As companies return to the office, workers want high-quality spaces...

As companies return to the office, workers want high-quality spaces...

"Return to the office" plans vary across the spectrum. In some instances, it means a full return, with in-office work at 100% capacity. In other places, it may be a "hybrid" model with a mixture of in-person and remote work.

In early May, only 1 in 20 buildings in the U.S. maintained occupancy levels above 10%, according to property-tech firm Freespace.

Increased vaccination rates have meant that most states are fully or nearly reopened, and this should lead to a greater return to in-person work.

The level amount of time employees will spend in the office is still up in the air. Companies and employees alike want one thing. Prospective office tenants are more focused on higher-quality "Class A" real estate office space.

A June article in The Economist notes that the majority of tours in New York City are for "Class A" office spaces. That's up from 38% before the coronavirus pandemic.

"Class A" locations often include desirable street-level restaurants, great views, or other features to attract new tenants and pull existing ones back to the building.

Property companies that do not own higher-quality real estate spaces are more likely to suffer from inventory with tight quarters and less favorable amenities.

The whole industry may potentially have a reckoning as leases roll off over the coming years. As corporations realize they need less space than before with a hybrid model, they will let much of their leased space expire.

Although the industry is facing serious headwinds, this company looks primed to survive...

Although the industry is facing serious headwinds, this company looks primed to survive...

Even though the industry may face serious headwinds, not every company will go under.

One commercial real estate company might survive the wave of lease rollovers: Boston Properties (BXP).

Boston Properties is so well-positioned because it has high-quality, "Class A" locations in some of the largest cities in the U.S. It operates the quality properties that tenants are looking for when they return to the office.

Of course, in real estate, it is all about location. The company owns buildings in prime locations.

However, there are still potential issues.

Even if the company is resilient and has a good probability of making it through the pandemic, it does not necessarily mean that it's a good investment right now.

We need to understand what the market is thinking in terms of Boston Properties' chances for a potential recovery...

We need to understand what the market is thinking in terms of Boston Properties' chances for a potential recovery...

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

However, here at Altimetry, we know that models with garbage-in assumptions only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. Here, we use the current stock price to determine what returns the market expects.

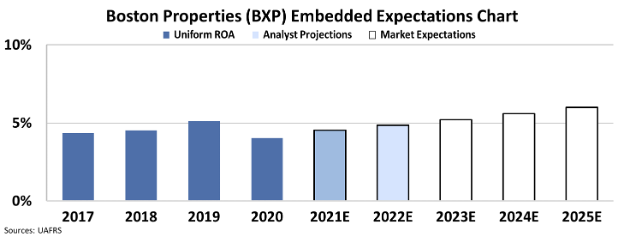

In the chart below, the dark blue bars represent Boston Properties' historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift in the next five years.

Our Embedded Expectations analysis highlights that Boston Properties' ROA levels would need to reach historical highs of 6% to be fairly valued at current valuations. Take a look...

So, if the company executes its strategies perfectly, it will only reach the market's expectations. And the stock won't budge.

Meanwhile, if management makes a single misstep, it could be a serious issue for shareholders.

As a result, it may make sense for investors to hold off before jumping aboard Boston Properties.

While the company itself may execute a strong recovery, the market is already pricing in any potential upside for the stock.

Regards,

Rob Spivey

July 13, 2021

P.S. We center our research process around big investment themes like the "At-Home Revolution," "Survive and Thrive," and "Gatekeepers of Booming Industries" and use Uniform Accounting to understand the full picture.

We've found a "Survive and Thrive" company that is winning – and is likely to accelerate even more from the pent-up demand for travel – and we just recommended it in our recent Microcap Confidential newsletter.

To find out how to gain instant access to this brand-new recommendation – and the full portfolio of 17 other microcaps we love – click here.

As companies return to the office, workers want high-quality spaces...

As companies return to the office, workers want high-quality spaces...