BYD (1211.HK) is making inroads in the crowded German autobahn...

BYD (1211.HK) is making inroads in the crowded German autobahn...

The startup is well-known in China for both its hybrid and electric vehicles ("EVs"). However, it remains relatively unknown outside of the country.

That's especially true in the crowded U.S. and western European markets. There, Tesla (TSLA) dominates as the premier EV maker. In February, one in four EVs registered in Germany was a Tesla.

BYD is trying to change consumer perception in the largest European car market. The company has had great success selling fleets of electric buses to transportation networks across Europe. It has sold more than 3,000 battery-powered buses alone to transportation networks.

In Germany, BYD has started deliveries to the Deutsche Bahn transportation company. The company aims to fully electrify the bus fleet by 2040. It also hopes to land a decisive market position in the EV rush.

Today, we'll examine BYD's struggle and strategy to break into the crowded western auto markets. While the company is making big strides, it may be too early for investors to get excited.

Germany has a storied auto market...

Germany has a storied auto market...

And that means BYD faces an uphill battle.

The German car market is huge, with 2.7 million cars registered last year alone. Germany also has a massive auto industry... It comprises more than 5% of the country's $4.3 trillion economy.

Tesla has done a good job breaking into this market, so it's clearly possible. BYD is hoping to follow suit. Its sales have been on an upswing in Europe so far.

On top of its electric-bus sales, BYD has sold consumer EVs in Norway and Sweden. The company managed to successfully integrate itself into those markets when sales of internal combustion engine vehicles fell fast.

BYD struck a deal in October to sell 100,000 cars to Germany's largest rental car company, Sixt. BYD also has a background in developing batteries, which may help it to sell combined packages to potential buyers.

BYD is positioning itself for the long run. Its strategy is subtle. Rather than making a big push to sell direct to consumer, BYD is presenting vehicles where people can test the cars (like renting a car).

Now, it's taking a big step. The company is in talks to buy a factory in Germany that used to be owned by Ford. That could be huge for its growth potential.

Investors are starting to take notice. The stock popped 6% following the factory announcement back in January. While it has given back those gains since then, the prospect of BYD's next move has gotten folks talking.

BYD has looked like most other car companies since 2017...

BYD has looked like most other car companies since 2017...

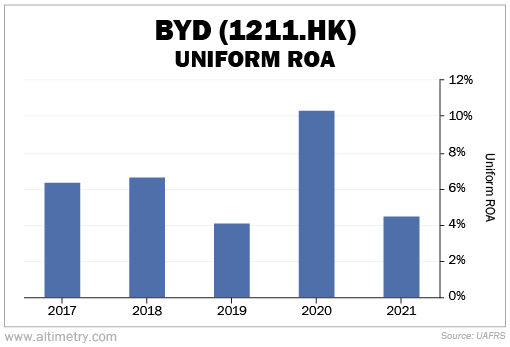

Its Uniform return on assets ("ROA") has been between 4% and roughly 10% through 2021 (the most recent full-year data in the Altimeter).

Take a look...

That's right in line with legacy automakers like General Motors (GM), Toyota Motor (TM), and Ford Motor (F). Their Uniform ROAs in 2021 were 7%, 2%, and 4%, respectively.

However, it's already better than most EV makers. Other young EV startups, like Rivian Automotive (RIVN), are still losing money hand over fist. Its Uniform ROA was negative 66% in 2021.

This is typical for new EV companies. Tesla was also unprofitable for years. Given how popular it has become in places like Germany, its recent profitability could give us a "best-case scenario" for BYD.

Tesla's Uniform ROA hit 30% last year. Traditional car companies usually earn somewhere between 6% and 12%.

Based on what happened with Tesla, BYD's returns could get much higher from here...

Based on what happened with Tesla, BYD's returns could get much higher from here...

Regular readers know that's not enough to make it a good investment, though. We also have to consider investor expectations.

If the market already thinks BYD's returns will soar, it won't be impressed by positive news. On the other hand, any negative surprises could send shares plummeting. And the reverse is true if the market doesn't expect much to begin with.

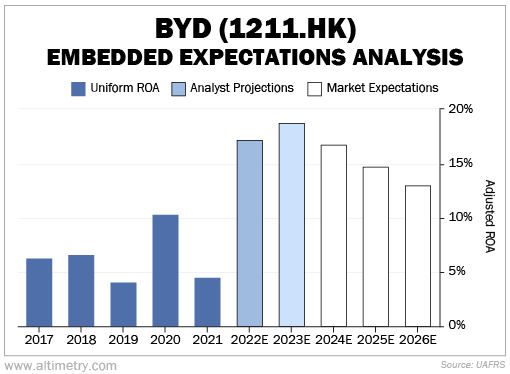

We can see investor expectations through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

As you can see in the following chart, Wall Street analysts and investors have split opinions about BYD's business. The "pros" (the light blue bars) currently forecast Uniform ROA to rise to 19% by 2023. The market (the white bars) expects that number to fade to 13% by 2026.

Check it out...

In other words, analysts think BYD will start to look like Tesla. The market thinks it'll keep looking like all other car companies. That means if you're patient, there could be an opportunity here.

Even though the market is more bearish than Wall Street, it's too early to pile into the stock. It's not cheap compared with traditional automakers. BYD hasn't proven that it can break into western markets... nor has its Uniform ROA started to consistently ramp up.

Pay close attention to BYD's next moves. If its cars catch on in international markets and its returns start to look like Tesla's, it could be a sign that BYD is about to take off.

Plus, if market expectations get any lower, it might just look cheap by normal automaker standards.

Regards,

Joel Litman

March 8, 2023

BYD (1211.HK) is making inroads in the crowded German autobahn...

BYD (1211.HK) is making inroads in the crowded German autobahn...