The coronavirus pandemic has created huge changes to consumer spending trends...

The coronavirus pandemic has created huge changes to consumer spending trends...

A few weeks ago, financial-services firm Jefferies released a piece discussing trends in personal consumption. Over the past decade, folks have spent more money on services than goods. This means spending more on vacations and restaurants than cars or televisions.

This trend was strongest for millennials, who have valued experiences over products.

However, the pandemic has reversed this trend in the short term. Travel, dining, and other experiences were halted earlier this year. Consumers couldn't spend in the services sector, since there was barely anything available to spend on during the April lockdowns.

As the economy has started to reopen, services spending has been slow to recover. And yet, consumer spending on goods has already passed the pre-pandemic highs.

This will be a trend to watch in the future... and the question is whether this is a sign of a trend reversal, or just a blip.

We've seen one example of this increased spending on goods in the golf equipment industry...

We've seen one example of this increased spending on goods in the golf equipment industry...

Golf equipment has seen massive sales during the pandemic. In July, sales for on- and off-course retailers hit a record $388.6 million.

The closest comparison is back in June 2007 at $368.1 million, during the height of Tiger Wood's fame and the growth of the game.

Golf ball sales are up 27% year over year, putters are up 32%, and irons saw 83% growth. The influx of new players has driven a large portion of the new club sales.

Golf is a natural way to socially distance, with its outdoor setting and wide-open courses. Additionally, golf was one of the first activities to resume after quarantine orders ended. This led to a flood of new players looking for a hobby to pass the time.

Not to mention, golf's demographic tends to skew toward higher incomes. These are the type of people who can afford a new hobby during the pandemic.

We covered this trend in a Forbes article in the beginning of June... And as the record July sales have shown, the trend continued to gain steam.

One of the companies set to benefit from the golf craze is Callaway Golf (ELY). It's the No. 1 provider of golf equipment, with nearly 25% market share. The company also has professional golfers under its brand, such as five-time major winner Phil Mickelson.

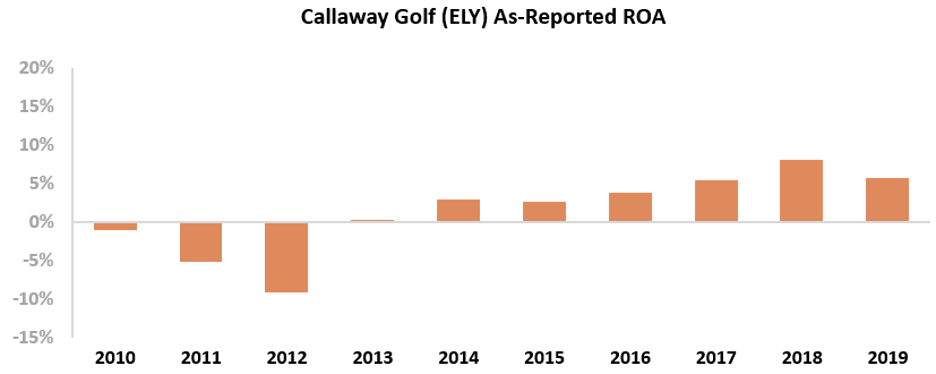

As the dominant player in a booming industry, investors would expect Callaway to have seen above-average profitability. But looking at its as-reported return on assets ("ROA"), Callaway's returns are closer to cost-of-capital levels. As you can see in the chart below, the company's ROA has grown from 0% in 2010 to 6% in 2019. It's an improvement... but hardly exciting for investors.

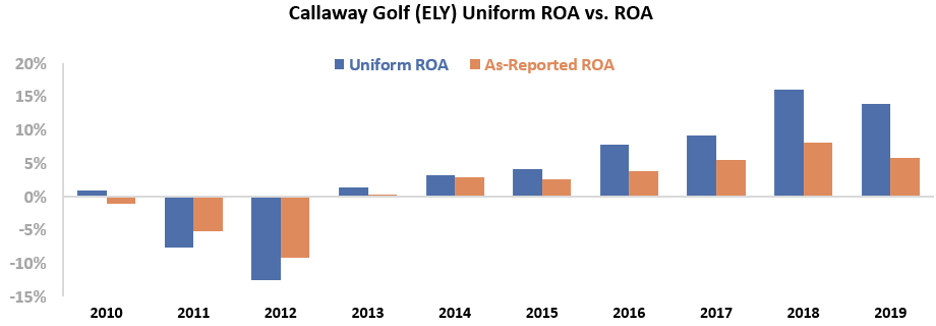

But due to the distortions in GAAP accounting, this picture of Callaway's performance isn't accurate. As-reported accounting's treatment of goodwill – among other distortions – mean that Wall Street isn't seeing the real story of Callaway's profitability.

The company's Uniform ROA has been nearly double the as-reported numbers since 2016. Callaway's Uniform ROA was 14% in 2019, compared to the as-reported 6% figure.

Callaway has used its industry-leading market position to generate above-average returns... but we need to look deeper to see if ELY shares are compelling for investors.

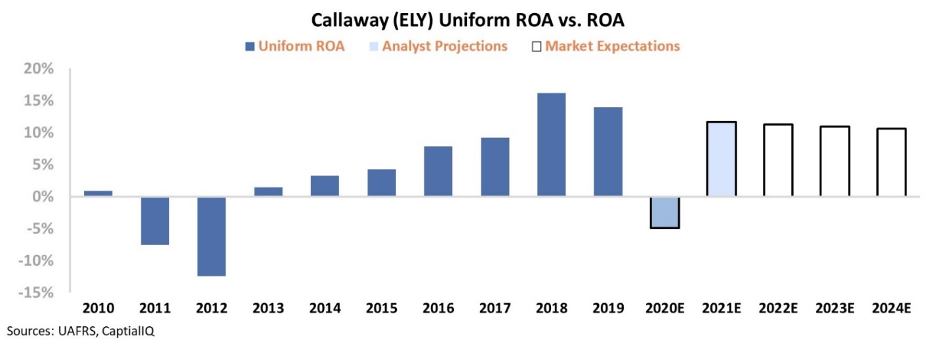

It's critical to consider what investors expect the company to do in the future. If they think Callaway's returns will continue to improve from here, then the big upside in ELY shares is likely already priced in.

The chart below shows the company's historical performance, in terms of ROA (dark blue bars) versus what Wall Street analysts think the company is going to do in the next two years (light blue bars). The returns investors are pricing into the current stock price are the white bars. Wall Street is projecting Callaway's returns to drop slightly to 12%, while the market is pricing in returns to fall to 10%.

However, Callaway may be able to benefit from tailwinds in the golf market and shifting consumer patterns. If the company can take advantage of these trends, then the market's expectations may be too pessimistic.

Without Uniform Accounting, investors might see Callaway as a company with cost-of-capital returns... The market is pricing in returns to fall to 2017 levels. However, Callaway already has robust profitability, and the company stands to benefit from the boon in the golf equipment industry and the shifts in consumption due to the pandemic.

Regards,

Rob Spivey

October 22, 2020

P.S. Have you recently picked up golf during the quarantine or another new hobby to pass the time if you can't travel? What companies do you think will be the big winners of these changes in how people spend their time? Let us know your thoughts by sending an e-mail to [email protected].

The coronavirus pandemic has created huge changes to consumer spending trends...

The coronavirus pandemic has created huge changes to consumer spending trends...