Oil prices have been rising ever since their March 2020 pandemic lows...

Oil prices have been rising ever since their March 2020 pandemic lows...

During the global pandemic, the price of oil cratered to historically low levels, dropping from $64 a barrel in late 2019 to $20 in March 2020.

The decline in travel along with the global lockdown reduced oil demand.

This absence of demand caused the unthinkable to happen. In April 2020, oil future prices dropped below zero to negative $37 per barrel. With such little demand for oil, companies and investors had to pay to get those contracts off the books.

However, the world has come a long way since the depths of the pandemic. Life is returning to some degree of normalcy. Global demand is surging, and many countries are reopening.

In Europe and the U.S., people are excited to return to their normal activities, and as a result, global travel is climbing.

Worldwide weekly flight departures hit a low of 200,000 in April 2020. But the volume has rebounded in July to more than 550,000 flights per week. The average number of road miles driven per person has seen a similar recovery.

OPEC and Russia have both managed supply since mid-2018. Supply was cut further in 2020 and hasn't returned to pre-pandemic levels.

In early July, OPEC tried to raise production. But it failed to reach an agreement on a policy for August and beyond.

Increased global environmental regulations make it harder for new oil supply to enter the market, further supporting oil prices.

It's these factors that sent oil to a recent high of $77 per barrel, a price not seen since October 2018.

Rising oil prices make shale producers economically viable again...

Rising oil prices make shale producers economically viable again...

The meaningful drop in oil prices over the past few years hurt many oil producers. The cost of production for shale producers and Canadian oil sands miners was well above the low oil prices seen for most of 2020.

However, the dramatic recovery in the price of oil makes these producers economically viable again. And that makes these producers' credits interesting stories to follow.

One of the biggest winners is Continental Resources (CLR), a U.S. shale producer in North Dakota and Montana.

Continental Resources was in a precarious financial position in March 2020. With the oil prices around $20 a barrel, the company had little to no incentive to produce barrels. Production breakeven prices vary, but at $20, the best Continental could hope for was to cover its operating and production costs. It couldn't cover the economic replacement costs of its assets.

But the recovery in oil prices changed the $13-billion company's fortunes, causing a dramatic comeback in its profitability and credit quality.

A return to economic viability gives this company a more attractive credit...

A return to economic viability gives this company a more attractive credit...

With the significant recovery in oil prices, Continental Resources is in a much stronger financial position.

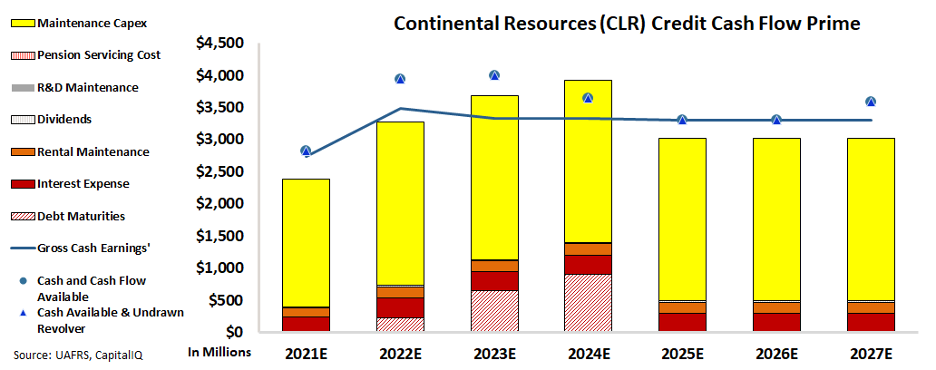

Using our Credit Cash Flow Prime ("CCFP") analysis, we can get to the heart of the firm's true credit risk.

The stacked bars represent the firm's obligations each year for the next five years. These obligations are compared with the firm's cash flow (blue line), as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Continental Resources has strong cash flows, supported by higher oil prices. The company's cash flows are well above the firm's obligations in normal years when there are no debt maturities.

In 2022, 2023, and 2024, there are meaningful debt maturities. In 2023, Continental will need to use some of its cash on hand to cover its obligations. Meanwhile, in 2024, it will need to either refinance or trim its maintenance capital expenditures ("capex").

Continental Resources should have little trouble delaying its capex spending. The company's assets are at an average age, which means that Continental Resources needs its capex spending to replenish aging assets.

Given the stronger outlook for oil prices coupled with Continental Resources' profitability, the Oklahoma-based company has a sufficient buffer to keep its operations running smoothly.

Continued green energy regulations on new drilling and pipeline construction will continue to boost oil prices.

While it is impossible to predict what OPEC and Russia will do in the future, they'll likely continue to manage oil production to support the oil prices.

While oil will likely not stay above its recent high of $77, it's not likely to fall back to its pandemic lows.

Continental Resources shows how the oil market can make a return through 2021. While there any many parts of the economy that will remain shaken by the 2020 shutdowns, industries like oil are back to business as usual.

Other companies hit by the pandemic are staging a comeback... And we found several 'Survive and Thrive' businesses primed for huge upside.

Other companies hit by the pandemic are staging a comeback... And we found several 'Survive and Thrive' businesses primed for huge upside.

In Altimetry's High Alpha, we found several "Survive and Thrive" companies poised to win in the midst of the economic recovery. They are growing faster than the market realizes with tremendous upside.

Subscribers to High Alpha have reached gains as high as 100%... 109%... and 141%.

To learn more about High Alpha – and gain instant access to these portfolio recommendations – click here.

Regards,

Rob Spivey

July 27, 2021

Oil prices have been rising ever since their March 2020 pandemic lows...

Oil prices have been rising ever since their March 2020 pandemic lows...