Memory-chip overproduction strikes again...

Memory-chip overproduction strikes again...

Semiconductor companies try their best to predict chip demand. They almost never get it right.

Chip demand is inherently cyclical. When the economy is doing well, more companies produce goods that need chips. When things start to head south, chip buyers have to slow down.

Right now, chip companies are reacting to the artificial-intelligence ("AI") investment boom. And memory-chip makers are ramping up capital expenditures ("capex") as a result.

AI is certainly heating up. Even so, you wouldn't know it by looking at chipmakers' financials... and Samsung Electronics is a great example.

Samsung is one of the largest chipmakers in the world. Its capex reached an all-time high of $43.1 billion in 2022.

The chipmaker expects to keep spending at a similar rate this year... and yet, it seems to be hurting. Samsung projects a 96% profit decline for the second quarter. It would be its lowest level of profitability since the first quarter of 2009.

Samsung's investments and profits seem to be moving in opposite directions. So today, we'll take a closer look at what's happening with the company... and how the AI trend could reshape the long-term landscape for Samsung.

Even though Samsung was a bit early with its capex spending, it's clear that demand is starting to ramp up...

Even though Samsung was a bit early with its capex spending, it's clear that demand is starting to ramp up...

The AI-server market is driving demand growth. All of the data used by AI needs to be stored somewhere, and that requires memory chips.

This means substantial opportunity for high-bandwidth memory ("HBM") chipmakers like Samsung. According to market-intelligence agency TrendForce, HBM sales are projected to grow 29% annually through 2026.

In the near term, Samsung is struggling with pricing. It has been investing so much in capacity that it has raised the memory supply... which, in turn, has caused prices to plummet.

The market seems to be missing Samsung's potential. It's focused on the company's short-term challenges.

Sure, Samsung stock is up 34% since its low in late September...

Sure, Samsung stock is up 34% since its low in late September...

That doesn't mean investors expect great things from here.

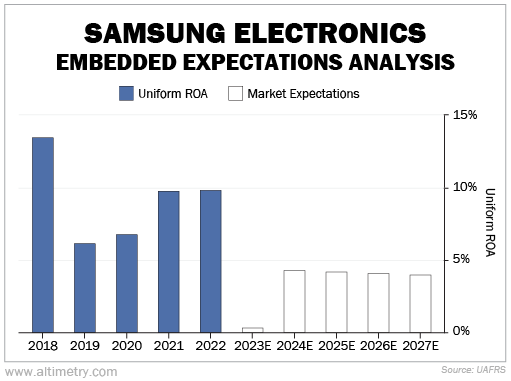

The market is still pessimistic about Samsung's future. We can see this by looking at our Embedded Expectations Analysis ("EEA").

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company must perform in the future to be worth what the market is paying for it today.

Samsung's profitability has been a bit choppy over the past five years. Its Uniform return on assets ("ROA") was as high as 13% in 2018, slightly above the 12% corporate average. And it has held at 10% for the past two years.

At current valuations, the market is looking for a big drop. Investors think Samsung's returns will be cut in half to less than 5% over the next five years.

Take a look...

Said another way, the market believes Samsung's performance through 2027 will be way worse than it has been at any point in the past five years.

That doesn't sound like a chipmaker gearing up for a major chip-demand boom.

Considering the importance of memory chips for AI, and Samsung's roughly 45% market share, it doesn't make sense for long-term returns to decline by half.

The company has consistently achieved a return on assets above 5%. Its 10-year average Uniform ROA is 10%. Investors expect Samsung to be gutted.

Samsung is facing some short-term challenges due to overproduction and excessive capex spending...

Samsung is facing some short-term challenges due to overproduction and excessive capex spending...

However, the structural changes in Samsung's production strategy have demonstrated that the company is moving in the right direction. It's investing more in HBM chips, which will lead the way during the AI boom.

As AI investment keeps ramping up, Samsung's memory chips will to be central to that cycle.

Even though shares are up since September, we think this is only the beginning for Samsung. Investors looking to take advantage of the growing AI industry have a chance to jump into this stock before it turns around.

Regards,

Joel Litman

July 25, 2023

Memory-chip overproduction strikes again...

Memory-chip overproduction strikes again...