America's infrastructure – both natural and manmade – has been one of the greatest drivers of the size and power of our economy...

America's infrastructure – both natural and manmade – has been one of the greatest drivers of the size and power of our economy...

The rivers of the Northeast helped make the country an early industrial powerhouse.

And the massive network of rivers feeding the Mississippi allowed the U.S. to unlock the value of the 1803 Louisiana Purchase, which almost doubled the size of the country. It meant fertile land thousands of miles from the nearest port could export food to the rest of the nation.

The Erie Canal, a marvel of infrastructure engineering, opened up the Great Lakes to settlement – enabling New York City to become a geopolitical trading hub.

The transcontinental railroads of the late 19th century and President Dwight Eisenhower's Interstate Highway system of the mid-20th century connected the U.S. and helped turn the country's raw economic potential into the largest economy in the world.

And yet, the infrastructure lead we've built over decades and centuries has gone from a tailwind for the economy to one of the key things holding it back...

And yet, the infrastructure lead we've built over decades and centuries has gone from a tailwind for the economy to one of the key things holding it back...

As Bloomberg recently explained, in 2009, only 47% of U.S. bridges were in good condition. That was concerning... More than half of bridges were in troubling condition 10-plus years ago.

Today, the number is down to 45% of bridges in good condition. Fifty-five percent of bridges are in less-than-ideal conditions and are nevertheless being used constantly.

The average bridge is 45 years old. A quarter of our bridges are more than 60 years old.

Roads, bridges, and buildings in the U.S. are deteriorating. And they need maintenance to get back to current standards.

But it's not just roads and bridges that need investment... The U.S. is falling behind in updating many other aspects of its infrastructure. This means there's potential for a possible rare bipartisan deal on infrastructure.

With much discussion and debate around President Joe Biden's $2 trillion infrastructure plan, there's some uncertainty about how things will play out...

With much discussion and debate around President Joe Biden's $2 trillion infrastructure plan, there's some uncertainty about how things will play out...

Republicans and Democrats alike are trying to understand the exact breakdown of the bill and how much money will actually be allocated towards things like improving physical roads and bridges.

If Biden's infrastructure bill is passed – or if parts of the bill are put forth into action – specific industries will be guaranteed to benefit.

For example, if the improvements are made in physical infrastructure and things like better Internet access in rural places, the construction and engineering industries will be among the largest winners from the bill.

More specifically, companies like MasTec (MTZ) should benefit...

More specifically, companies like MasTec (MTZ) should benefit...

MasTec's construction business ranges from oil and gas to wireless technology, electrical transmissions, and clean energy. The company supports booming industries like clean energy and the 5G network rollout.

And yet, GAAP financial metrics indicate that this focus hasn't translated into big profitability.

