The market has rebounded sharply since its lows in March, but the events industry is still struggling...

The market has rebounded sharply since its lows in March, but the events industry is still struggling...

When the coronavirus pandemic began, nearly all events with large crowds were canceled. These included sporting events, conventions, and live concerts. Some of these events continue to be canceled, while others have started to pick up again. However, even for companies that have been able to resume their events schedules, the damage has already been done.

As The Economist recently highlighted, the combined market cap of "crowds businesses" is $183 billion – down from $243 billion at the beginning of the year.

To try and survive the pandemic, the companies involved have been forced to come up with innovative solutions.

For the conference industry, organizers are now offering virtual options. These alternatives provide firms with short-term revenues and attendees and experts with some engagement. However, it isn't a perfect solution... The biggest conference benefits, like networking and traveling, are severely reduced.

Similarly, the concert business has gone remote. Some high-profile online concerts took place over the summer, including Travis Scott's event, which kicked off Fortnite video-game concerts. However, the value of a concert is the experience, not just hearing the music.

The revenue that venues make from online concerts is negligible compared to 2019 and earlier. However, folks will still want to go to concerts once the pandemic ends, so there's little fear demand won't return to normal levels in the future.

Of all the events sectors, live sports may see the most permanent, long-term shift in demand. While the sporting industry is large and makes a healthy revenue, fans may be satisfied with watching more games from home.

Sports tickets have spiked in price, with concessions seeing a huge mark-up in the stadium. Furthermore, people are investing in bigger TVs and enjoy watching multiple games at a time. This is driven partly by the legalization of sports gambling in states around the country. Thanks to this trend, views of game highlights are rising... while views of actual games are falling.

The major sports leagues make the lion's share of their profit from tickets and television deals. If fans start only watching highlights from home, the leagues could stand to lose money.

Investors should be on the lookout to see how these companies "survive and thrive," and if they'll be forced to rely on broadcast as opposed to in-person revenue.

One of the biggest live music venue companies is Live Nation Entertainment (LYV)...

One of the biggest live music venue companies is Live Nation Entertainment (LYV)...

The firm was mentioned specifically in The Economist article about the struggles in the industry.

Live Nation is involved in the promotion of live events and operates a collection of music venues. That said, despite its sales falling roughly 95% year over year in the third quarter, the company has little risk of becoming insolvent. Live Nation has almost $1 billion in cash on hand, and management believes it can bridge the gap until live events make a comeback.

Knowing how the industry has been beaten up and that Live Nation can survive the current freeze in its business, investors might think the stock is an opportunity today.

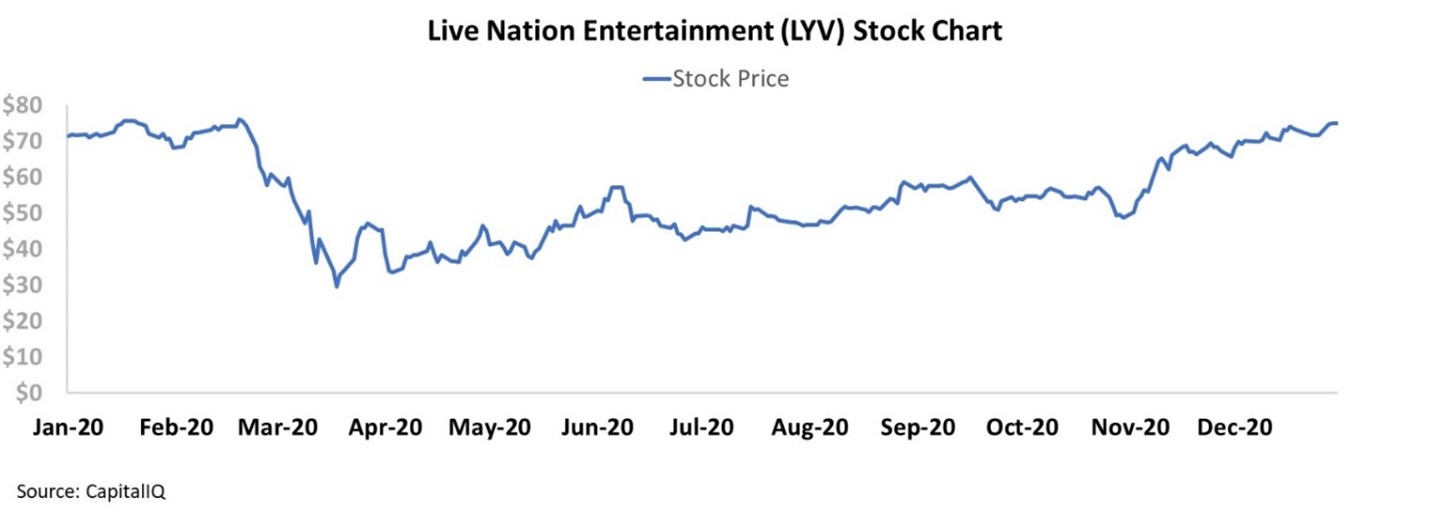

However, unlike many other companies in industries where the pandemic has halted revenue and stock prices are well below levels from before March, Live Nation is bucking the trend... LYV shares currently trade around $75, slightly below the pre-pandemic 52-week high of $77.

