Auto workers finally got what they wanted...

Auto workers finally got what they wanted...

Late last month, the United Auto Workers ("UAW") union settled on a new contract with Ford Motor (F).

The deal includes a 25% wage increase over four and a half years, improved benefits, and more than $8 billion in new investments at Ford plants.

The good news for Ford is that it can start making cars again. It also got a special retirement provision included in the deal, which lets the company offer an unlimited number of $50,000 buyouts to older workers earning the top wage. This allows Ford to replace them with younger workers who will earn less for a few years.

The bad news is that the new contract will make Ford less profitable...

You see, the company's labor costs are now rising. And there's a growing trend of workers trying to claim a larger slice of the corporate success pie.

Today, we'll delve into the implications of this settlement for Ford. As we'll explain, this is a great reminder of why investors need to be careful when investing in auto companies – especially ones with powerful unions.

Eventually, car companies always return to breakeven...

Eventually, car companies always return to breakeven...

The auto industry is temperamental.

Car companies are beholden to consumers, unionized workers, and volatile commodity prices.

In other words, you need a "perfect storm" to make a good return as a car company.

For the most part, car companies tend to operate in cycles based on consumer demand. When consumer demand is strong, their returns rise. When demand suffers, like it did at the very beginning of the pandemic or as it typically does during a recession, returns fall.

Over the long term, most car companies generate Uniform return on assets ("ROA") of between 4% and 8%. For comparison, 12% is the corporate average and roughly 6% is breakeven. So, essentially, car companies are just breaking even over the long run.

The problem is that they only make a profit when the conditions are right...

For instance, commodity prices for metals, rubber, and even plastic have to remain stable. Employees have to accept their current wages. And consumers have to buy cars. If all of these conditions are in place, car companies stand to profit.

Just one of these conditions falling apart, though, is enough to hurt returns.

We saw this in full force during the pandemic. Ford's Uniform ROA fell to negative 4% because all three of these conditions were disrupted...

Global supply-chain shortages caused commodity prices to fluctuate, auto factories were either shut down or running below capacity, and Ford couldn't sell as many cars as a result.

On the other hand, those disruptions created a much stronger cycle peak. Consumers wanted to buy cars... there just weren't any cars available.

As automakers worked through their supply issues and employees got back to work, Ford's Uniform ROA quickly rebounded. It climbed back to around 5% in 2021 and reached 7% in 2022.

However, now that Ford's profits are up, its workers want a bigger piece of the pie...

However, now that Ford's profits are up, its workers want a bigger piece of the pie...

Aside from the fact that the old UAW contract was set to expire in mid-September, it was actually a great time for the union to strike...

Ford's returns are near cycle highs, so it's harder to argue that it can't afford to up its workers' pay.

Without a doubt, this new labor contract will cause Ford's returns to fade back toward breakeven levels. And it seems like investors are already catching on...

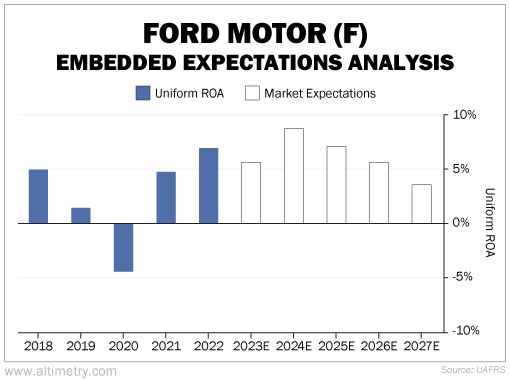

We can see what the market thinks of this new contract by looking at the company's Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current prices, the market expects Ford's Uniform ROA to fall back to 3% by 2027. Take a look...

In this case, we agree with the market here. Not only is Ford on the doorstep of higher labor costs... we're also on the edge of a recession.

It's bad enough that interest rates are so high today. That's making it harder for folks to finance new cars. If we enter a recession, most people's budgets will get even tighter. They'll likely keep driving their old cars rather than splurge on a new one.

So Ford could be looking at a tough 2024. The market's expectations are low right now, and they can certainly go lower if economic conditions worsen.

There may be a "buy the dip" opportunity for auto companies like Ford several quarters from now. However, for the time being, we'd stay far away from this industry.

Joel Litman

November 9, 2023

Auto workers finally got what they wanted...

Auto workers finally got what they wanted...