Health care costs make no sense...

Health care costs make no sense...

Wild inconsistencies exist between what various customers and insurers are being charged for the exact same service. It also explains why American health care is so expensive.

The New York Times article on "Hospitals and Insurers Didn't Want You to See These Prices. Here's Why" confirms what many people have suspected for a long time.

However, it's important to appreciate just how many moving pieces there are to price setting in the health care world. As many experts, insurers, and hospitals point out, news headlines can sow confusion and distrust among the public.

The article does a great job of cutting through much of the noise and presenting the "smoking gun" facts.

Instead of focusing on the list rates that insurance companies pay for different types of care, reporters Josh Katz and Sarah Kliff focus on how much other insurers pay for identical care services at the same hospitals. They also show how much uninsured or self-insured people actually pay out of pocket for different procedures.

For example, someone without insurance would be charged $10 for a pregnancy test at the Hospital of the University of Pennsylvania. But depending on which Blue Cross plan the patient holds, and whether it is a health maintenance organization ("HMO") plan in Pennsylvania or a preferred provider organization ("PPO") plan in New Jersey, the test could cost between $18 and $93. That's a massive dislocation for the same service.

In this particular instance, if the patient hasn't used up their deductible, it would be cheaper to circumvent their insurance.

While it is true that some of these issues stem from differing types of coverage depending on in-network and out-of-network facilities, the report's research also shows severe discrepancies between costs for patients covered by the same kinds of plans.

The medical establishment has been hiding its pricing tactics for decades, but the cat is out of the bag...

The medical establishment has been hiding its pricing tactics for decades, but the cat is out of the bag...

The catalyst for the report was the Biden administration's new policy that forces hospitals to disclose their pricing systems. The medical establishment resisted the policy en masse, leading to lawsuits against the administration that failed in court. Some companies filed appeals, which went nowhere.

Having widespread availability of information is a cornerstone feature of a functioning capitalist economy, and regulators are willing to enforce it with a heavy hand.

Just like the regulators, any economist would quickly recognize the situation as an asymmetric informational advantage. When one side of a transaction knows more about the environment than another, it creates inefficiencies in the market.

Because hospitals and insurers kept their pricing tactics secret for so long, these institutions and businesses have been able to pass these high prices into deductibles and premiums. Consumers are left in the dark about whether their premiums cost more because of higher-quality services or because of these backdoor, nonsensical pricing negotiations.

When looking across the marketplace, it seems that this informational advantage may be the culprit behind HMO insurers' generally high return on assets ("ROA").

But the regulatory push to force HMOs to disclose prices may be starting to tame that informational asymmetry, which could push prices (and hence premiums) down to a more reasonable level.

It could also broadly force the medical establishment to take a hard look at how its pricing schemes are structured, and it will no doubt put new pressure on insurers' profitability.

This is just another example of something that economists have talked about for ages. Informational availability improves competition, encourages fair-play innovation, and benefits the consumer.

One HMO provider saw this coming...

One HMO provider saw this coming...

UnitedHealthcare (UNH) has been preparing for this shift for the past decade.

Although most people think of United as an insurer, it generates $140 billion in revenue from its Optum division, a data-driven business focused on prescriptions, care delivery, and analytics.

This pharmacy benefits division contributes to nearly half of its $22 billion in operating profits, insulating it from much of the upcoming pressure.

UnitedHealthcare has become more focused on leveraging the data and insights from its platforms to optimize care and prescriptions and sell valuable data to partners and clients.

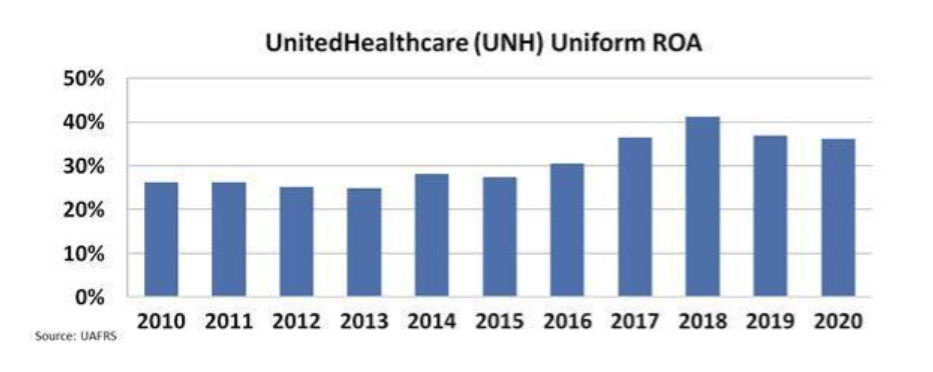

As the company built this new profit center from its legacy insurance business, UnitedHealthcare's Uniform ROA rose from a stagnant 25% during the first half of the decade to more than 40% by 2019.

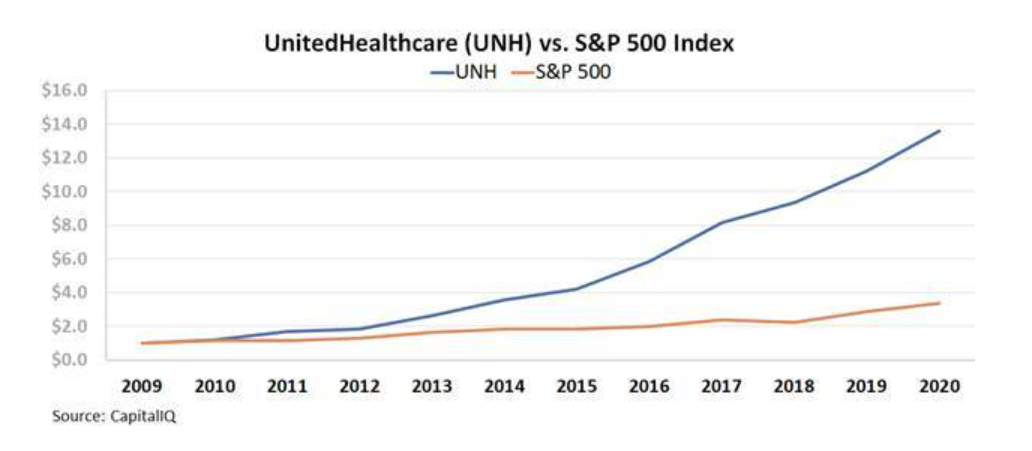

The market has reacted accordingly, and UNH stock massively outperformed the market from 2010 to 2020:

However, anyone looking at UnitedHealthcare's as-reported metrics would have no idea why institutional investors were so excited about the change in strategy.

For the past 10 years, as the company experienced significant improvements in profitability, as-reported ROA has remained stagnant at 8% levels. We refer to that upside as "hidden alpha."

As-reported metrics fail to capture large transformations for companies that have built new, better businesses on top of their legacy ones...

As-reported metrics fail to capture large transformations for companies that have built new, better businesses on top of their legacy ones...

But to unlock alpha, you need to know more about a company than just its initiatives and undistorted profitability. You also need to know the degree to which the market has already priced in future growth.

Every month, we highlight a great large-cap company that the market is missing in our Hidden Alpha newsletter.

Our stock picks are made based on the power of uniform accounting and qualitative research. The average return among our Hidden Alpha portfolio is 43%, with some recommendations yielding as high as 193% and 111%.

To learn how to subscribe to our Hidden Alpha newsletter and gain instant access to the full portfolio – click here.

Regards,

Joel Litman

September 14, 2021

Health care costs make no sense...

Health care costs make no sense...