Joel's note: The Altimetry offices are closed tomorrow in observance of Independence Day, so look for the next Altimetry Daily Authority on Monday, July 6. I hope everyone has a safe and enjoyable holiday!

The 'At-Home Revolution' is the only thing that's stopping Coke's dominance...

The 'At-Home Revolution' is the only thing that's stopping Coke's dominance...

For years, authorities across the globe have been focusing on reducing their populations' sugar consumption. Governments ranging from cities like New York City to countries like South Africa and Thailand have attempted to enact taxes on sugary items to reduce consumption in the hopes of improving consumers' diets.

And yet, none of it worked – sugar consumption trends have continued to rise. Coca-Cola (KO), PepsiCo (PEP), Nestlé (NSRGY), Hershey (HSY), and the rest of the sweets and sugary-beverage brigade continued to dominate the world of consumption.

While all the "nudging" in the world didn't affect consumption – as this recent Bloomberg piece highlights – it only took a month of placing the world on lockdown for sugar demand to finally decline.

Coca-Cola's volumes fell by 25% in the first three weeks of April. And Pepsi expects a fall in revenue in Germany – a key sugar-consuming country.

In the June 23 Altimetry Daily Authority, we talked about the "Big Bath"... and how Wall Street hasn't realized how bad earnings will be for companies during the second quarter. Coca-Cola is reporting a volume collapse of 25%, while Wall Street is forecasting the company to see earnings per share ("EPS") of $0.44.

That's basically in line with Coca-Cola's fourth-quarter EPS, and only down from $0.51 per share in the first quarter. Analysts haven't come to terms with how bad earnings will be.

The main reason that experts attribute to the decline in demand for sugar is differing consumption patterns at home versus out socially. People might consume a lot of candy or soda at a movie or a theme park, or order a big Coke from a fast food restaurant. At home, they're more likely to opt for smaller portions... or skip sweets all together.

Considering how diets and tastes can change from prolonged exposure to new trends, it'll be interesting to see if sugar demand bounces back to the scale it saw before the coronavirus pandemic as the world reopens... and what that means for candy and soda makers.

I love the 'treasure hunt' shopping experience...

I love the 'treasure hunt' shopping experience...

I've always found it exciting when you don't know what you might find in a store.

It's easy to get that feeling at open markets with rotating vendors in different countries. But here in the U.S., it's not as common.

A few large companies have built their businesses that way, though. Companies like Burlington Stores (BURL) and TJX Companies' (TJX) TJ Maxx appear to lay their stores out in random ways, but this is done to encourage the "treasure hunt" experience for customers.

My family loves to shop this way – we'll often find ourselves hunting for interesting deals and unexpected items. We treat it as an adventure, and we're always entertained by the unique treasures we find.

That said, we've had a different experience recently...

As businesses have started reopening, I found myself at a Burlington store in New Hampshire... and I was stunned by the selection.

After three months of being closed to the public, the shelves was shockingly sparse.

You'd think that these big discount chains like Burlington and TJX would have spent the past few months accumulating interesting inventory in preparation for when they reopen.

These businesses operate by buying extra inventory from higher-end companies that can't sell all of their stock. During a shutdown, one would expect a lot of that inventory to sit and collect dust – the perfect opportunity for a discount store to snatch it for cheap.

However, after thinking about it a bit more, it's easy to see what's going on. Part of the reason the treasure hunt model works is it forces fast turnover.

If you go to TJ Maxx one day, there's no guarantee that same item will be there the next day. Since everything is both inexpensive and limited, discount retailers tend to turn over their inventory very quickly. But in order to make a profit, these companies rely on both buying and selling in bulk.

Even though my local store in New Hampshire just opened back up, many other stores are still closed around the country. Those in big profit centers like Boston, New York, and other parts of the Northeast – along with other areas around the U.S. – aren't opening up.

TJX is likely holding off on buying in bulk until it can ensure its ability to sell in bulk as well. But that's just an added problem to the company's troubles...

