Even in downturns, one group has traditionally kept shelling out cash...

Even in downturns, one group has traditionally kept shelling out cash...

While most of the world tightens their purse strings when times get tough, high-income folks don't tend to follow suit. Spending habits for this group are usually stable, no matter how the economy is doing.

But in the wake of the COVID-19 pandemic, that trend has changed. According to Bank of America (BAC), high-income individuals started spending dramatically more in 2021 as the world reopened and travel returned.

This group accounted for a disproportionate share of spending last year. But now, these folks are cutting back...

More specifically, as inflation and market volatility eat into wealth, high earners are cutting back on travel and clothing-related expenses. According to Bloomberg, households making more than $125,000 per year cut spending by 0.5% in July. That's the third straight month of declines.

Spending habits usually increase during the back-to-school season. If this downtrend continues, it could hurt the companies with the most exposure to high-income spending.

One of those heavily exposed companies is American Express (AXP)...

One of those heavily exposed companies is American Express (AXP)...

American Express' platinum card is a status symbol. It costs about $700 per year in fees, offers double that in perks, and doesn't have a spending limit.

The company helps facilitate the spending habits of high-income folks. It also has a lot to lose if wealthy Americans become more choosey with their spending.

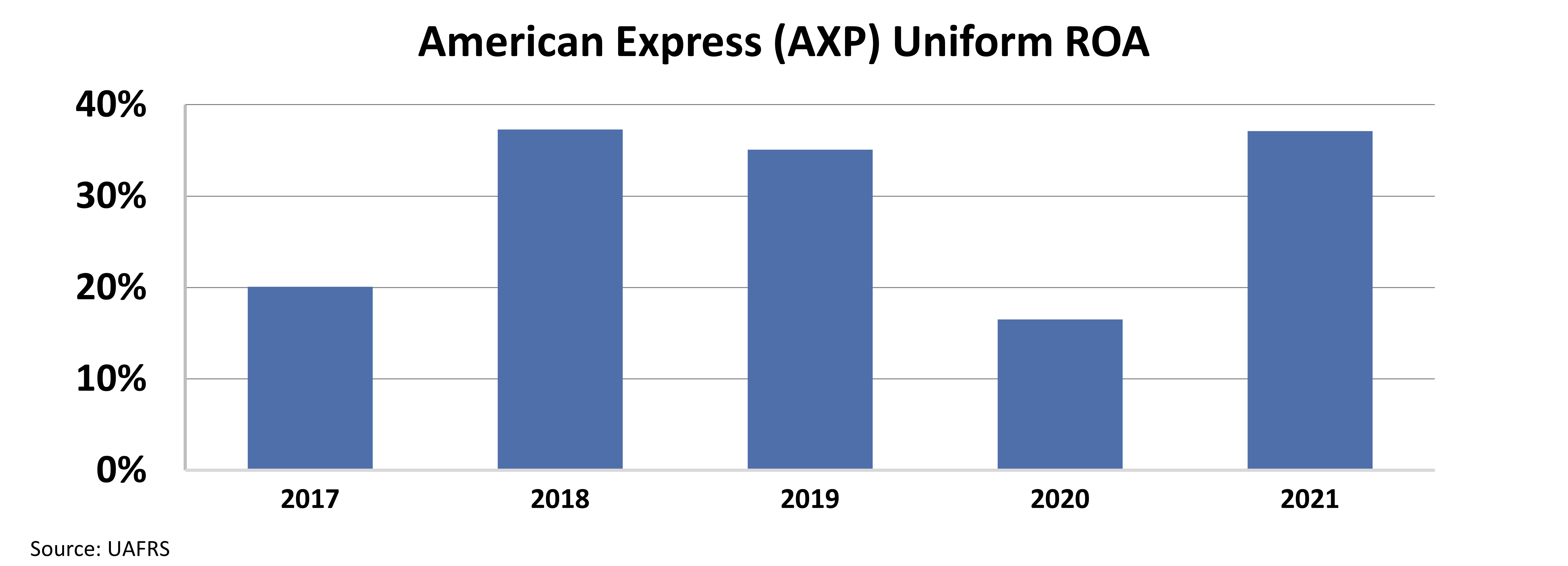

American Express' Uniform return on assets ("ROA") trend reflects strong spending habits from the upper class since 2017. Take a look...

