Most folks know chips are important for AI...

Most folks know chips are important for AI...

They also know not all chipmakers are destined to be winners.

The semiconductor space is vast and highly diverse. And for years, much of the market has been focused on graphics processing units ("GPUs") and central processing units ("CPUs") – the areas dominated by players like Nvidia (NVDA) and Intel (INTC), respectively.

But memory chips are equally important to fueling the AI revolution... particularly high-bandwidth memory ("HBM") chips, the latest breakthrough in the space.

HBM chips enable fast data storage, transfer, and processing. And they're more in demand than ever. In 2023, memory chipmakers generated approximately $4 billion in HBM chip sales.

Sales are expected to reach $18 billion in 2024... and grow to $81 billion by 2026. That's compound growth of more than 170% in three years.

Amid this impressive expansion, some of the biggest players in the industry already sold almost their entire production for next year. And they're committing billions of dollars to increasing capacity.

Today, we'll look at one of those prominent memory chipmakers. And we'll explain why it's well-positioned to capitalize on surging demand for HBM chips moving forward.

Besides the guaranteed demand, HBM chips are also more profitable than standard memory chips...

Besides the guaranteed demand, HBM chips are also more profitable than standard memory chips...

They have operating margins more than five times higher than regular chips. Combined with outsized demand, this allows producers to boost their profitability... not just their sales.

Micron Technology (MU) is currently No. 3 in HBM chips, controlling slightly less than 5% of the market. It's expected to double its market share by 2026.

However, the market doesn't seem to understand what an opportunity this is for the only big U.S.-based memory chip player.

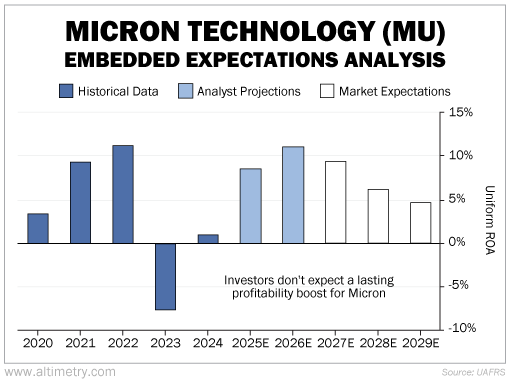

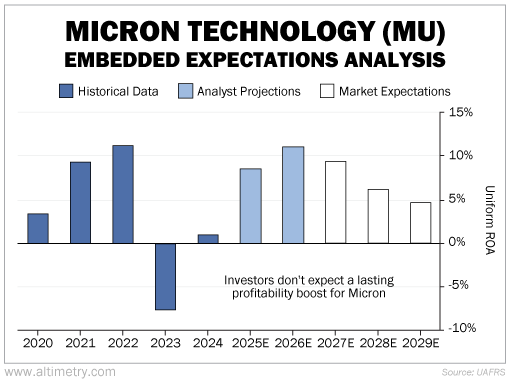

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use Micron's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Chipmaking is a cyclical industry... and recently, Micron has been on the lower end of that cycle. Uniform return on assets ("ROA") peaked at 11% in 2022 and has since turned negative.

Wall Street analysts are expecting a ROA recovery in 2025 and 2026, mainly driven by HBM chip sales. Meanwhile, the market is already pricing in the end of the cycle. Take a look...

As you can see, investors expect the impact of HBM chips to shine for a little... and then fade, with Micron returning to much lower profitability.

This company already has a bunch of customers lined up to buy its high-priced HBM chips. We expect it to get more profitable in the next several years, not less.

Memory chips may not be the splashiest or most expensive part of the semiconductor industry...

Memory chips may not be the splashiest or most expensive part of the semiconductor industry...

But they're essential to powering AI.

Right now, memory chipmakers are racing to ramp up HBM production as fast as possible. They don't want to be the bottleneck in the AI industry.

That said, demand is only going to get stronger from here.

Micron has a golden opportunity to tap the captive AI audience... all it needs to do is get the product ready to capitalize on this huge demand.

Regards,

Joel Litman

November 21, 2024

Most folks know chips are important for AI...

Most folks know chips are important for AI...