The world has moved on, and they failed to keep up...

The world has moved on, and they failed to keep up...

It was impossible to go to the mall in the 2000s without seeing a few familiar accessories such as Bluetooth earpieces and Ugg boots.

As with all fashion trends, these accessories gradually fell out of favor.

For professionals ranging from investment bankers and lawyers to doctors and executives, the accessory of choice also saw a widespread decline.

BlackBerry (BB) phones were arguably the first smartphones to achieve widespread adoption. In 2010, they had 43% of the smartphone market, with universal acclaim for their physical QWERTY keyboard and strong messaging features.

But as rivals such as Apple (AAPL) and Samsung (BC94.L) moved in with touchscreens, they failed to keep up with changing consumer preferences.

These new competitors offered a better operating system and construction, paired with a sleek screen, more applications, and a focus on media.

Rather than pivot to adapt, BlackBerry management continued to create clunky phones with limited functions and a focus on enterprise customers.

A slow-marching funeral for BlackBerry?

A slow-marching funeral for BlackBerry?

The past few weeks have felt like a slow-marching funeral as BlackBerry officially ended service for BlackBerry devices in early January.

Then, to put the final nail in the coffin, the company announced last week that it was selling its legacy patents for the products and services that were its bread and butter in its heyday.

The sale of its messaging and mobile device business patents was for $600 million to Catapult IP Innovations.

Many folks may be confused about where BlackBerry goes after this big move. But this move isn't much of a surprise for those who have kept an eye on the firm.

For the last few years, management has leaned into different growth areas where they have core competencies. Namely, they have been focusing on the cybersecurity and automobile software markets.

Are these changes going to be enough?

Are these changes going to be enough?

Some concerns remain as BlackBerry begins a new chapter and hopes to put its legacy business behind.

Despite efforts to right the ship, BlackBerry hasn't reached its peak returns from when it was on top of the cellphone world.

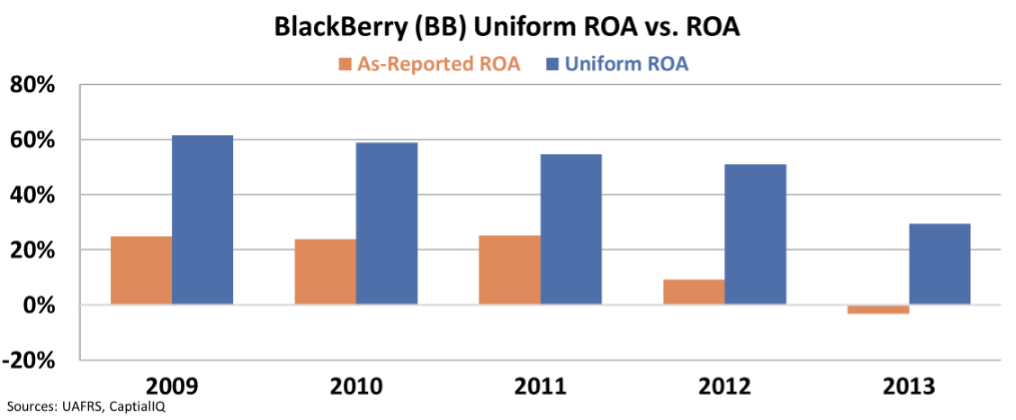

With Uniform Accounting data, we see a highly profitable company at its peak, with a return on assets ("ROA") above 50% through 2012. A steep drop followed in 2013, foreboding a rough decade for the firm.

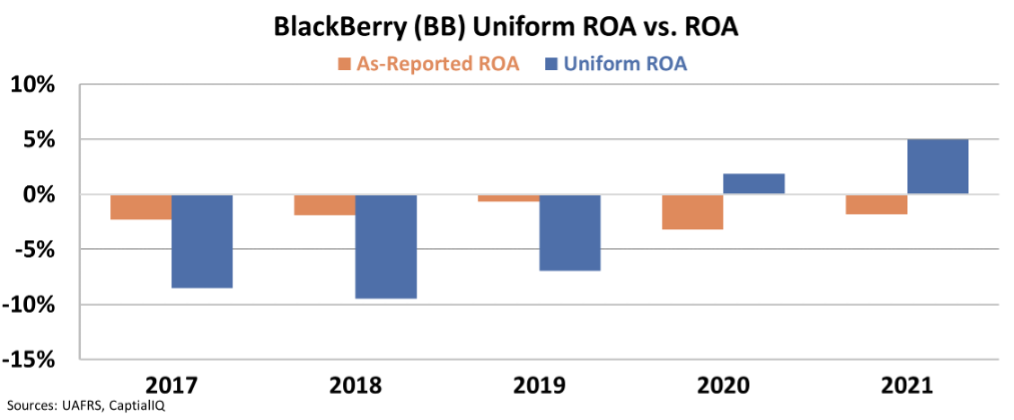

The data doesn't get much better today after the firm has pivoted to cybersecurity and cars.

