Another bank is joining the online brokerage industry...

Another bank is joining the online brokerage industry...

Last week, Morgan Stanley (MS) announced that it's acquiring E-Trade Financial (ETFC) for $13 billion.

This news comes just a few months after another banking and brokerage giant, Charles Schwab (SCHW), agreed to buy TD Ameritrade (AMTD) for $26 billion.

This is a great move for both companies, to say the least...

You may have noticed that in 2019, brokerage fees basically disappeared altogether. With upstart trading platforms like Robinhood offering zero-commission trades, the larger players – including E-Trade, TD Ameritrade, and Charles Schwab – were quick to follow.

To be clear... offering commission-free trades isn't profitable for most of these firms. However, customers don't have much incentive to stay with a broker that charges $4.95 per trade – meaning it may be more damaging to the assets at the brokerage not to eliminate these fees.

This is why there's a natural common interest between banks and online brokerages. For brokers, banks can offer financial backing that will stop the bleeding. On the other hand, for a company like Morgan Stanley, E-Trade and its more than 5 million customers represent a massive opportunity.

Most of these clients would be considered "low end" because of the low restrictions on opening an E-Trade account. This provides Morgan Stanley with some of the best access to low-end clients on Wall Street and helps the company compete with Goldman Sachs' (GS) Marcus online bank offering.

Additionally, E-Trade's clients may be interested in some of Morgan Stanley's higher-end offerings. Morgan Stanley's private wealth management ("PWM") division traditionally only serves high-net-worth individuals, requiring a minimum investment of anywhere from $250,000 to a few million dollars.

With E-Trade's customer base – some of whom may already qualify for these higher-end services – Morgan Stanley aims to enroll those clients in the future.

This is far from the first time Morgan approached E-Trade about a deal. The company's CEO, James Gorman, brought up the fact that he began researching E-Trade as early as 2002 and as recently as 2007.

We wouldn't be surprised if questions around "too big to fail" will come back into debate after the significant consolidation in the industry.

It's probably no surprise that homebuilders were hit hard during the Great Recession...

It's probably no surprise that homebuilders were hit hard during the Great Recession...

Given the fact that the housing market was at the center of the 2008 financial collapse, it's easy to see why related industries suffered the most.

Of course, the banks that financed massive amounts of housing debt – including Bear Stearns and Lehman Brothers – suffered immensely.

That said, after so many houses were foreclosed and many Americans had to live by much more humble means, demand for new houses nearly disappeared completely.

It was a tough time to be a homebuilder. Not only could these businesses not develop new properties, but most couldn't sell their existing inventories.

Huge new development communities went completely unoccupied all across the country. The major players had to write off huge losses on their inventories... which lead to massively negative earnings.

Over the past decade, industries have recovered to different levels of success. Eventually, Americans began buying homes again – although many homebuilders had to adjust their inventories to more modest aspirations.

While McMansions were all the rage in the early 2000s, so-called "starter homes" have come into fashion. These are often smaller, simpler, and directed towards first-time buyers.

The homebuilders who were able to adapt to this new trend generally performed better coming out of the recession.

That said, one homebuilder doesn't look like it has capitalized on the starter home trend...

KB Home (KBH) historically targeted first-time buyers long before the Great Recession. It was also one of the most successful homebuilders at the turn of the millennium – in fact, the company was the first publicly traded homebuilder.

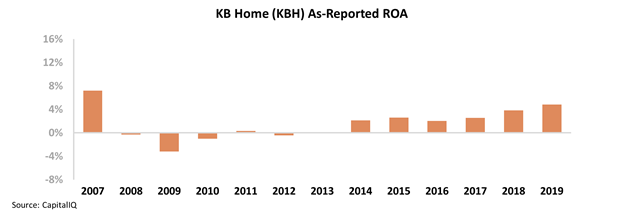

Yet despite its longtime focus on building less extravagant homes that should have appealed to the post-recession buyer, KB Home has struggled for the last decade. According to as-reported financial metrics, the company has been slow to recover from the Great Recession...

In 2007, before the housing crisis was in full swing, KB Home managed to sustain a 7% return on assets ("ROA"). In the following years, the company's ROA fell to negative levels. And more than a decade later, its returns have never fully recovered. Take a look...

Last year, KB Home's ROA only improved to 5%. This recovery has been slower than many other homebuilders, who have already returned to pre-recession levels.

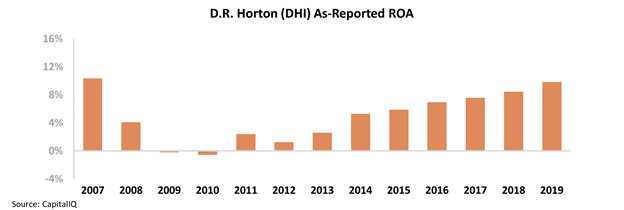

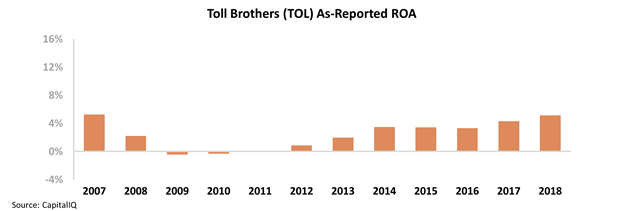

For example, the ROAs for competitors D.R. Horton (DHI) and Toll Brothers (TOL) have already recovered to pre-recession levels. Take a look...

But even though KB Home's returns aren't back at their peaks before the recession, the company is starting to catch up to the competition. And investors seem to have noticed...

Over the past three years, as the company's ROA has risen from 3% to 5%, KBH shares are up around 150%. Investors appear to be buying into the momentum, as KB Homes finally breaks through to pre-recession profitability levels.

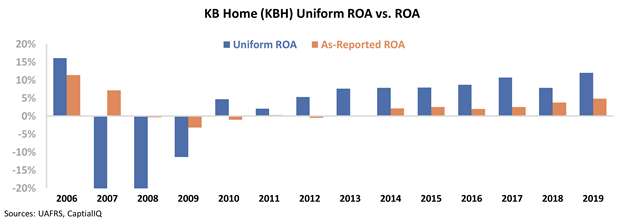

However, this isn't the same story Uniform Accounting tells us...

You see, rather than being a laggard in recovering from the housing crisis, KB Home was actually one of the first homebuilders to rebound to profitable levels.

After making the appropriate adjustments – including for inconsistencies like non-operating investments, goodwill, and excess cash – we can see the market was reacting to what we already knew under Uniform Accounting...

As opposed to as-reported metrics, which make KB Home look like it's just approaching profitable levels more than a decade after the housing crisis, Uniform Accounting metrics show that the company's ROA has been consistently positive since 2010 and strong since 2013... and the market is only just catching up.

While KB Homes certainly had a few tough years during the height of the recession, the impact was not as long-standing as traditional metrics would have you think.

The as-reported numbers make it seem like KB Homes has room to continue expanding. However, Uniform Accounting shows us that investors were simply catching up to what we have been able to see for years.

Anyone rushing into KBH now might be betting not on a recovery to old norms, but rather for KB Homes to produce returns that are stronger than historically normal... which is a higher bar to meet.

Regards,

Joel Litman

February 25, 2020

Another bank is joining the online brokerage industry...

Another bank is joining the online brokerage industry...