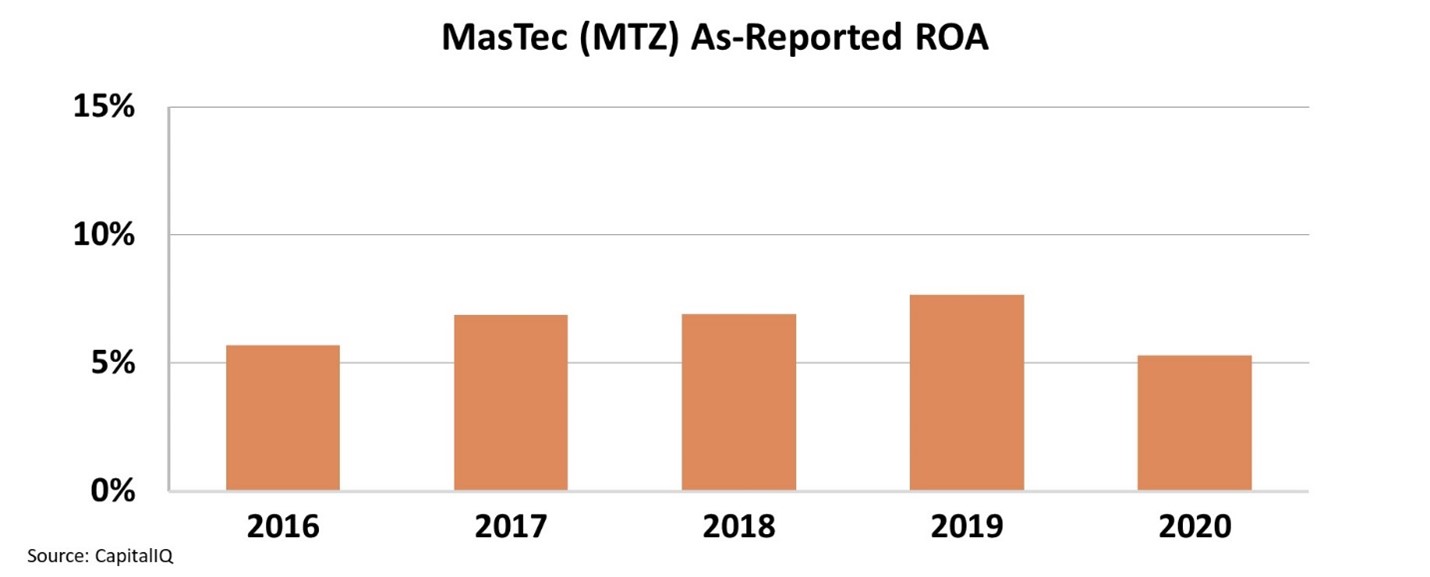

MasTec's as-reported return on assets ("ROA") has been weak over the past five years, well below the corporate average of 12%. Specifically, since 2016, the company's as-reported ROA has ranged from 5% to 8%. Take a look...

Looking at the GAAP numbers, it seems that if MasTec gets more business, it might not matter... as the company would just be putting more money into a low-return business.

In reality, this isn't an accurate picture of MasTec's profitability levels...

In reality, this isn't an accurate picture of MasTec's profitability levels...

Investors are just looking at bad data.

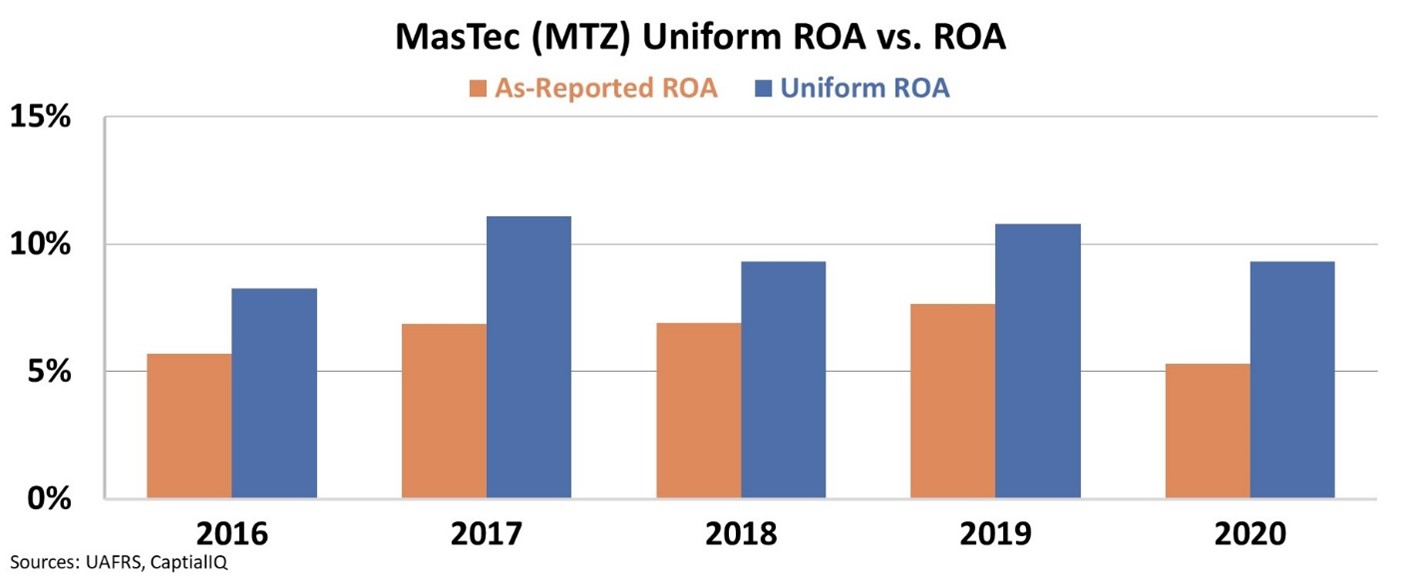

When we use Uniform Accounting to remove the financial distortions, we can see that MasTec actually generates much stronger returns.

Specifically, the company's lowest Uniform ROA over the past five years was 8%, and it was as high as 11% in 2017. Last year, MasTec's real profitability was 9%, not 5%.

With much stronger profitability than the as-reported metrics would have investors believe, any more incremental demand related to the infrastructure bill is likely to going to be value-creating for MasTec.

Thanks to Uniform Accounting, we can see the real story...

Thanks to Uniform Accounting, we can see the real story...

And with our Altimeter software tool, so can you.

Our team of more than 100 financial analysts and accountants breaks down the as-reported financials and then reconstructs Uniform Accounting-based financial statements. We then load the data into The Altimeter, which converts the numbers into grades to rank more than 4,000 stocks based on their real fundamentals.

With The Altimeter, you can see how MasTec and its peers grade out through a Uniform Accounting lens... Learn how to gain instant access right here.

Regards,

Joel Litman

May 25, 2021

America's infrastructure – both natural and manmade

America's infrastructure – both natural and manmade