To gain greater insight into what the market is expecting the company to accomplish – and to find out if LYV shares could see greater upside ahead – we can use our Embedded Expectations Framework.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces an "intrinsic value" of a particular stock.

However, models with garbage-in assumptions only come out as garbage... So here at Altimetry, we turn the DCF model on its head. Instead, we use the current stock price to determine what returns the market expects a company to make.

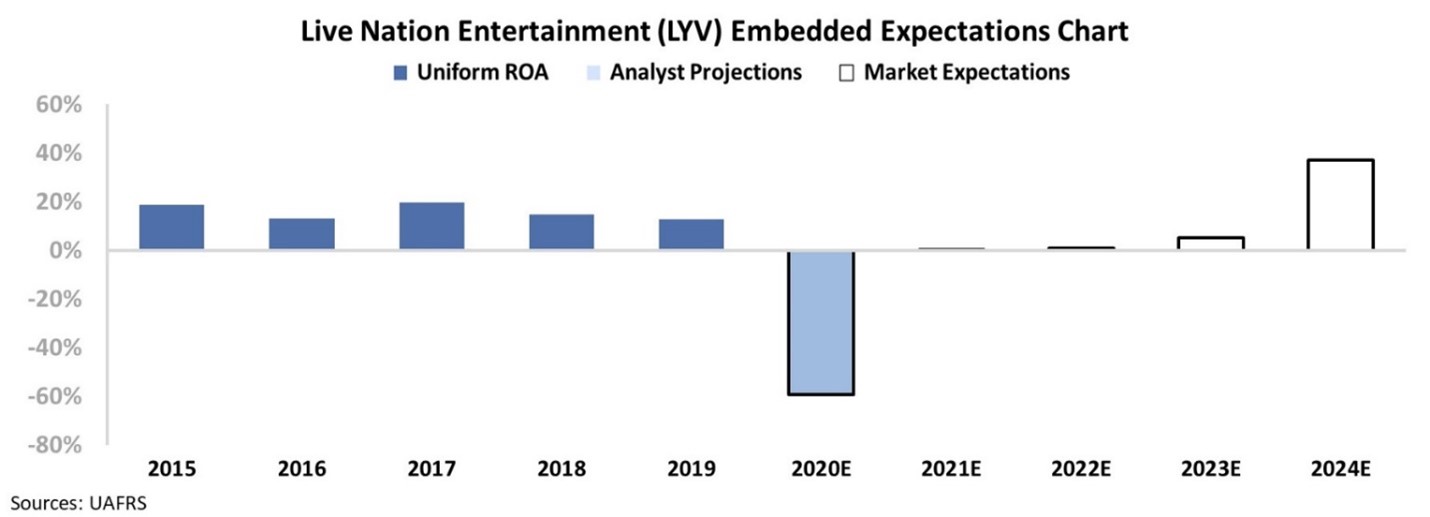

In the chart below, the dark blue bars represent Live Nation's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how Live Nation's ROA will shift over the next five years.

As you can see, Live Nation had a Uniform ROA ranging between 13% and 20% from 2015 to 2019. This shows the concert business can be lucrative when in-person events are the norm.

Wall Street analysts project Live Nation's Uniform ROA levels to crumble this year and next year. This makes sense given that most of the company's demand is temporarily constricted.

However, the market is pricing in Live Nation's profitability to rebound sharply – reaching a Uniform ROA of 37% by 2024. Take a look...

This would be the highest level for the company since 2013 and a reversal of the recent profitability trend prior to the pandemic. In time, the concert business will return to normal, yet the road to recovery is long and will be hard to predict. It may prove difficult for Live Nation to see returns break records by 2024, if ever.

Live Nation highlights how it is important to look at the entire picture of a firm when evaluating potential "survive and thrive" companies. While Live Nation is on strong footing, the market has already realized that.

Regards,

Rob Spivey

December 30, 2020

P.S. With more people staying home, society is changing. And even though the pandemic will eventually recede, some of the changes will be permanent, long-term shifts.

That means the companies who can take advantage of these changes will see their stocks primed for big upside ahead – creating fortunes for investors. Here at Altimetry, we've identified the best opportunities to profit from this massive societal shift... Find out more right here.

The market has rebounded sharply since its lows in March, but the events industry is still struggling...

The market has rebounded sharply since its lows in March, but the events industry is still struggling...