After nearly two decades at the helm of the Wendy's (WEN) board, Nelson Peltz has stepped down...

After nearly two decades at the helm of the Wendy's (WEN) board, Nelson Peltz has stepped down...

Peltz was appointed chairman back in 2007, two years after his firm Trian Fund Management started building up a nearly 20% stake in the fast-food chain.

In early September, he was replaced by Arthur Winkleblack, who previously served as chief financial officer for H.J. Heinz (which is now part of Kraft Heinz).

According to the announcement from Wendy's, Peltz is stepping down to "devote more time to his other board commitments and Trian's future activities."

Peltz has been instrumental to the board and company over the years... so much so that Wendy's has named him chairman emeritus in recognition of his long-term commitment.

His departure, however, is a sign of a new era for the company – and it's not just about who now runs the board.

Today, we'll dig into why Peltz's exit signals a major turning point for Wendy's...

When Peltz and his firm took a huge stake in Wendy's in 2005, they had big plans...

When Peltz and his firm took a huge stake in Wendy's in 2005, they had big plans...

They wanted to combine Wendy's with Arby's to create a fast-food empire. (At the time, Arby's was owned by restaurant company Triarc... which was run by Peltz.)

Unfortunately, the timing couldn't have been worse.

Wendy's agreed to join hands with Arby's in 2008... in the midst of the Great Recession.

This poorly timed deal set Wendy's up for failure. At its worst, the stock was down as much as 85% during the recession. And since then, Wendy's has been unsuccessfully playing catch-up with its peers...

Wendy's spent a lot of time and effort just recovering from the recession, which meant it fell behind in other areas of its business.

For instance, while Wendy's has made a lot of the same moves as rivals like McDonald's (MCD) – introducing features like self-ordering kiosks and mobile ordering – it was late to the game incorporating these changes... by several years.

Currently, the stock is right about where it was prior to the Great Recession. Meanwhile, competitors like McDonald's have left Wendy's in the dust... with shares up more than 400% since early 2008.

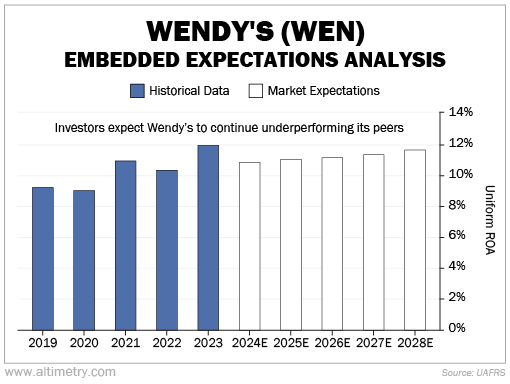

The numbers make it clear. After the Wendy's merger with Arby's, the company's Uniform return on assets ("ROA") dropped to around 6%... weak for a fast-food chain.

Today, Uniform ROA has recovered to 12%, though that still lags behind where other industry leaders are operating.

Giants like McDonald's and PepsiCo (PEP) consistently deliver returns in the range of 15% to 20%.

Wendy's has struggled to achieve this kind of performance over the years...

Wendy's has struggled to achieve this kind of performance over the years...

And investors don't seem too hopeful that the company will manage to get there.

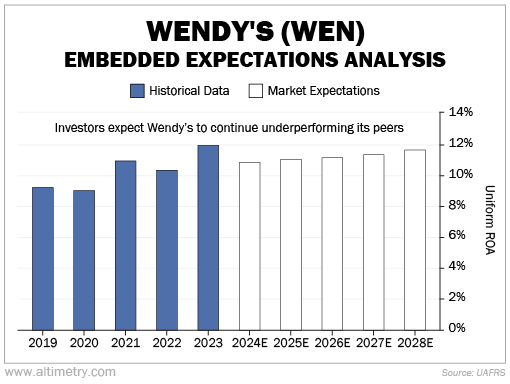

We can see this by looking at our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

As you can see, the market is pricing Wendy's as if Uniform ROA will remain roughly flat over the next few years.

Take a look...

However, as we said earlier, Wendy's is at a turning point...

Winkleblack just replaced Peltz this past September. Prior to that, in February, PepsiCo veteran Kirk Tanner replaced Todd Penegor as CEO of Wendy's. So the company has fresh leadership... with a different playbook.

Moreover, Tanner knows how to compete at the top. He has hit the ground running with big marketing pushes aimed at improving the Wendy's brand and bringing in more customers.

And the timing couldn't be better... McDonald's has recently come under public scrutiny over an E. coli outbreak.

This gives Wendy's an opening to win over customers and build momentum.

If it's successful, and it can push its Uniform ROA closer to the 15% to 20% range, Wendy's might finally be in the same league as the industry's best.

Wendy's has a chance to prove it can play with the big guys...

Wendy's has a chance to prove it can play with the big guys...

Peltz laid the foundation – now it's time to see if Wendy's can reach new heights.

With new leadership stepping in and several changes already being made, the company has a chance to chase growth in a way it hasn't before.

For investors, this could mean big gains... If Wendy's starts actually competing against industry leaders, its stock could deliver the kinds of returns that it has been missing out on for years.

Regards,

Joel Litman

November 13, 2024

After nearly two decades at the helm of the Wendy's (WEN) board, Nelson Peltz has stepped down...

After nearly two decades at the helm of the Wendy's (WEN) board, Nelson Peltz has stepped down...