Demand for home health care has been increasing for the past two years...

Demand for home health care has been increasing for the past two years...

The coronavirus pandemic made studying, working, and socializing from home the new norm. As our typical activities radically changed due to public safety concerns, the demand for home health care services also surged.

When hospitals were overrun with contagious COVID-19 patients, folks started to realize the risks associated with other hospital-borne illnesses, particularly for older or immunocompromised people.

Seeking an alternative to traditional hospital stays, many patients found home health care services a desirable alternative. Home health care means accessing treatment from the safety of the patient's home and can often be cheaper than traditional hospital stays. Policymakers also like it as it doesn't burden an otherwise overwhelmed hospital system.

According to the U.S. Bureau of Labor Statistics, health care services provided by home health and personal health aides are poised to grow more than almost any other occupation in the coming years. As the occupation grows, demand for these services should increase exponentially as well.

The largest domestic health insurer also seems to be acutely aware of this trend, and it is getting ready to make the right capital investments to ride the wave.

UnitedHealth (UNH) has been successfully rolling up companies across the health care world, with the goal of using its tech-based health care approach to become a super-powered vertically integrated business.

Keeping in line with UnitedHealth's goal of becoming a dominant player in the space, the firm just announced its latest acquisition of home health care player LHC (LHCG) for $5.4 billion.

While this was one of the biggest recent health care acquisitions, UnitedHealth can't afford to let off the gas at all. One of UnitedHealth's competitors Humana (HUM) spent $5.7 billion on its home health care business last year and is looking to expand further.

Now, as health care moves into the home, investors should turn to this new area of demand.

With big money being thrown around, it's time to look at potential acquisitions...

With big money being thrown around, it's time to look at potential acquisitions...

Home health care can actually save patients money, as it's much cheaper than a stay at the hospital or acute rehab. This is where players like LHC and Amedisys (AMED) come in.

Both companies provide home health care services, offering in-home skilled nursing, physical therapy, occupational therapy, and home aids. They save the system lots of money by bringing health care to the home.

Thanks to these companies, patients can both save money and lower their risk of contracting hospital-borne infections.

However, this doesn't mean that we should immediately invest in both names... It only makes sense to invest in a business if it's able to create enough value to justify its rapid growth.

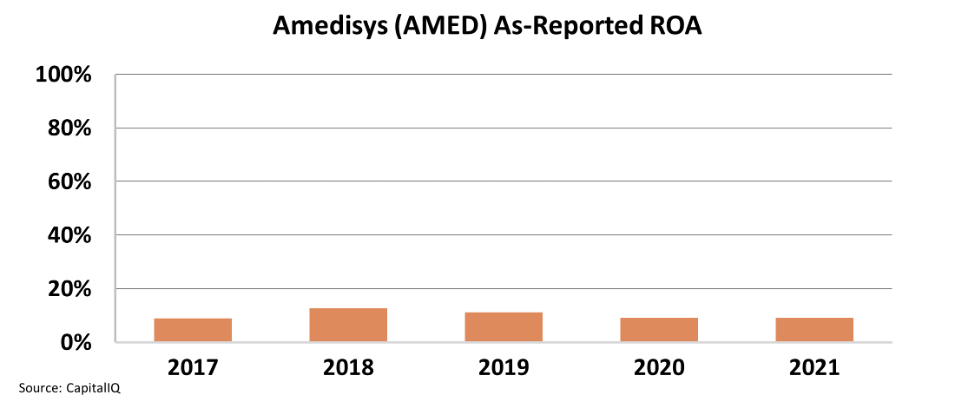

We can take a deeper look to see if bringing health care to the home is as profitable as UnitedHealth and Humana hope. A look at Amedisys' as-reported metrics makes it seem like the business is average at best...

The company's as-reported return on assets ("ROA") has hovered around 10% since its initial public offering in 2004 and only reached a peak of 13% in recent years.

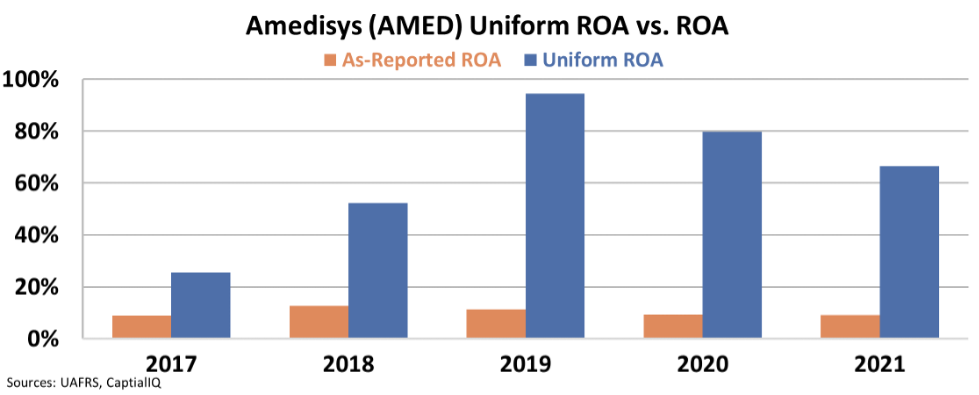

However, this isn't a reflection of reality. When we clean up the numbers using Uniform Accounting, we see a different picture than what the as-reported metrics show. In reality, the business is extremely profitable and Uniform ROA towers over as-reported ROA every year.

Average Uniform ROA for the past three years stands at 80%, reaching a whopping 95% in 2019. The company isn't just profitable... it prints money by helping the health care system save money, which in turn sends its Uniform ROA through the roof.

Investors looking at the as-reported metrics alone would not understand how rewarding the home health care business has been. Thanks to Uniform Accounting, we can see why established health care players are so desperate to enter the at-home health care space.

Regards,

Rob Spivey

April 19, 2022

P.S. Before his death, Apple (AAPL) founder Steve Jobs said "the biggest innovations of the 21st century would come at the intersection of biology and technology." Today, his final prophecy is starting to play out... and early investors could make a fortune. This story is so big that I recently put together a video presentation explaining everything you need to know. I even give away the name and ticker symbol of my favorite stock to play it, absolutely free. You can watch it here.

Demand for home health care has been increasing for the past two years...

Demand for home health care has been increasing for the past two years...