After the pandemic, Uniform ROA more than doubled from 17% to 37%. That's largely due to high-income individuals making up for lost time after the pandemic lockdowns.

As high-income spending decreases, we can expect American Express' profitability to do the same...

As high-income spending decreases, we can expect American Express' profitability to do the same...

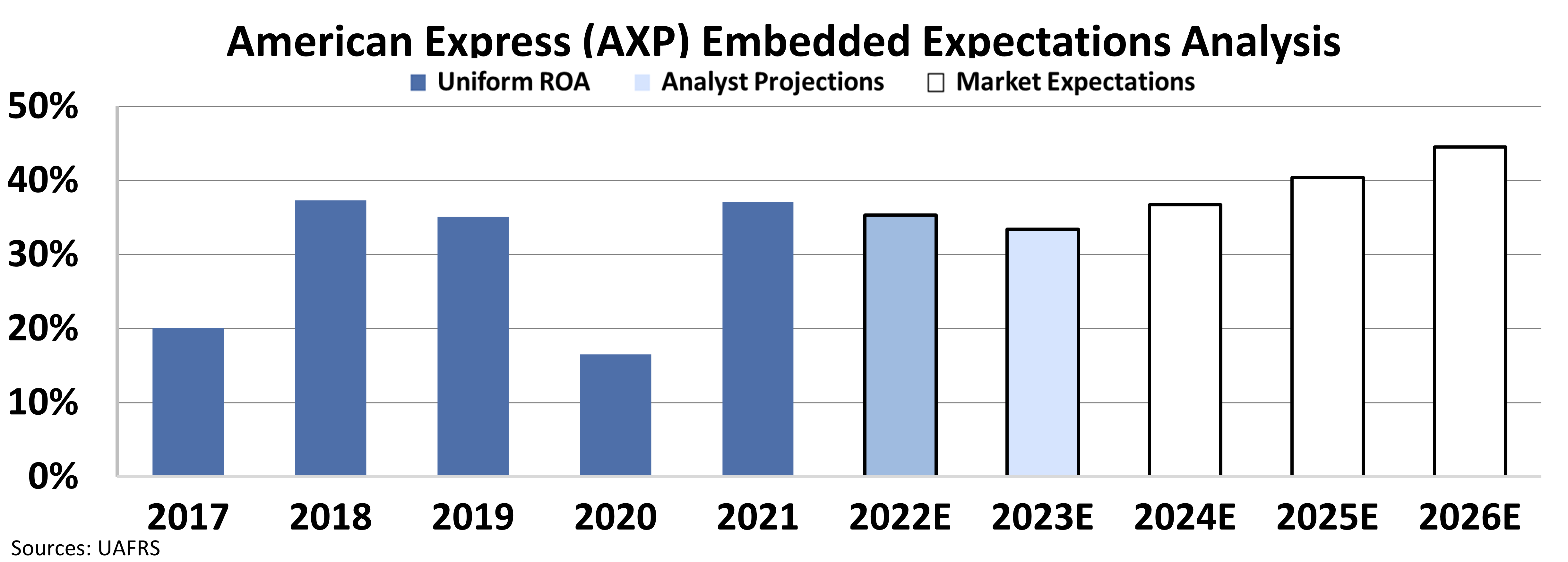

To understand whether the market sees this trend, we can use our Embedded Expectations Analysis ("EEA") framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

However, here at Altimetry, we know models with garbage-in assumptions only come out as garbage. So we use the current stock price to determine what returns the market expects.

In the following chart, the dark blue bars represent American Express' historical Uniform ROA. The light blue and white bars are Wall Street analysts' expectations through 2026.

Check it out...

American Express' main customers are spending much less than usual. But despite this, analysts expect the company's ROA to hit a record 44% by 2026.

If high-income individuals continue to decrease spending in the coming credit cycle, they'll use their credit cards less. New customers will apply for less credit as well. It seems safe to assume this will hurt American Express.

But it doesn't look like the market is accounting for this slower spending.

Thanks to overly optimistic market expectations, valuations are getting too expensive. For investors looking to ride the next wave of digital payments, it may be best to avoid stocks like American Express.

Regards,

Rob Spivey

September 7, 2022

Even in downturns, one group has traditionally kept shelling out cash...

Even in downturns, one group has traditionally kept shelling out cash...