As usual, the big banks are kicking off earnings season...

As usual, the big banks are kicking off earnings season...

Citigroup (C), JPMorgan Chase (JPM), and Wells Fargo (WFC) are set to report this week – just to name a few.

And investors are eager to see what lies in their reports, as they give us insights into lending practices, interest margins, and loan default rates. In other words, their earnings help us gauge the health of the broader economy.

But this quarter, there's something else we're looking for when banks report their numbers... the "big bath."

Regular readers are familiar with this concept...

It's when management opts to take as many write-downs, provisions, and charges as possible in a single quarter, typically when the company is already expecting bad financial results.

The idea is to make current earnings look particularly poor. Then, as the company cleans up its balance sheet all at once, future quarters look much better by comparison.

It's a tactic to bundle bad news into one single quarter... rather than letting bad news drag down performance over multiple quarters.

Some banks, like Truist Financial (TFC), have made announcements prior to their upcoming earnings calls. And they're showing signs that they may be taking a big bath...

Truist is one of the largest banks in the U.S., with roughly $555 billion in assets. And last month, it revealed plans to reduce expenses by $750 million. This includes a sizeable reduction in its workforce, a consolidation of its businesses, and a rationalization of technology spending.

Announcements like these typically scare investors away. But they're also the exact type of "big bath" news we're looking for.

Today, we'll explain why investors should pay attention to news like this... and why it could signal a major buying opportunity.

A bundle of problems has led Truist's stock to decade lows...

A bundle of problems has led Truist's stock to decade lows...

Year to date, shares have slumped more than 30%.

As is the case with many other banks, the banking crisis from earlier this year crushed Truist's stock. Investors were worried about which bank would be hit next. And Truist, along with many other banks, felt the brunt of those fears.

The Federal Reserve's interest-rate hikes have also hurt business. Customers can now secure interest rates of 4% or 5% on risk-free assets and money-market funds in the short run, as opposed to a 0.01% savings rate with Truist. The bank expects deposits to be down as a result.

Most significantly, Truist has been struggling to control rising costs.

According to research analysts from Wells Fargo, Truist's costs are expected to rise 7% this year. That would be the biggest increase in expenses among all major U.S. banks.

These rising expenses hurt margins and, in turn, the company's profitability.

Now, as we said earlier, management is undoubtedly gearing up for a big bath...

It recently unveiled three separate strategies to cut costs – and investors seem to have taken that news poorly as well.

First, it's modernizing its technological infrastructure. The upgrades should save about $200 million over the next 12 to 18 months.

Second, it's streamlining and optimizing various operations, such as enhancing the efficiency of its branches. Here, Truist expects to save an additional $250 million.

Third, and likely the most crucial announcement the company has made, Truist said it will significantly reduce its workforce over the next three quarters. The cuts are expected to save about $300 million, bringing Truist's cost-savings program to a total of $750 million.

So you see, many factors are weighing on Truist's stock price today.

Yet, the bank's valuation is actually increasingly attractive...

Yet, the bank's valuation is actually increasingly attractive...

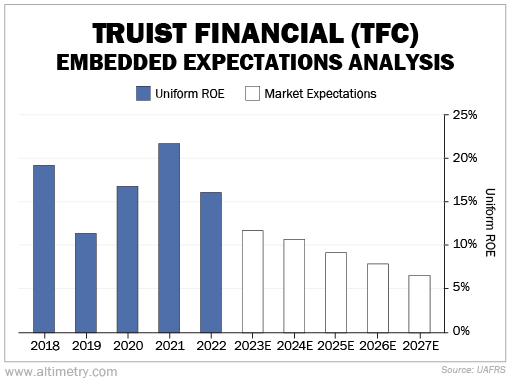

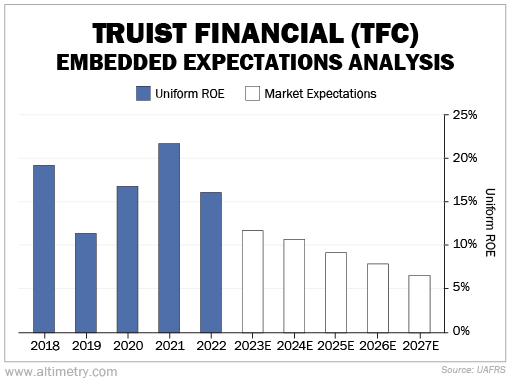

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At current valuations, the market expects Truist's Uniform return on equity ("ROE") to fall below 7% by 2027. It assumes the company's problems will persist.

Take a look...

Remember, cost-cutting should improve returns, not hurt them. Investors seem to be reacting to the bad news rather than what it means for future returns.

Over the past five years, Truist's Uniform ROE has never been below 10%. Even if returns fall to the low end of that range, it should still be worth more than the market's pricing in.

This means if the company can get out of its current rut, its stock should see significant upside.

Truist's big bath is one to watch...

Truist's big bath is one to watch...

Yes, the bank is struggling with rising expenses today. But it's taking steps to address that problem...

And as we explained, it's dropping all of its cost-savings initiatives on investors at once.

Management knows their efforts could make things look a bit worse in the short term before they start looking better. It also knows that negative announcements like layoffs will further hurt the company's stock price.

But this "big bath" will only make Truist's future earnings look better by comparison. Once it gets all the bad news out of the way, it can reset investor expectations and set the stage for improved earnings next quarter.

We'll keep an eye on Truist. It's clearly in the midst of a big bath – and once investors realize this, the stock could skyrocket.

Regards,

Rob Spivey

October 11, 2023

As usual, the big banks are kicking off earnings season...

As usual, the big banks are kicking off earnings season...