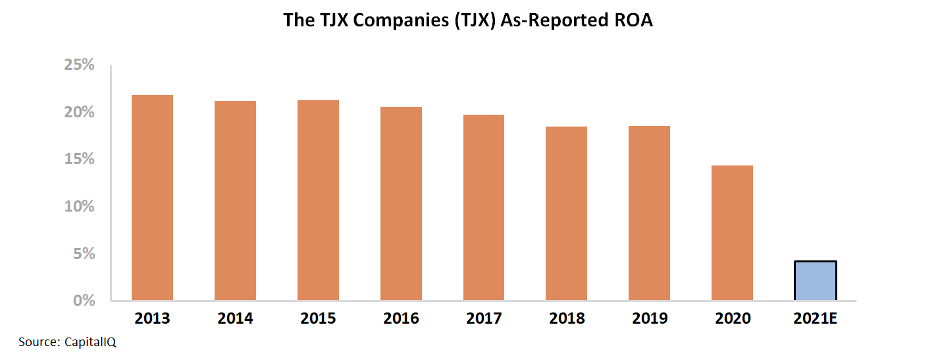

Since 2013, TJX looks like it's been in secular decline. After seeing its return on assets ("ROA") peak at 22% in 2013, the company's profitability has fallen to just 14% this year.

To make matters worse, discount retail is a momentum-propelled machine – when it's up and running, it's incredibly profitable. But when it's stopped, it's hard to get things moving again.

You can see this clearly in TJX's expected financial performance. For fiscal year 2021, TJX is expected to see its ROA drop further to just 5%. Take a look...

With nearly 10 years of declining returns, investors might be concerned that the pandemic is just speeding up TJX's inevitable decline. At best, it seems like it would take several months – if not years – for TJX to regain momentum.

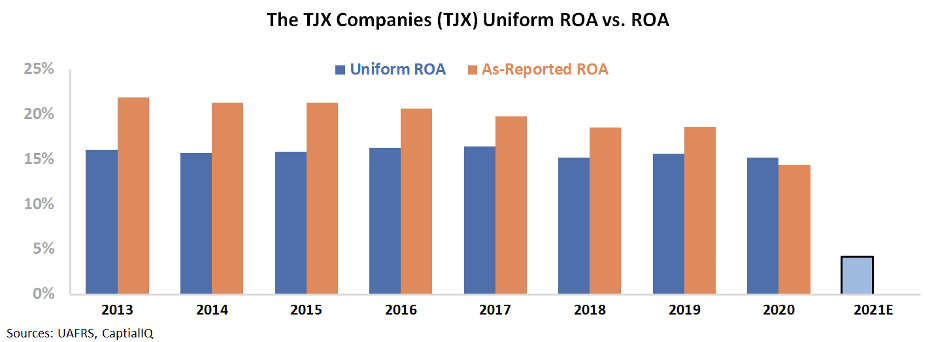

That said, TJX's as-reported financials are misleading.

Once we apply our Uniform Accounting metrics – which adjust for distortions from items like operating leases, non-cash stock expenses, and depreciation – we can see that the company was more stable prior to the pandemic.

TJX's Uniform ROA has remained at stable 15% to 16% levels since 2013, with no signs of decline until the outbreak forced the company to shut its stores.

Though fiscal year 2021 will undoubtedly be a tough one for TJX, the company's real historical profitability signals that it might be able to rebound better than investors might think.

Shoppers will want to look for discounts as they get back on their feet after the pandemic-driven recession, and TJX's business model has proven to be resilient to online competitors.

If the company is able to ramp its inventory turnover back up to full speed, investors may soon be in for a positive surprise.

Looking at GAAP metrics, investors might consider abandoning the name right now. But Uniform metrics show they'd be missing the point... because TJX is likely to see business as usual in short order.

Regards,

Joel Litman

July 2, 2020