Uniform ROA remains weak, with an ROA of less than 5% after three years of being significantly negative.

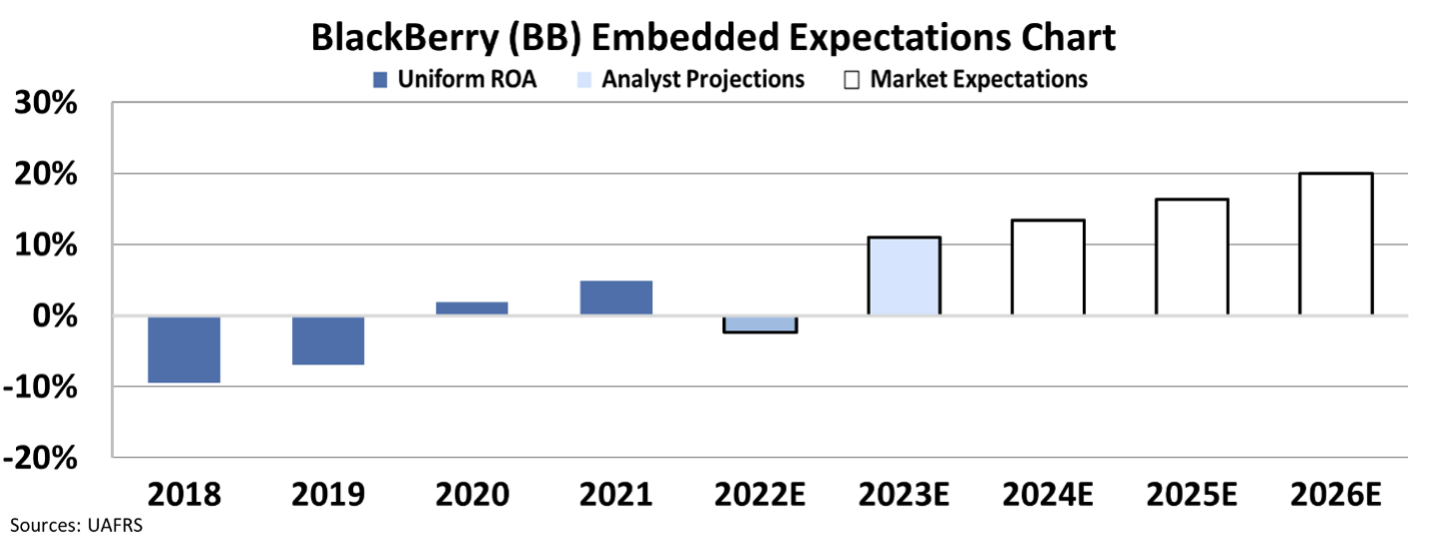

For investors bullish on BlackBerry's future, there is still a long road to recovery for the business to reach its old highs. However, the market is already pricing in a full comeback.

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the stock's intrinsic value.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

Despite only seeing profitability hit 5% in 2020, the market is pricing in returns to climb to 20% by 2025, which would be a huge swing for the company.

Over the past seven years, BlackBerry's history strikes as a cautionary tale to would-be investors. Diminishing profitability and a history of shrinkage may mean that a recovery might be asking for too much...

While BlackBerry isn't a reliable bet, we found several stocks that are...

While BlackBerry isn't a reliable bet, we found several stocks that are...

Here at Altimetry, we use our propriety method of sifting through thousands of publicly traded stocks to discover trends that Wall Street fails to notice.

Our team recently discovered a high-upside opportunity in a different corner of the market.

And we found five stocks with tremendous upside using a scientific system... and these companies are all profiting from the same $12 trillion industry.

It could mean billions of dollars in pure profit for the companies involved. And for you, it could mean a series of 250%... 500%... even 1,000% gains...

Click here to learn more.

Regards,

Joel Litman

February 16, 2022