlings...

The "at-home revolution" dominated markets in 2020. And that led to all kinds of mini-investment themes playing out.

From protecting their homes with beefed-up security... to relying on new work-from-home technology... to tricked-out home entertainment systems... folks were investing in their homes like never before.

This was good news for companies that made home goods. Higher demand meant higher revenue and better brand recognition. Manufacturers pumped up production and were rewarded with record sales.

But the trend reversed in 2022. Order books filled up and backlogs grew. Deliveries have slowed to a crawl. Costs are rising, and inflation is running rampant.

These disruptions were already in the works last year. We were worried they would continue into 2022. That's why we closed most of our at-home revolution recommendations.

It turned out to be a good choice.

Lots of companies are reporting surging inventories in the latest quarter... Take home-appliance maker Whirlpool (WHR), for example.

Whirlpool is the latest in a string of businesses to report problems last quarter...

Whirlpool is the latest in a string of businesses to report problems last quarter...

Demand for the company's products is declining due to pricing and delay issues. Investors are selling the stock en masse.

Whirlpool did well during the pandemic. It makes all kinds of home products, like refrigerators, microwaves, and washing machines. Anyone investing in their home was a potential customer.

The company had an amazing 2021. It achieved record margins, recorded double-digit revenue growth, and delivered significant shareholder returns. Investors were thrilled with the company's $22 billion in net sales.

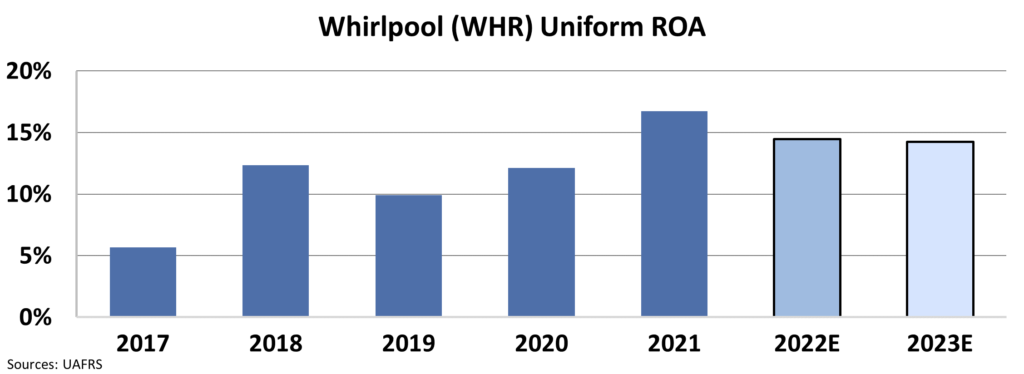

This reliable performance showed in Whirlpool's profitability as well. Its Uniform return on assets ("ROA") reached an all-time high of 17% in 2021. Analysts expect ROA to stay strong in 2022 and 2023.

But those strong results might not last forever... and that could be an opportunity.

But those strong results might not last forever... and that could be an opportunity.

The market is pricing in a different outlook for Whirlpool.

Experienced investors know that you can't rely on a company's past performance alone. You also need to consider how the company's future lines up with what the market thinks about it.

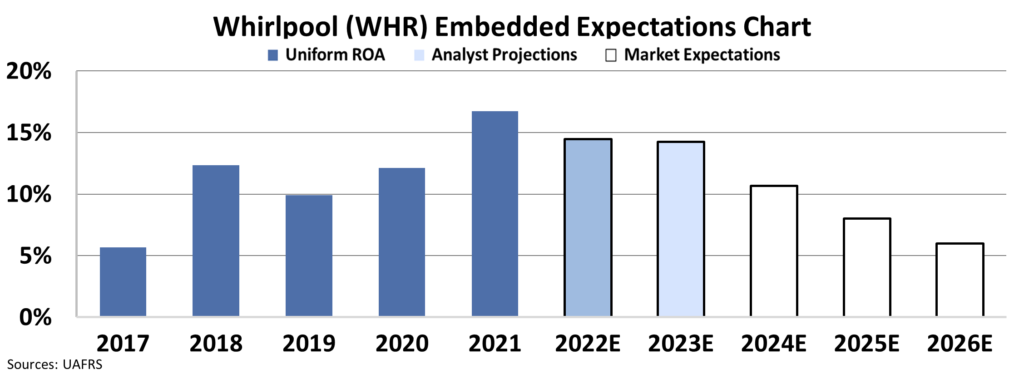

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

As we often like to say here at Altimetry, stock prices aren't driven by performance – they're driven by changing expectations. Said another way, a "good" company could be a terrible investment... while a struggling company could lead to huge upside.

Wall Street loves to use simple ratios to determine if a stock is cheap. But we understand the importance of market expectations. If a company can do significantly better than the market anticipates, it could be cheap. On the flip side, if the market expects greatness and the company doesn't deliver, its price falls.

At around $150 per share, the market expects Whirlpool's Uniform ROA to fall back to 6%. That's tied for its lowest return in 10 years.

Our EEA shows that the market is already pricing in a total profitability collapse. If the company keeps 2019-level returns, investors might be pleasantly surprised.

Whirlpool might be oversold at current prices. It's far from the only stock in that boat. Thanks to Uniform Accounting, we can see at a glance where the market may be overreacting.

Regards,

Rob Spivey

June 22, 2022