Dear reader,

Let's talk about one of America's most beloved – and infamous – companies. But it might not be for the reasons you think...

I'm not talking about its viral one-cent burger promotion.

While I'm excited about it as a pescatarian, I'm not discussing this company's partnership with meat-substitute producer Beyond Meat (BYND)... nor its recent focus on cutting-edge technology... or its notorious "pink slime" burgers.

That's right... I'm talking about McDonald's (MCD). The famous golden arches. Whether you have a soft spot for its perfectly golden french fries or couldn't be caught dead patronizing one of its restaurants, there's one factor of the company's business model worth discussing today...

Franchising.

McDonald's is one of the world's largest franchisors. The company has 37,855 restaurants under its brand, but owns very few locations itself. Most of its restaurants are owned individually or by smaller groups. Business owners pay McDonald's a fee to set up and run a restaurant under the McDonald's banner.

When McDonald's opens a franchise, the franchisee (the individual who will "own" the location) puts up the majority of the cost. The franchisee is also responsible for the majority of the operations once the restaurant is open.

This means McDonald's has basically no upfront costs, very limited operational risk... and yet it still collects fees from every location.

McDonald's collects a $45,000 new-franchise fee, 4% of monthly sales, and monthly rent from every location. And that's before factoring in how much McDonald's makes for supplying the location with the products it prepares and sells to customers.

McDonald's isn't in the food business... It is in the branding and supply chain business.

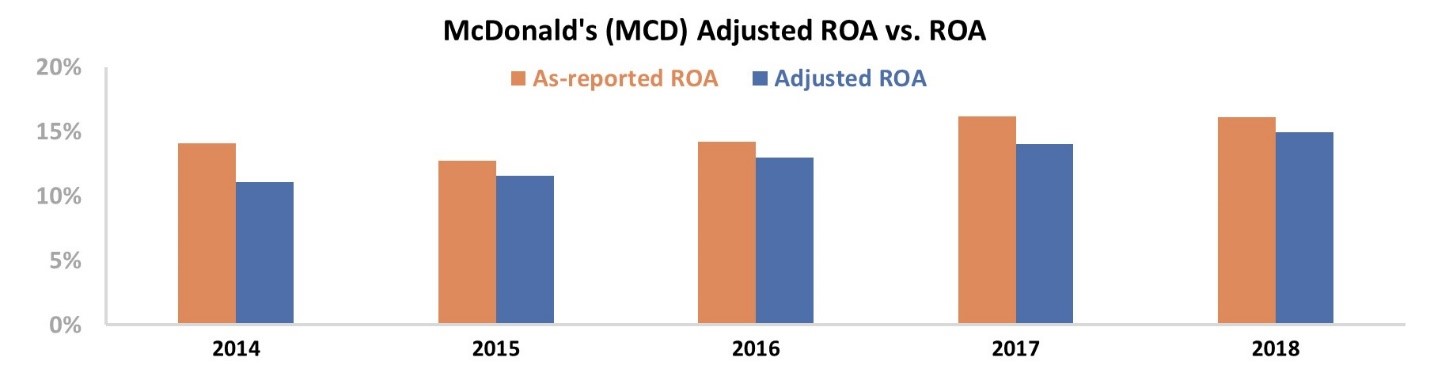

This is massively profitable. In an industry notorious for its razor-thin margins, McDonald's generates a healthy 15% return on assets ("ROA").

From 2014 to 2018, McDonald's grew its franchise base from 29,544 to 35,085 restaurants. Many of these were converted from company-owned locations, which shrunk McDonald's asset base while maintaining its revenues.

The market loved this, with MCD shares rising more than 115% since the beginning of 2014.

Investors have been rewarding McDonald's for minimizing its risk while maximizing its profitability.

However, the market might have gotten carried away with the franchise frenzy...

