It has been a tough few years for Koninklijke Philips (PHG)...

It has been a tough few years for Koninklijke Philips (PHG)...

Back in mid-2021, the Dutch tech giant announced a massive recall within its respiratory-care unit. About 20 different ventilator devices that were produced between 2009 and 2021 were found to have serious health risks.

The devices used a polyester-based polyurethane foam to reduce sound and vibration. And a U.S. regulator said that the foam could break down, causing serious injury.

Potential risks included irritated eyes and airways, headaches, nausea, and "toxic or cancer-causing effects."

The recall crushed the stock, with shares falling nearly 80%. Today, they're still down more than 60% from their all-time highs.

That's a sign that most investors have lost faith in the company.

One investment firm, however, has decided it's the perfect time to buy.

Exor (EXO.AS), a holding company that invests on behalf of the Italian Agnelli family that made its money by founding carmaker Fiat, bought a 15% stake in Philips worth $2.8 billion...

It appears that Exor thinks the market is overreacting.

So today, we'll take a look at whether Exor is investing in a sinking ship... or if it's buying a great business at a steep discount.

Exor isn't an activist investor...

Exor isn't an activist investor...

But Philips does hope its investment will help get others on board.

With Exor's new stake in the company, it will get a seat on Philips' board. It also has the option to eventually increase its position to 20%. Philips hopes investors will see this as a "vote of confidence" in its business.

There's also good reason for the company to buy now. While Philips' recall started in 2021, a lot of the financial pain took place in 2022. It wrote down 1.3 billion euros in goodwill for its respiratory business.

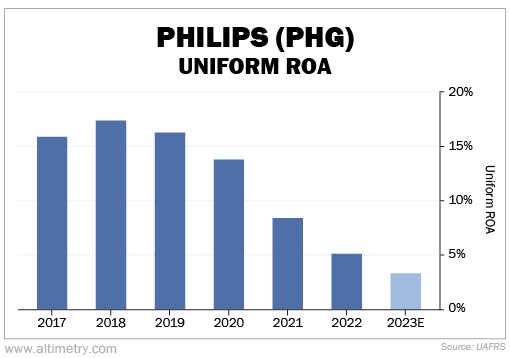

As a result, Philips' Uniform return on assets ("ROA") rolled over from more than 10% before the recall to 5% last year. This year, it's expected to mostly wrap up its recall... but Uniform ROA is still projected to fall even further to 3%.

This doesn't look great – until you look at the long-term picture.

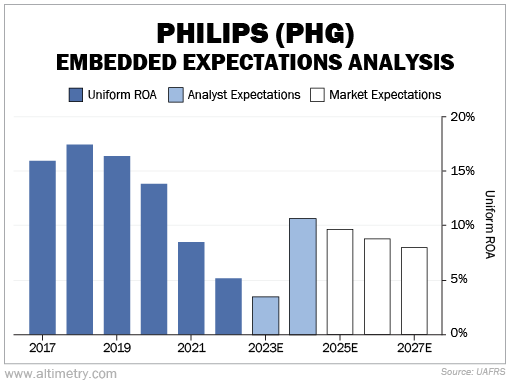

Philips' Uniform ROA had held steady at about 15% in the years before the recall. And yet, the market doesn't expect it to ever recover to those levels.

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, the EEA tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Investors expect Philips' Uniform ROA to only recover to 8%... whereas, Wall Street analysts (the light blue bars) think its Uniform ROA will recover above 10% by next year.

Take a look...

Something has to give. Right now, the market doesn't believe Philips is ever going to recover from its massive recall. Analysts, on the other hand, are more optimistic.

And Exor seems to realize that it's buying this company right when investors have lost faith.

This is exactly when you want to buy...

This is exactly when you want to buy...

Exor's vote of confidence in the company could pave the way for Philips to recover.

Since 2021, Philips has been totally without investor support, which is why investor expectations are still so low today.

Wall Street analysts don't seem nearly as bearish, though. The company should be well on its way to recovery by 2024, and Exor seems to be the only investor to understand this.

This could be a huge opportunity to pick up shares of a great company for cheap. And investors might start to follow Exor's lead as Philips puts its recall behind it.

Regards,

Rob Spivey

August 23, 2023

It has been a tough few years for Koninklijke Philips (PHG)...

It has been a tough few years for Koninklijke Philips (PHG)...