Elon Musk isn't wasting any time when it comes to AI...

Elon Musk isn't wasting any time when it comes to AI...

Musk's startup, xAI, is scaling rapidly. It's working on a host of AI projects, including powering Musk's social media network X's AI chatbot called Grok. And he's pulling in the biggest names in tech to make it happen.

Companies like Dell Technologies (DELL), Nvidia (NVDA), and Super Micro Computer (SMCI) have already secured a piece of the action. They're supplying the cutting-edge hardware needed to power xAI's new facility.

But Musk isn't putting all his eggs in one basket. He has been strategic about diversifying his suppliers. And now, a new player is emerging.

The latest news could be the breakthrough that finally puts one legacy computer business in the running with AI...

Hewlett Packard Enterprise (HPE) has long been viewed as a laggard in the AI race...

Hewlett Packard Enterprise (HPE) has long been viewed as a laggard in the AI race...

The company had a rough run after splitting from its consumer hardware division in 2015. It has struggled with low profitability and weak stock performance.

Uniform return on assets ("ROA") has stayed below the 12% corporate average, not even surpassing 10%. Meanwhile, shares have lagged the S&P 500 by about 90% since the spinoff.

But over the past few years, HPE has been quietly trying to put its laggard reputation behind it...

In 2022, it launched a machine-learning development system aimed at training models as fast as possible.

The business started catching on last year without much fanfare. In the second quarter of 2024, AI systems revenue more than doubled from the quarter before, surpassing $900 million.

And last September, HPE announced its Private Cloud AI tool... which helps developers create AI applications as fast as possible.

This new offering helped revenue grow another 45% to $1.3 billion in the third quarter. It rose even further in the most recent quarter, to an all-time record of $1.5 billion.

So AI is already turbocharging HPE's business...

So AI is already turbocharging HPE's business...

And it's about to get even better... because HPE recently won a $1 billion contract to supply AI servers for developing X's AI chatbot.

The deal should mean a big boost for the company. But investors seem to be ignoring the latest news.

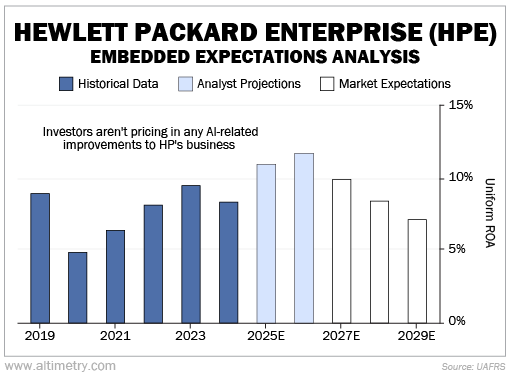

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use HPE's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Uniform ROA has ranged from 5% to 9% in the past six years, right around HPE's breakeven point of roughly 6%.

Wall Street is starting to pay attention to the headlines. Analysts expect improvements in HPE's AI server business to boost returns to 12% by 2026... right in line with the market average.

But the market isn't even expecting that modest improvement. At current prices, investors think Uniform ROA will stay flat at 8% through 2029.

Take a look...

AI server sales are ramping up. And strong tailwinds for the entire AI space should be great for HPE.

Despite this, investors still see it as the same low-earning business it has always been.

If the company continues landing more and more AI server deals and increasing AI systems sales... its profitability could start getting closer to industry leaders like Dell (which booked around 30% returns last year).

The AI boom extends far beyond the few big names dominating the headlines...

The AI boom extends far beyond the few big names dominating the headlines...

That's great for investors who are willing to look beneath the surface. There are still plenty of undervalued opportunities in this trend.

My team and I have been closely watching Musk's latest moves as head of the Department of Government Efficiency ("DOGE"). And we've found a select group of stocks set to profit as he brings AI to the federal government.

Like with HPE, investors are undervaluing these stocks... ignoring the tailwinds that will push them to new heights. We don't expect them to stay cheap for long. Get the details here.

As for HPE, this X deal could be the first step toward creating an important AI infrastructure competitor.

If the company keeps winning contracts and delivering competitive AI servers, its future could look a lot brighter.

Investors who recognize this potential early might be in for a positive surprise.

Regards,

Joel Litman

February 4, 2025

Elon Musk isn't wasting any time when it comes to AI...

Elon Musk isn't wasting any time when it comes to AI...