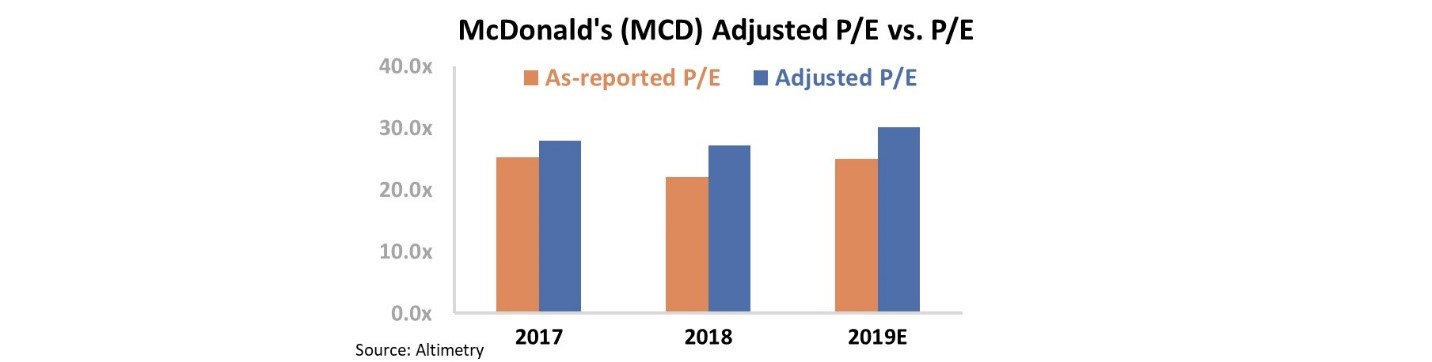

On an as-reported basis, McDonald's currently trades at a price-to-earnings ("P/E") ratio of about 25. This is slightly above corporate averages around 20, but higher valuations can be justified if companies are growing, massively profitable, or transforming their business – as McDonald's is doing.

When looking at as-reported accounting metrics, McDonald's looks like it has been able to remove most of its restaurants from the balance sheet. This is great for profitability and valuations because it limits risk and makes the company look more efficient than it really is.

When we apply our Uniform Accounting metrics, though, the distortions from as-reported GAAP and IFRS accounting statements are removed – including the operating leases which have disappeared from the company's balance sheet – and we can immediately see that valuations have reached excessively high levels.

When looking at an adjusted P/E, which takes into account the value of the company's operating leases, we can see McDonald's is trading at a ratio of 30 – a multiyear high.

At these levels, the company's business transformation likely does not justify current prices.

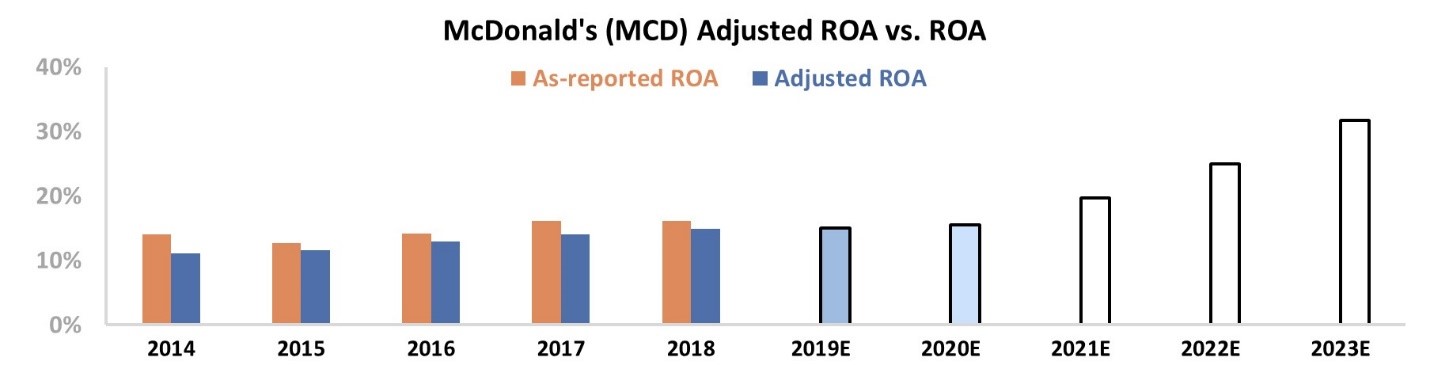

We can take this a step further by looking at what current stock prices imply for future ROA.

In the chart below, the light blue bars represent analyst expectations for ROA, and the white bars are the market's expectations at current stock prices.

To justify current prices, McDonald's needs to double its ROA over the next five years.

It's unlikely a restaurant business could ever achieve this level of profitability, franchised or not. Furthermore, McDonald's has fewer than 3,000 company-operated locations remaining, limiting its ability to quickly convert restaurants to the franchise model. That's less than 10% of its total restaurant footprint.

As franchise growth slows, the market is going to realize its expectations for McDonald's are far too bullish.

Using Uniform Accounting, you can get ahead of the curve and realize the market's mistakes before anybody else.

Regards,

Joel Litman

October 15, 2019