2022 was a banner year for oil giant Shell (SHEL.L)...

2022 was a banner year for oil giant Shell (SHEL.L)...

And it was entirely because of the world's renewed appetite for oil and gas.

Europe has been prioritizing green energy for years. It wasn't long before other parts of the world started to follow its lead. Energy companies shifted gears, focusing on their environmental, social, and governance ("ESG") scores and setting emissions goals... and often facing fines if they didn't.

Governments and international committees are trying to transform a traditionally "dirty" business to something more sustainable. And while that's a good thing for the planet's health, it's bad for oil investors.

Shell is no stranger to the difficulties green energy poses to traditional energy companies. It projects that between 2025 and 2030, renewables and marketing will generate between 40% and 45% of its total costs... and only 25% to 30% of its cash flows.

Said another way, renewables will be Shell's worst business by far.

In the face of this data – and with a recession looming – the company is now admitting that green energy isn't the most efficient focus of its capital.

Today, we'll take a look at two big changes Shell recently announced... why they should be good for investors... and how the market has reacted to the news.

For Shell, the road to profitability is paved with fossil fuels...

For Shell, the road to profitability is paved with fossil fuels...

That's why it announced two big changes in its most recent investor presentation.

First, it's going to return more capital to shareholders. The company boosted its dividend by 15%.

And about a year and a half after Russia launched its war on Ukraine, Shell announced it will expand its natural gas capacity.

This is great for a few reasons. While natural gas isn't as clean as completely renewable energy, it's a lot cleaner than crude oil.

Plus, with Russian natural gas off the market, more of the global supply is expected to start coming from other parts of the world.

That means producers like Shell, which has natural gas production all over the world, will have higher demand.

Management seems to recognize that natural gas is a profitable midpoint between its legacy oil operations and its unprofitable green ventures.

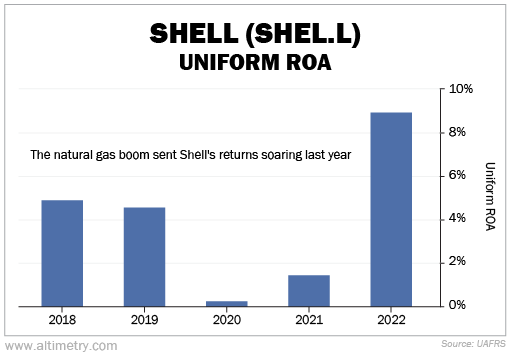

When Shell was ramping up its renewable investments, its business was slowly dying. Even before the pandemic, Uniform return on assets ("ROA") failed to surpass 5%. That's less than half of the 12% corporate average.

After two five-year low returns during the pandemic, the company enjoyed high demand and high profitability in 2022 thanks to the natural gas boom. Uniform ROA reached 9%.

Take a look...

Shell's management has made it clear that the company will ramp up natural gas production. So profitability could stay higher for even longer.

However, longtime subscribers know it's not enough to look at Uniform ROA alone...

However, longtime subscribers know it's not enough to look at Uniform ROA alone...

To determine upside potential, we also have to understand what the market thinks.

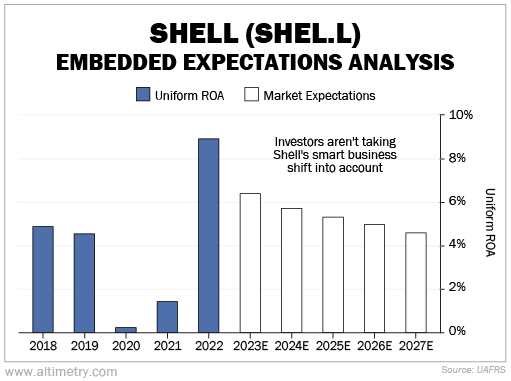

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects Shell's Uniform ROA to collapse back to 5% by 2027. Check it out...

In other words, the market doesn't seem to believe Shell's change in strategy will do anything for profitability.

Investors are being overly pessimistic...

Investors are being overly pessimistic...

And that could mean an opportunity.

Shell is doing what's best for the business. It's investing in a more profitable venture and giving money directly to shareholders.

Natural gas demand is rising... And it's unclear when Russian natural gas could re-enter the market. Consumers need to get their gas from somewhere else. Shell is investing to get ahead of that trend.

Management hasn't gotten the point across to investors yet. It needs to keep making its new priorities clear until folks believe the story.

If it does, valuations could rise quickly.

Regards,

Joel Litman

July 18, 2023

2022 was a banner year for oil giant Shell (SHEL.L)...

2022 was a banner year for oil giant Shell (SHEL.L)...