The most successful trades in technology have had nothing to do with artificial intelligence...

The most successful trades in technology have had nothing to do with artificial intelligence...

Rather, they've been about companies "getting religion."

Take Google parent Alphabet (GOOGL), for example.

Back in the early 2010s, the tech titan was throwing money at all kinds of moonshot investments that weren't likely to succeed. Its profitability stagnated. And what should have been a high-growth tech stock only gained about 74% from 2010 through May 2015... slightly lagging the S&P 500 Index.

That's when management brought in Ruth Porat.

As the new chief financial officer, Porat reined in spending by forcing the business to invest in only its most promising ventures. The new strategy sent income soaring. And through the rest of the decade, Alphabet's stock rose nearly 150%... almost doubling its gains from the prior five years.

More recently, Meta Platforms (META) "got religion"... The stock was in the doldrums in 2022. Investors were worried the company would use all of the profits from its social media networks to fund the Metaverse. And shares plunged 74% as a result.

Then, CEO Mark Zuckerberg announced that 2023 would be a "year of efficiency." He focused on cutting costs through things like layoffs and office closures... and the stock took off. It soared more than 170% over the course of the year.

Today, we'll look at another tech giant that's showing signs of a similar comeback. As you'll see, when it comes to investing in big tech companies... getting religion can be just as important as innovation.

Alibaba (BABA) has had a turbulent few years...

Alibaba (BABA) has had a turbulent few years...

As we covered back in March 2023, investors lost confidence in the Chinese e-commerce giant for a myriad of reasons...

Not only was China's economy starting to slow, but the government was cracking down on Big Tech. And it seemed to have a personal vendetta against Alibaba's co-founder, Jack Ma...

Ma had a history of speaking out against the Chinese government when it came to problems with state-owned banks and regulations.

Of course, the government didn't take kindly to that. It forced Alibaba to halt its initial public offering of its financial-services arm, Ant... announced investigations into the company's operations... and even slapped a $2.8 billion fine on it for antitrust violations.

Then, Ma disappeared from the public eye for a few months, and speculation ran rampant about where he had been.

As a result, Alibaba's stock has been on a one-way trip lower over the past few years... Shares are down 77% from their all-time high set in 2020 and are now approaching an all-time low.

However, the stock may have just gotten its strongest buy signal in more than a year...

However, the stock may have just gotten its strongest buy signal in more than a year...

See, according to recent reports, Ma and Alibaba's chairman, Joe Tsai, have been on a buying spree... They've picked up more than $200 million worth of Alibaba stock over the past few months.

Make no mistake – despite its recent struggles, Alibaba is still a great company. It's often referred to as the "Amazon of China." And Ma and Tsai snatching up shares is a huge vote of confidence in the business.

It could signal an end to the company's ongoing battle with the Chinese government... and the start of a "getting religion" comeback. Yet, the market seems to think otherwise...

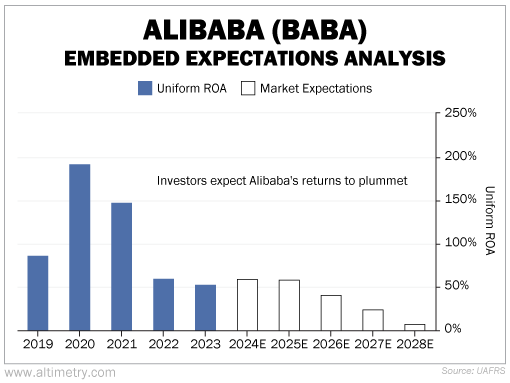

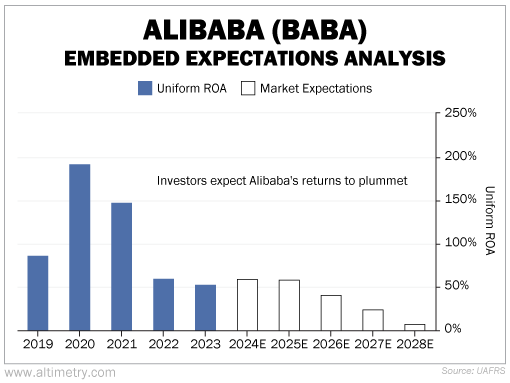

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Alibaba's Uniform return on assets ("ROA") has been at least 50% for the past five years. It even topped 100% in 2020 and 2021. But investors expect Uniform ROA to fall to just 8% by 2028.

Take a look...

It's clear that investors don't see Alibaba recovering from its regulatory challenges. In fact, they expect the situation to get much worse from here...

They're completely overlooking the huge vote of confidence from Alibaba's top executives... and the fact that the company is planning a major restructuring.

Alibaba plans to become a holding company with six different business groups that will each have its own CEO and board of directors. The business groups include Chinese e-commerce, global e-commerce, cloud computing, food deliveries and local services, logistics, and digital media and entertainment.

It claims this restructuring will allow for quicker decision-making and that it might also help prevent the Chinese government from interfering in the future.

In other words, Alibaba is getting religion.

And savvy investors have a chance to get in before the rest of the market realizes.

Regards,

Rob Spivey

February 14, 2024

The most successful trades in technology have had nothing to do with artificial intelligence...

The most successful trades in technology have had nothing to do with artificial intelligence...